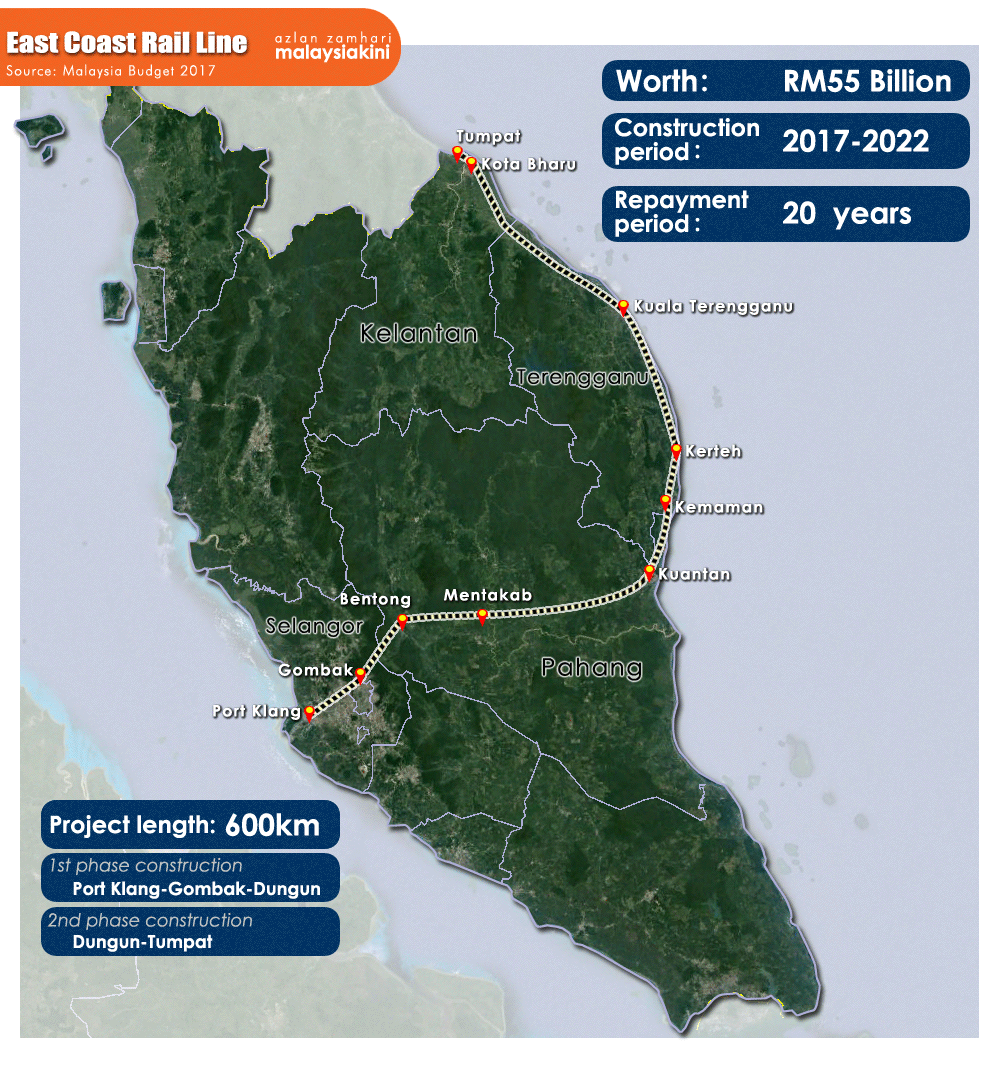

A QUESTION OF BUSINESS | Why does the country need a double-tracked, electrified East Coast Rail Line (ECRL) from Port Klang on the west coast of Peninsular Malaysia to Kuantan and Tumpat on the east coast - 688 kilometres, to be built at a massive cost of RM55 billion?

Especially since the earlier double-tracking project from Padang Besar, Perlis to Johor Bharu costing a massive RM36 billion is already one of the greatest, if not the greatest, infrastructure failures in Malaysia ever?

Proceeding with such a dubious project raises many questions over the competency and integrity of the government which awarded this project without a tender process to the China Communications Construction Company (CCCC), a China state-owned company which was barred from World Bank projects in 2009 because of alleged fraudulent practices in other countries.

Also, by now, China’s efforts to further its own interests under the One Belt One Road (OBOR) project is now well-known. Many, including this writer, consider it to be a thinly disguised plan using Chinese and other concessional financings which will strengthen China’s role in international trade, industry and connectivity, often at the expense of other countries.

China’s vision for the ECRL seems to be for the link to provide connectivity via rail between Port Klang and Kuantan for cargo to be moved back and forth which will save transport costs for goods headed to and out of China. But at RM55 billion, the number of goods moved has to be astronomical for it to be economically feasible.

Here are 10 reasons why that ECRL project should absolutely not proceed.

1. Economically not feasible. At RM55 billion, it’s the largest infrastructure project ever for Malaysia. If we assume a required 10 percent rate of return on the investment, the ECRL has to generate an income, not revenue, of RM5.5 billion a year. Assuming income is even 20 percent of revenue, then revenue needs to be a massive RM27.5 billion! The impossible task ahead is illustrated by this: In 2016, Singapore’s port had a turnover of S$3.7 billion (RM11.7 billion) and a profit of S$1.2 billion.

2. Earlier RM36 billion double-tracking has failed spectacularly. Let’s look at the utter failure of the RM36 billion double-tracking venture initiated under the Mahathir regime. Rail operator KTM had a revenue of RM1.1 billion in 2016 from which it obtained a cash flow of a mere RM166 million. Revenue is only 3 percent of the cost of double-tracking while operating cash flow is a mere 0.5 percent, not anywhere near enough to cover even interest expenses. For a 10 percent return on costs, cash flow needs to rise over 20 times to RM3.6 billion a year. This is the backbone north-south route of Peninsular Malaysia. How is the ECRL going to fare any better?

3. Expensive. Not only is the ECRL extremely expensive in absolute terms, it is also very expensive in terms of cost per km at RM80 million compared to the Gemas-Johor Bharu double-tracking stretch of RM45 million per km. However, this is not strictly comparable given that the ECRL goes over hilly terrain. But analysis is seriously hampered by the lack of information.

4. Unnecessary. Such a large investment can only be justified if there is a great economic benefit. Economically it will depend on one major customer - China - which is looking to export and import goods more cheaply by ferrying goods between Kuala Lumpur and Kuantan via a rail to cut shipping costs.

5. Does not serve the country’s purpose. Such a move does not serve the country’s purpose but instead represents the diversion of badly needed and scarce resources to a project that could potentially fail and fail big and will benefit China directly.

6. Opportunity for patronage and corruption. By inflating project costs, there are plenty of opportunities for patronage and outright corruption, representing a huge risk to the country and further erosion of government governance and accountability. Reports have flourished saying that amounts from overpricing the contracts could find its way into 1MDB to fill the hole in its debt obligations. Considering that 1MDB is in a rather bad state and needs rescue, such reports cannot be dismissed outright.

7. Serves China’s interests. The project serves more China interests by providing a cheaper transport alternative to China instead of right around the Straits of Malacca. However, there is no indication that such a move is feasible, with no feasibility study of the project in the public domain at all. That China will provide cheap financing is an indication that China wants the project to go ahead.

8. Mortgaging our future to China. Malaysia is relying on Chinese finance to get the project off the ground. Abdul Rahman Dahlan, Minister in the Prime Minister's Department in charge of the Economic Planning Unit, reveals that the loan will be provided by China, with a grace period of seven years and a 20-year repayment. What happens, if the project does not pay for itself? What will the government give China in return? Land? Something else? The government should be careful of pawning Malaysia’s future to China through projects which are not likely to be feasible.

9. China’s track record elsewhere not great. China has come under strong criticism for its actions in other countries in Africa. In Sri Lanka, ports have been constructed with Chinese help for which there is no use and Sri Lanka is hard put to repay debts. Instead, it is said to be giving China large chunks of property surrounding these ports. Surely we don’t want the same to happen in Malaysia.

10. Very high opportunity cost. RM55 billion is a lot of money. It can be put to better use elsewhere. Also, there is a tendency to regard this as easy money, but easy or not, it needs to be repaid at some time in the future. If there is no return, the repayment comes from public funds - the economy could crunch then. Not only would we be crippled with massive losses and debts, we would have lost the opportunity to put the money to far better use, helping entrepreneurs for instance through reasonable access to funds.

The evidence so far is overwhelming against ECRL but the government’s persistence in going ahead with the project with unusual haste and without due consideration is extremely alarming. The consequences for the future of the country can be devastating, especially if more such projects materialise.

P GUNASEGARAM, an independent consultant and writer, hopes the government won’t railroad us into the ECRL but instead allow and abide by reasoned discussion. E-mail: t.p.guna@gmail.com. - Mkini

Do not use all of these Private Money Lender here.They are located in Nigeria, Ghana Turkey, France and Israel.My name is Mrs.Ramirez Cecilia, I am from Philippines. Have you been looking for a loan?Do you need an urgent personal or business loan?contact Fast Legitimate Loan Approval he help me with a loan of $78.000 some days ago after been scammed of $19,000 from a woman claiming to be a loan lender from Nigeria but i thank God today that i got my loan worth $78.000.Feel free to contact the company for a genuine financial Email:(urgentloan22@gmail.com)

ReplyDeleteHello Everybody,

ReplyDeleteMy name is Mrs Sharon Sim. I live in Singapore and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of S$250,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of S$250,000.00 SG. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs Sharon, that refer you to him. contact Dr Purva Pius,via email:(urgentloan22@gmail.com) Thank you.