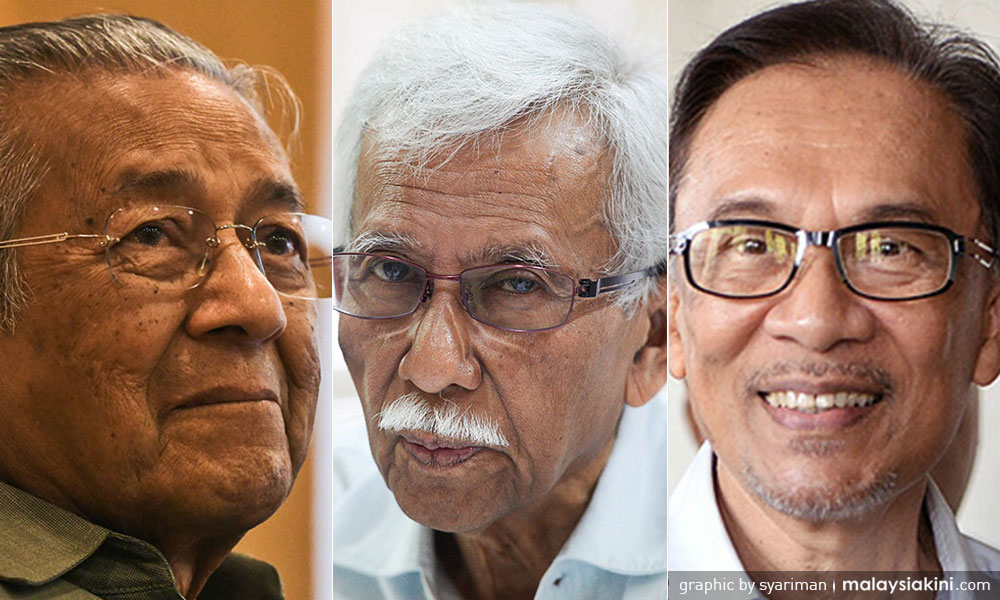

QUESTION TIME | Once the Royal Commission of Inquiry (RCI) on the forex losses recommended that an investigation is carried out to determine if former prime minister Dr Mahathir Mohamad and his deputy then, Anwar Ibrahim, had concealed facts from the cabinet, it became obvious that they don’t have anything on the two.

The commission's report released on Nov 30, said that the pair had likely abetted Nor Mohamed Yakcop, the Bank Negara Malaysia advisor then and the person responsible for the forex trades, and hid certain facts from the cabinet.

The RCI had recommended that Nor Mohamed is investigated for criminal breach of trust (CBT) under Section 409 and for contravening the Central Bank Ordinance 1958. The commission also accused former finance minister Daim Zainuddin of abetting Nor Mohamed in committing CBT. Daim was finance minister until 1991, after which he was replaced by Anwar.

That basically means that the RCI has no solid evidence to say that all those mentioned above were guilty of any offences under the Penal Code or the Central Bank Ordinance 1958, but instead bowed out tamely by saying the police should investigate further.

That’s nothing new or radical. A quarter of a century ago, all those who were following the foreign exchange scandal, which lost the country RM31.5 billion, but at that time was passed off as a loss of RM5.7 billion, still knew that much had to be investigated. How could a central bank be so careless as to speculate to the tune of billions of ringgit and lose so much of money? We did not need an RCI to tell us that 25 years later.

To help launch the police investigations, RCI secretary Yusof Ismail (photo) made a police report at the Putrajaya district police headquarters. "The report is based on the RCI's investigations. We found that there is a possibility of wrongdoing by those involved in the forex dealings then.

"After this, police will hand over their report to the Attorney-General's Chambers for further action," he said.

But the police investigations are not going to be easy, with the inspector-general of police already saying they are likely to be lengthy. If the RCI, who are composed of an array of experts with various backgrounds, can’t find enough to finger anyone, is the police going to be any better?

I could not find a reference in press reports to any specific provision of the Central Bank Ordinance which was violated. That absence indicates there is not enough specificity as to the offence. The RCI mentioned Section 409 of the Penal Code which reads as follows:

“Whoever, being in any manner entrusted with property, or with any dominion over property, in his capacity of a public servant or an agent, commits criminal breach of trust in respect of that property, shall be punished with imprisonment for a term which shall not be less than two years and not more than twenty years and with whipping, and shall also be liable to fine.”

But what is CBT, and how is it related to the forex losses? Section 405 of the Penal Code defines it as follows:

‘Whoever, being in any manner entrusted with property, or with any dominion over property either solely or jointly with any other person dishonestly misappropriates, or converts to his own use, that property, or dishonestly uses or disposes of that property in violation of any direction of law prescribing the mode in which such trust is to be discharged, or of any legal contract, express or implied, which he has made touching the discharge of such trust, or wilfully suffers any other person so to do, commits “criminal breach of trust”’.

Terms of reference

During the entire RCI proceedings, there was little or no mention of CBT and there was no question arising as to anyone personally benefitting from the forex losses and by how much. That makes it rather strange for the RCI to suggest that criminal breach of trust happened.

The RCI itself claimed that RM31.5 billion was lost due to Bank Negara's "excessive" and "speculative" foreign exchange activity between 1992 and 1994. But it established no connection between that and criminal breach of trust.

So it looks extremely unlikely that Nor Mohamed will be successfully charged under Section 409, and if he is not guilty, then neither will be Mahathir nor Anwar on the charge of abetment or concealment.

If standards of behaviour were lacking under the Central Banking Ordinance, Nor Mohamed could simply say that the instruction for him to trade and permission for him to do so came from then Bank Negara governor, the late Jaffar Hussein, as he did at the RCI, meaning any action against Nor Mohamed is unlikely.

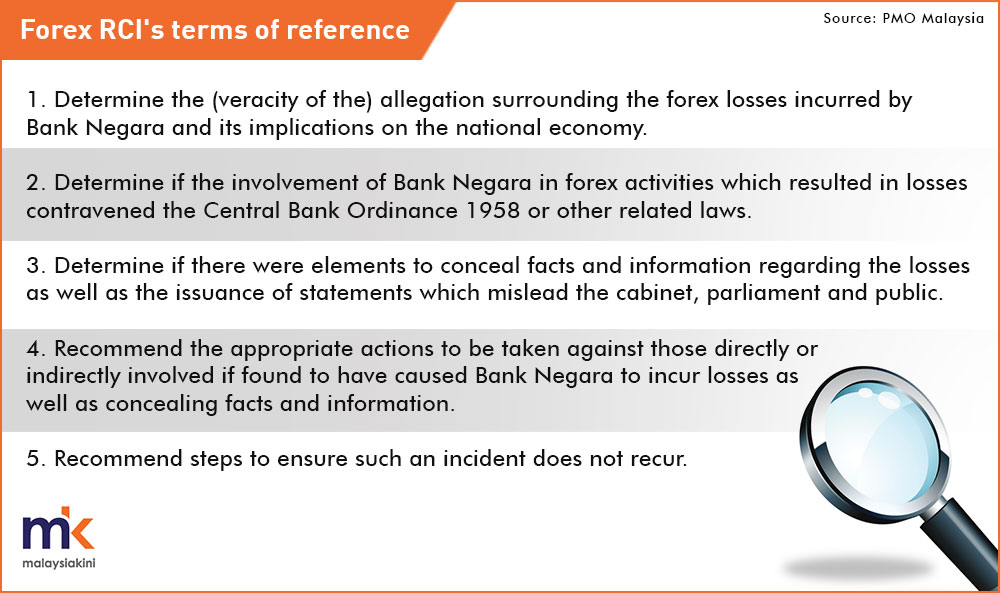

Now, let’s look back at the terms of reference for the RCI (see chart) and determine how much they succeeded.

In terms of point 1, they succeeded in establishing RM31.5 billion of losses. But really that’s no big deal, a Bank Negara official just gave the figure. If that was what the government wanted, simply ask Bank Negara to state the losses.

In terms of points 2, 3 and 4, the RCI was unable to say definitely whether the forex trading resulting in the losses contravened existing laws and whether there was concealment as required to do so. But instead of stating that, the RCI passed it on to the police to investigate when it was in their mandate to investigate and come to conclusions.

After all, isn’t a Royal Commission of Inquiry supposed to inquire and investigate? If the police are now required to investigate, could not a police report have been made earlier and save a lot of expense and time in terms of setting up the RCI and have the hearings?

In terms of point 5, I have not seen any report on what recommendations the RCI made for the future. Perhaps it was not highlighted by the press.

Still, there is no questions that the RCI has been a dismal failure for it has not given definite answers for the key terms of reference but instead came out with a set of wishy-washy recommendations for another body - the police - to investigative.

It has needlessly prolonged the issue, playing right into the hands of those who set up this RCI for political gain but refuse to set up one for the biggest robberies the world has ever known - 1MDB.

P GUNASEGARAM never had high hopes that this RCI would do something substantive. E-mail: t.p.guna@gmail.com. -Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.