Over the last five years FGV has lost more than RM10 billion of its market capitalisation and this will increase to RM13 billion by or before the end of this year. What caused this? Well, the market has always been known to vote with its feet so this means FGV is suffering from a crisis of confidence. And this reflects on those helming the organisation.

THE CORRIDORS OF POWER

Raja Petra Kamarudin

When Felda Global Ventures Holdings Bhd (FGV) was listed in June 2012 its share price was RM4.55 per share, giving the company a market capitalisation of RM16.6 billion. Today, at RM1.66 per share, RM10.6 billion of FGV’s market capitalisation has been wiped out.

Why has FGV’s market worth suffered so badly? After all, FGV is the world’s largest plantation operator with more than two million acres of oil palms across Malaysia and in other parts of the world. So the company is solid and stands on firm ground.

Isa Samad does not have the confidence of the public so FGV is suffering a serious crisis of confidence

The problem is not the company. The problem is the person helming that company, Mohd Isa Abdul Samad. Isa does not command confidence and the investors and market players are basically demonstrating this crisis of confidence by voting with their feet. And if this situation prevails, by or before the end of this year FGV’s share price will be below RM1.00 and the market worth of that company will be further eroded to less than RM3 billion — or a loss of more than RM13 billion in market capitalisation.

The market is fully aware of what is or has been going on in Felda in general and FGV in particular. And the market reacts in the normal way it always does: it votes with its feet. That is why most investors or market players do not want to touch FGV with a ten-foot pole. FGV is suffering a crisis of confidence. And that crisis of confidence is because the market views Isa as someone totally unqualified, extremely tainted, and who is ripping off Felda left, right and centre.

Isa is supposed to be the non-executive Chairman of the company but he is interfering in the day-to-day operations and is treating the company like it is a political organisation. He has changed many of the heads of departments and puts his family and cronies in various important positions even if they are not suited to the job. Isa is totally unqualified for the job and his interference is messing up everything. He thinks that running a company is the same as running a state as the Menteri Besar of Negeri Sembilan.

Isa’s wife is flying all over the world on first class and is charging it to Felda Travel, as are all the other members of the family

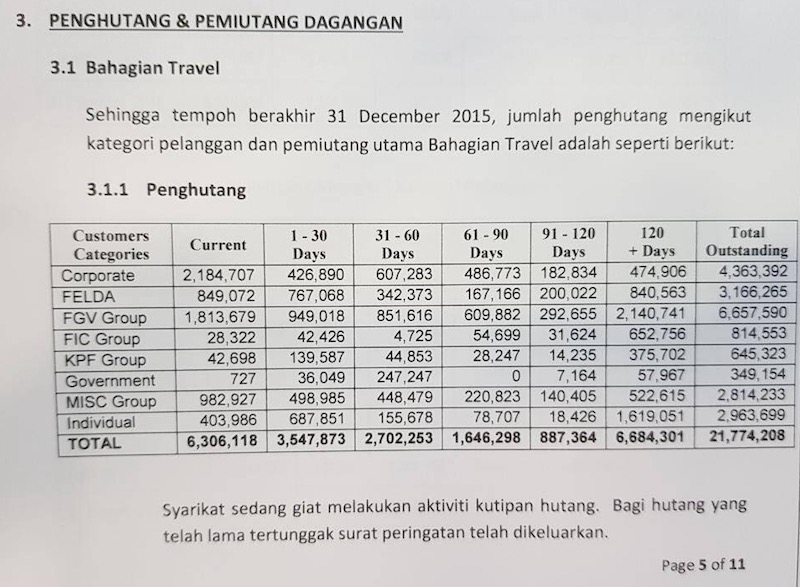

There is rampant and blatant abuse of power and conflict of interest and one very glaring case involves Felda Travel Sdn Bhd. As at yesterday, Isa’s wife, Bibi Sharliza Mohd Sulaiman, owes Felda Travel more than RM200,000, which is an outstanding two-year-old debt. Felda Travel has about RM22 million in debts out of which more than RM6 million are over 120 days. And most of these outstanding debts involve Isa’s family.

Bibi Sharliza’s cousin, Rushdanridia Husney, who ‘coincidentally’ also works in FGV, owes Felda Travel another RM400,000, which is still unpaid until today. So we are talking about a quarter of a million Ringgit that Isa’s wife and her cousin have been owing Felda Travel for some time. And this is no secret because everyone is aware of it.

Isa’s son dabbling in RM1 billion worth of deals all over the world

Then there is the matter involving Isa’s son, Najib, who was implicated in the RM330 million deal to buy over Park City Hotel in Kensington, London. (READ MORE HERE: Felda Investment buys London hotel for RM330m). Added to that is the RM538 million deal for the purchase of the Grand Plaza Serviced Apartments, also in London, which also involves Isa’s son.

All this has been revealed long ago and the article ‘The Mess Isa Samad left behind’ goes into more details of the transgressions and losses suffered by Felda (READ MORE HERE: The Mess Isa Samad left behind).

Felda is dabbling in billions worth of property deals instead of concentrating on its core business

What is even more damaging is FGV’s 2014 purchase of Troika Apartments near the KLCC for RM8.4 million. Isa’s daughter, Lelawati, is staying in that apartment. Isa is the Chairman of FGV and he uses FGV’s money to buy a multi-million apartment in the best area in Kuala Lumpur for his daughter.

It is also well-known in Felda that Isa’s son from his first wife, Najib, and Isa’s second wife, Bibi Sharliza, do not get along. The reason for their rivalry and bickering is because both are competing for the same business from Felda. So this is a situation where stepmother and stepson are trying to outbid each other. This must be a constant source of headache for Isa who has his son and wife at each other’s throats. And it is all about money.

Soon after Isa was made the Chairman of Felda be brought Zahid Mat Arip in as one of his senior executives. Zahid Mat Arip was not really qualified for that job so they faked his credentials whereas the truth is Zahid Mat Arip did not even pass his form five exam. Forging your university degree or PhD is one thing but forging your SPM certificate must be the first and qualifies to be recorded in the Guinness Book of Records.

When the Prime Minister’s Office found out and enquired into this. Isa quickly told Zahid Mat Arip to resign before the matter became a huge embarrassment for them both. Zahid Mat Arip’s personnel file then conveniently disappeared along with the evidence. Both Isa and Zahid Mat Arip have since become the laughing stock of Felda.

The market is always very well-informed and the people at the helm of any organisation determines the confidence the market has on that organisation. In fact, the market always knows more than us about what is happening because it is their business to know the affairs of the companies they are investing in. Because of Isa, FGV is suffering from a crisis of confidence. And if this crisis of confidence is not addressed, FGV is going to suffer more than RM13 billion in loss of market capitalisation when its share price drops below RM1.00. That is the long and short of the whole issue.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.