KINIGUIDE | The crisis involving Felda Global Ventures Holdings Bhd (FGV) started after its group president and chief executive officer Zakaria Arshad was told to take an immediate leave of absence early this week.

In a filing to Bursa Malaysia, FGV - the world’s third largest oil palm plantation operator - stated that the leave of absence was pending an investigation of certain transactions by FGV’s subsidiary, Delima Oil Products Sdn Bhd.

Apart from Zakaria, FGV chief finance officer Ahmad Tifli Mohd Talha, FGV Trading chief executive officer Ahmad Salman Omar and Delima senior general manager Kamarzaman Abd Karim were also suspended.

FGV chairperson Isa Abdul Samad at a press conference on Tuesday confirmed that an internal audit would be conducted into the matter. He stressed that the decision to suspend Zakaria was made by the FGV board and not by him alone.

However, Isa threatened to sue a journalist for asking him to respond to allegations of abuse of power. The journalist had sought his comment on an article by blogger Raja Petra Kamarudin, who alleged that Isa wanted Zakaria removed in an attempt to cover up alleged corrupt practices in FGV.

That could just be speculation, but based on what that has been reported, Zakaria was purportedly suspended after he reportedly refused Isa’s request that he resigns over alleged wrongdoing in the credit arrangements between Delima Oil Products and Dubai-based Safitex Trading LLC.

Safitex reportedly has an outstanding debt of US$8.3 million (RM35.38 million at current rates) and had not made any repayment since the end of 2015.

However, Zakaria, in a letter to Isa, denied he had violated the corporate code of governance.

In the letter dated June 5, Zakaria argued that the paying process and the credit conditions used by Delima were already in place before he became the chief executive officer.

He was also reported by The Star on Tuesday as saying that he had tried to stop hundreds of millions of ringgit in investments by the company's board, which he described as “ridiculous”.

These reportedly include a £100 million ((RM551 million) expansion plan for the loss-making Felda Cambridge Nanosystems Ltd and a RM300 million plan to acquire a 30 percent stake in a creamer factory. Zakaria had pointed out these were non-core businesses of FGV.

Armed with a stack of documents, Zakaria the next day went to the Malaysian Anti-Corruption Commission (MACC), telling reporters that he was there to assist in investigations into allegations concerning mismanagement in the company.

Armed with a stack of documents, Zakaria the next day went to the Malaysian Anti-Corruption Commission (MACC), telling reporters that he was there to assist in investigations into allegations concerning mismanagement in the company.

Responding to Umno supreme council member Mohd Puad Zakarshi's call for both him and Isa to resign over the current crisis, Zakaria stressed that he would not do so as he had “done no wrong”. Isa, too, dismissed calls for him to resign, also claiming that he did no wrong.

Putrajaya has since announced the appointment of former minister Idris Jala as an “independent party” to look into the decision to suspend the FGV officials.

As part of the investigation into FGV, the MACC on Thursday raided Felda’s headquarters in Kuala Lumpur. Scores of officers seized four boxes and three trolley bags of documents from FGV following the eight-hour raid.

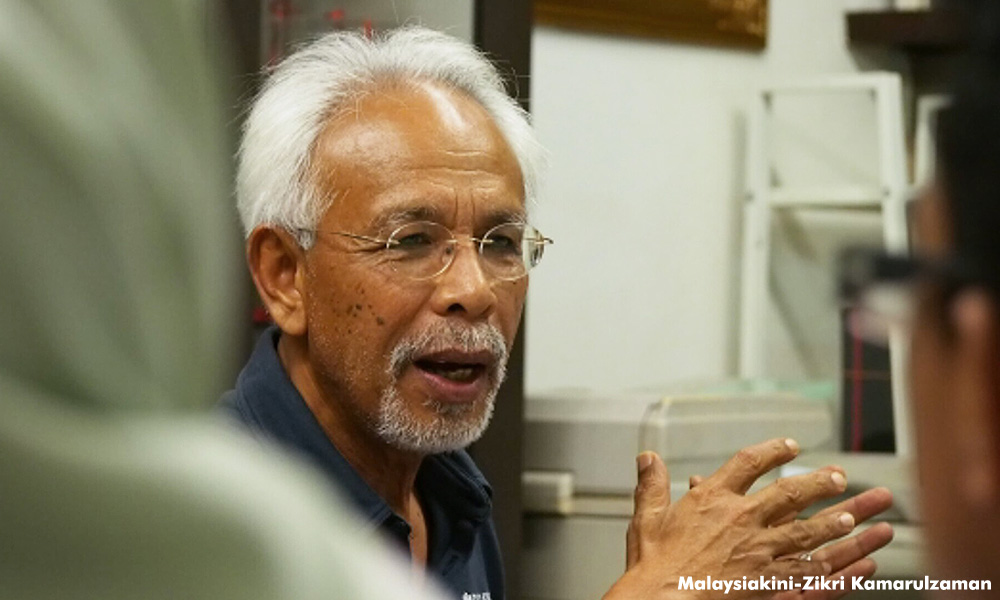

Who is Zakaria?

This 57-year-old, who has been thrust into the limelight after his suspension, is a second-generation Felda settler. Zakaria is a son of a settler from Felda Palong 1, Negeri Sembilan.

The father-of-four graduated with a Bachelor of Social Science (Economics) degree from Universiti Sains Malaysia.

Since then, Zakaria has spent the last 33 years in Felda, working in various companies under the group.

He started his career as an administration and marketing manager with Felda Rubber Industries Sdn Bhd in the same year he graduated.

According to information on FGV’s official website, Zakaria was the chief executive officer of Delima Oil Products Sdn Bhd (2010-2013) and Felda Vegetable Oil Products Sdn Bhd (2012-2013). He was also head of FGV’s Palm Downstream Cluster from 2014 to 2016.

As listed on his LinkedIn page, Zakaria is also vice-chairperson of the Palm Oil Refinery Association of Malaysia (Poram), alternate board member of Malaysian Palm Oil Board (MPOB) and a board member of the Malaysia Palm Oil Council (MPOC).

Zakaria’s tenure in FGV

Zakaria was appointed as FGV’s chief executive officer on April 1 last year. His appointment came after a failed deal for FGV to buy a stake in Indonesia’s Rajawali Group.

Opposition politicians had claimed that FGV’s plans to buy 37 percent of palm oil plantation firm PT Eagle High Plantations Tbk at an overpriced tag of US$680 million was a favour for Indonesian tycoon Peter Sondakh, who controls Rajawali Group as well as Eagle High.

Billionaire Sondakh is believed to have long-standing ties with Prime Minister Najib Abdul Razak.

Following FGV’s failed deal to acquire the stake, Felda ultimately acquired the 37 percent stake via subsidiary FIC Properties Sdn Bhd, at a price of US$505.4 million.

Under Zakaria's stewardship, FGV returned to profitability in the first quarter ended March 31, 2017, posting a net profit of RM2.46 million in contrast with the net loss of RM81 million it saw in the same period a year ago.

Revenue grew 15 percent to RM4.32 billion, from RM3.76 billion.

Who is Isa Samad?

Whether he likes it or not, Isa, who once served as Negri Sembilan menteri besar for 22 years, cannot run away from the fact that he has a history of graft.

The 67-year-old was suspended from Umno for three years after he was found guilty of buying votes during the party elections in 2004.

The former Umno vice-president was originally suspended for six years but this was slashed to three years on appeal. He served out the suspension in June 2008.

Also a father of four, Isa was appointed as Felda chairperson in December 2010, despite opposition from Felda settlers groups such as the National Felda Settlers' Children Society (Anak), among others.

Also a father of four, Isa was appointed as Felda chairperson in December 2010, despite opposition from Felda settlers groups such as the National Felda Settlers' Children Society (Anak), among others.

Isa helmed the government agency for six years before he was replaced by Umno veteran Shahrir Samad in January this year.

In March 2015, Isa’s son was summoned by the MACC to have his statement recorded over the multi-million ringgit purchase of luxurious London hotels.

However, two months later, the MACC in its early investigation report cleared the Felda management of alleged embezzlement in Felda Investment Corporation’s (FIC) payment of RM538 million for a hotel in London.

Minister in the Prime Minister’s Department Paul Low, who was asked about the status of the investigation in Parliament, did not say anything about Isa’s son in his reply.

Opposition leaders had cited the “many failures and losses incurred” under Isa’s leadership of Felda following the government’s decision to retain him as FGV chairperson.

They had also trained their guns on him following corruption investigations into Felda earlier this year. Several top Felda officers were arrested by the MACC for alleged abuse of power in relation to an RM47.6 million sturgeon rearing project.

Impact on Felda

As the biggest shareholder with a 33 percent equity in FGV, it is undeniable that woes faced by FGV would in one way or another have some effect on Felda.

Just yesterday, Shahrir had pointed out that Felda had invested a huge amount in FGV and the return from that investment was one of Felda's major income source.

The main source of income was the leasing of Felda land to FGV, where the agency received a fixed income of RM250 million per annum and 15 percent of the profit, Shahrir said.

FGV was listed on Bursa with much fanfare in mid-2012, debuting at RM5.39. At the time, it was touted as one of the biggest initial public offerings in the world for that year. However, within two years, FGV's share price halved, following a drop in commodity prices and downstream losses.

FGV was listed on Bursa with much fanfare in mid-2012, debuting at RM5.39. At the time, it was touted as one of the biggest initial public offerings in the world for that year. However, within two years, FGV's share price halved, following a drop in commodity prices and downstream losses.

The Employees Provident Fund (EPF), which was among the early investors in FGV and reportedly had up to a 6.8 percent stake, sold off all its shares in December last year.

Isa nevertheless stressed that FGV’s success should not be evaluated merely on its financial performance.

He cited an increase in non-leased land, production of various world-class planting materials through research and development and establishing the crude palm oil trade division supported by assets following FGV’s listing in 2012.

On the day it was announced that Zakaria had been suspended, FGV’s shares fell seven sen to RM1.66 at 12.04pm, before trading was halted at 12.05pm. Trading resumed at 2.30pm, with shares dipping further before closing the day at RM1.62.

What about Shahrir?

Following Shahrir’s “sudden” appointment as Felda chairperson, PKR leader Rafizi Ramli had said that this was an admission by Najib that all was not well in Felda, citing the various revelations and allegations of mismanagement in the agency.

PKR communications director Fahmi Fadzil had noted that the agency had racked up debts upwards of RM6 billion after losses from the FGV listing and an RM3.5 billion loan from the Employees Provident Fund during Isa’s time as chairperson.

This was unlike Felda’s performance 13 years ago, where under the stewardship of then-chairperson Raja Muhammad Alias, it had repaid all government debts and boasted reserves in excess of RM4 billion.

Shahrir, on his part, had conceded that there were indeed “leakages” in Felda, more specifically in investment arm Felda Investment Corporation (FIC). Instructing all FIC board members to resign was Shahrir’s first substantial step in his earlier announcement of a major shake-up in the Felda top management.

Shahrir, on his part, had conceded that there were indeed “leakages” in Felda, more specifically in investment arm Felda Investment Corporation (FIC). Instructing all FIC board members to resign was Shahrir’s first substantial step in his earlier announcement of a major shake-up in the Felda top management.

Explaining further on the purported leakages in Felda, Shahrir had said that this was also the reason why Felda was forced to look for extra earnings to absorb its losses, justifying Felda’s decision to sell its shares worth some RM280 million in Maybank.

He also denied allegations that the sale of its stake in Maybank was to finance its purchase of the 37 percent stake in Eagle High.

Apart from selling its shares in Maybank, Shahrir also announced that Felda would be selling a hotel it owns in London.

The Umno veteran, two months later, refuted claims that Felda was in dire straits, pointing out that the federal agency still had assets worth RM22 billion.

Admitting that he was considering selling Felda’s assets, most of which are in the United Kingdom, Shahrir also said that he may also sell off Felda’s shares listed on Bursa Malaysia.

This, he had said, would help lessen the deficit of nearly RM1 billion since 2015 which the agency has had to bear, and it would also return Felda to its roots of “protecting the well-being of the settlers”.- Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.