Prime Minister Dr Mahathir Mohamad said he stands by Pakatan Harapan government’s move in being upfront about the country’s financial situation.

He previously pegged the national debt level at more than RM1 trillion and subsequently cancelled several mega infrastructure projects to cut government spending.

These announcements had caused a dip in the market, and the government was accused of “spooking” the market with such revelations and measures.

Today, Mahathir questioned if the market preferred to be told “lies” about the country’s economy.

“The strange thing is when we are doing something to improve the financial situation and the economy of the country, the market becomes disturbed.

“They feel uncomfortable and some of the money has flown out of the country, because (there is a) feeling in the market that something is wrong with the government.

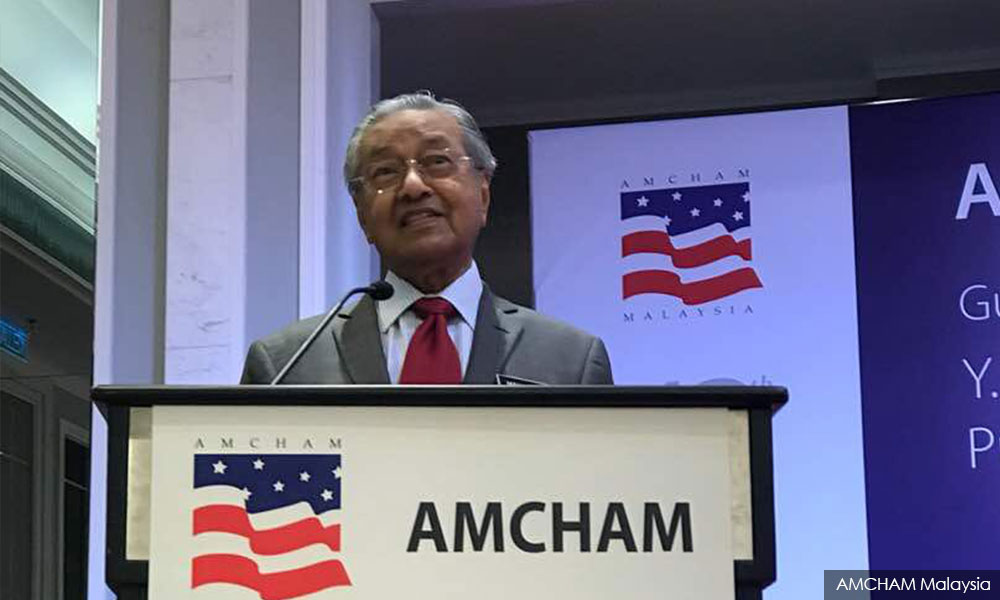

“Sometimes I think that the market prefers to be told lies about how good we are than to be told the truth that we are to do a lot of cleaning up,” he told about 240 members of the American Chamber of Commerce in Kuala Lumpur, eliciting laughs from those present.

During his speech, he repeatedly assured that the government welcomed foreign direct investment (FDI) into the country and was very supportive of multinational companies succeeding in Malaysia.

“We want the private sector to work closely with the government, and we would like to see that you make a lot of money.

“That is because 24 percent of that money is ours,” he said to even more laughter from the audience.

Corporate tax in Malaysia is 24 percent.

Mahathir added that the success of the corporate sector was beneficial to the country’s economy.

“We find that working with the private sector is a very good thing for any country, we don’t want to be antagonistic, or to be jealous of the money you are making. Because we know that the private sector will generate the wealth of this country,” he said.

Among those in the audience today were executives from Deloitte, West Digital, JP Morgan, AmMet Life and Citibank.

[More to follow] - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.