For the past few months, revelation upon revelation were leaked to the public about 1MDB’s mismanagement, massive debts and the eventual asset stripping exercise. The company has all the signs of insolvency due to its inability to pay debts and had resorted to selling off their assets which were bought via debts, just to pay off those said debts.

All these problems can be traced back to its first foray in the dubious Petrosaudi joint venture back in 2009.

The whole world now have the documented evidence that 1MDB embezzled about USD700 million into another dodgy company called Good Star Ltd.

Minutes of 1MDB BOD paper published

This unsanctioned transaction had caused the 1MDB’s chairman and another director to resign in protest back in 2009.

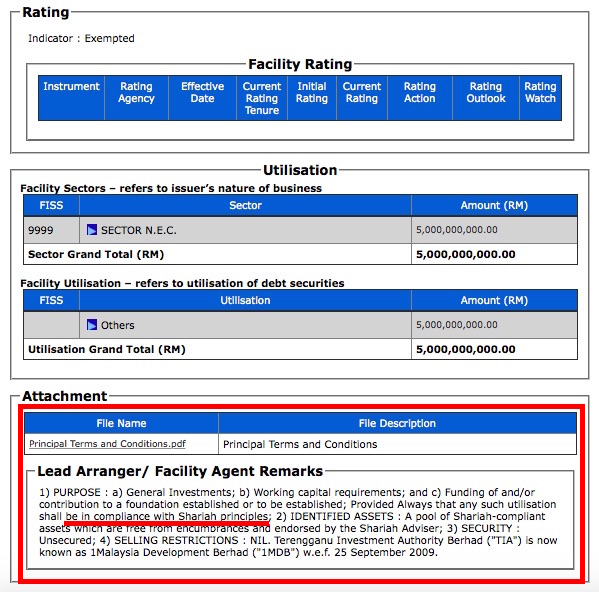

That USD700 million was part of the money 1MDB had raised via issuance of RM5 billion bond and this debt was guaranteed by the Government (in other words, guaranteed by the rakyat).

Securities Commission, being the regulator that regulates the securities market and protects investors’ interest against any deceitful corporate managers would have had the sense to identify and punish any wrongdoers, particularly in the case of 1MDB.

The functions of Securities Commission

Securities Commission, in its investor protection role should have at least issued some statement given the fact that evidence have been presented to the public. Furthermore, Bank Negara Malaysia had chastised 1MDB over the misrepresentation of facts and inaccurate disclosure of material information regarding the utilisation of the RM5 billion bond.

The terms and conditions of this RM5 billion bond had been clearly spelled out and that it could only be used according to Shariah principles. And according to one of its covenants, 1MDB (as the issuer) must obtain and get all the relevant authorisations from the regulators. This will ensure that the investors (the bondholders) will always have their investment protected.

The terms and conditions of the RM5 billion bond

The terms and conditions of the RM5 billion bond

Did 1MDB obtain the proper approvals and authorisations? BNM’s investigations clearly had found that 1MDB had committed fraud by making false applicationwhen they tried to utilise the RM5 billion proceeds.

Subsequently, the minutes from 1MDB board of directors’ meeting had discovered that indeed, USD700 million was diverted elsewhere.

Securities Commission is the controller of bond issuance process. It also ensures compliance to documents when the bond was offered as well as the continuous monitoring that the terms and conditions are always being complied with.

Is sending money to Good Star Ltd in compliance to Shariah principles? What does Good Star do?

Clearly shown the principal terms and condition of the loan is to be utilised in compliance to Shariah principles

The silence of Securities Commission could either be construed that they have made the proper investigation and concluded that Good Star had used part of that RM5 billion according to Shariah principles. Perhaps Securities Commission has discovered the true business nature of Good Star Ltd after all, which must have complied to the terms and conditions set by Securities Commission themselves.

Good Star needs the USD700 million to start selling hijab to Hollywood stars

Or, the silence of Securities Commission was due to the dereliction of duty in regulating the securities market and protecting the investors. There were institutional buyers of that RM5 billion bond yet, Securities Commission had slept throughout the tenure of the bond.

Guidelines set by Securities Commission

USD700 million (RM2.96 billion in today’s rate) is not a miniscule amount. This money was diverted into a company which even the 1MDB BOD was unaware of.

While Bank Negara Malaysia took steps to uphold their task and responsibility, Securities Commission has been really quiet.

Perhaps they are no longer following their own mission statement and the reason for their existence. They proudly state in their website that their ultimate responsibility is to protect investors of the bonds. But alas, there seems to be a breakdown in this regulatory body.

There is no use for its top bosses to receive six figure salary and trying to appear professional when a precedent is taking place – where issuing companies can just do whatever they want with bond proceeds and the regulator will not do anything about it. If there is really a strong reason not to reprimand 1MDB, please let the public know. The market is watching.

“Hold on there, please do not attack Securities Commission. We are here to cari makan.”

Maybe it’s time for the Securities Commission to be independent and report to Parliament, or at least the key posts in regulatory bodies must be approved and selected by a bipartisan parliamentary committee. This will ensure professionalism and good governance. -jebatmustdie

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.