One of Australia’s biggest banks, ANZ, insists it had no authority to act over the alleged transfer of more than $US1 billion into Malaysian Prime Minister Najib Razak’s personal accounts at AmBank, despite being a major shareholder of the Malaysian institution with ANZ executives working in senior management and sitting on the board.

The scandal surrounding money transfers totalling $US1,050,795,451.58 said to have flowed into Mr Najib’s bank accounts between January 2011 and April 2013 has rocked the Malaysian government and triggered financial investigations by authorities on three continents.

Mr Najib has denied any wrongdoing and in January his hand-picked new Attorney-General, Mohamad Apandi Ali, demanded all Malaysian investigations into the transfers be closed, declaring the bulk of the money a gift from Saudi royalty.

The ANZ has been a major shareholder in Malaysia’s AmBank for almost 10 years, after buying a 24.9 per cent stake in 2006.

A partnership agreement drawn up after the acquisition and lodged with the ASX not only gives ANZ seats on AmBank’s board and empowers it to parachute its staff into key management positions, it also obliges the Malaysian institution to follow its Australian partner’s rules of probity and core policy “to the extent appropriate in Malaysia”. It must also consult ANZ before approving any business plan, major mergers, disposals, acquisitions or changes in capital structure or direction.

According to bank documents seen by the ABC’s Four Corners, between January 13, 2011, and April 10, 2013, Mr Najib received more than $US1bn into personal AmBank accounts held under the name Mr X in instalments of between $US9 million and $US70m from, variously, the Saudi Arabian government, a Saudi prince and two Virgin Islands companies.

At the same time, Nik Faisal bin Ariff Kamil, the former investment director of the 1MDB state investment fund at the centre of the corruption scandal, was topping up the Prime Minister’s credit cards with millions of dollars in cash.

Mr Faisal is also chief executive of the state-owned SRC International, which is alleged to have paid $9m into Mr Najib’s accounts in 2014, a “smoking gun” that was to have formed the basis of a “criminal misappropriation of public money” charge against the Prime Minister until his then attorney-general was removed in July.

So much money was pouring into the accounts of the country’s highest office holder, a man with an annual income of $130,000, that the activity triggered money-laundering alerts within AmBank.

In November, AmBank paid a fine equivalent to more than $17m after Malaysia’s central bank found it had breached anti-money-laundering and counter-terrorism finance obligations in relation to “politically exposed persons” ,_ believed to be a reference to Mr Najib’s accounts.

Yet the ANZ has repeatedly refused to say what, if any action, it took as a major shareholder with key appointments in senior probity, auditing and management positions within AmBank in the face of obviously suspect activity.

Last night, ANZ said: “As a minority shareholder, ANZ is not involved (and not permitted to be involved) in the day-to-day operations of AmBank, which is a listed company on the Malaysian Stock Exchange.

“ Directors have a fiduciary duty to all AmBank shareholders (not just ANZ) and nominated executives are employees of AmBank (and do not report to ANZ).

“Naturally, ANZ is very concerned by the recent issues involving AmBank. Both ANZ-nominated directors and nominated employees of AmBank are, however, subject to a significant restrictions under Malaysian law both as a listed company and under banking, privacy and other laws in Malaysia relating to operational matters and to specific accounts .”

ANZ’s new chief executive Shayne Elliott sat on the AmBank board until October, when he stepped down citing “additional workload commitments”.

Until January last year, AmBank was run by Ashok Ramamurthy, a 23-year ANZ veteran who joined AmBank as chief financial officer in 2007. After stepping down, he returned to ANZ’s Melbourne headquarters to work on “special projects”.

ANZ has told The Australian Mr Ramamurthy “co-operated fully with any regulator’s inquiry into 1MDB”.

Other ANZ executives to hold top-level jobs at AmBank in recent years include its chief internal auditor Thien Kim Mon, who join AmBank in 2010 after 21 years with ANZ. ANZ’s Mandy Simpson and Nigel Denby serve as AmBank’s chief financial officer and chief risk officer respectively.

ANZ may appoint up to four directors to the AmBank board but has only one, Suzette Cor, following the resignations of Mr Elliott and ANZ executive Mark Whelan this month.

ANZ is understood to have been trying to divest its stake in the scandal-plagued Malaysian bank since at least September — one month after tens of thousands of Malaysians staged street protests over the scandal.

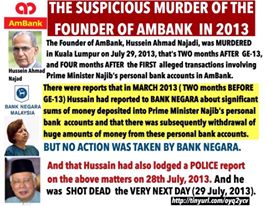

That same month, Malaysian public prosecutor Kevin Morais, the man believed to have drafted the charge sheet against Mr Najib over the $9m payment from SRC, was abducted from a Kuala Lumpur street and found 12 days later stuffed in an oil drum filled with cement in a swamp on the capital’s fringes.

Kevin Morais

- http://www.theaustralian.com.au/

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.