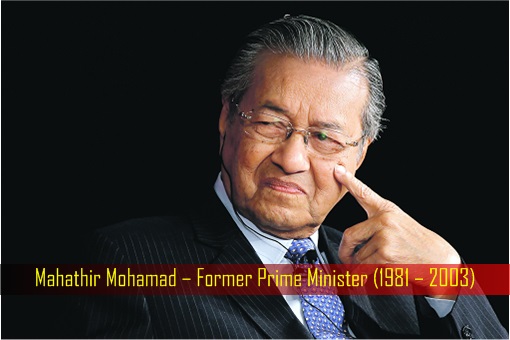

When Mahathir Mohamad launched his Vision 2020 in 1991 – 26 years ago – it was really a big deal to everybody. Very few people understood the real meaning of the vision. They thought it had to do with eyesight as having “20/20 vision” means an individual’s eyesight is normal. So some people actually thought they would not have to wear eyeglasses or contacts anymore.

It was, of course, the former Malaysian Prime Minister Mahathir’s calls for the nation to achieve a self-sufficient industrialized nation by the year 2020. Again, it was a big deal back then because even leaders from the West were impressedwith Mahathir’s vision. Almost overnight, bosses started torturing their employees with companies’ “vision”, “mission” and all the propaganda junks.

To put it in perspective, the concept of vision back then was like the marketing theory “Blue Ocean Strategy” unleashed in 2004 – a sexy marketing story. In practice, however, Mahathir admitted Malaysia required an annual growth of 7% (in real terms) over the thirty-year period 1990–2020. Of course, even a hamster would tell you that are not possible due to global economic uncertainties.

With 3 more years before 2020, Malaysia does not talk about its vision anymore. Instead, a vision-less Prime Minister Najib Razak simply launched another 30-year vision – TN50 (Transformasi Nasional or National Transformation) – whatever that means. Mr. Najib was himself clueless whether his TN50 was meant to replace Vision 2020 or an extension to the failed vision.

Regardless, the year 2020 will not only affect oil-producer Malaysia but the rest of global oil-exporting countries. One of the reasons the then arrogant Mahathir was cock sure Vision 2020 was achievable was because Malaysia was an oil producer. In addition, the country was one of Asian tigers in the making, until the 1997-98 Asia Financial Crisis swept the nation to near bankrtcy.

Analysts once believed that an agreement by oil producers (led by Saudi Arabia) to pump less would send crude prices to at least US$60 a barrel. One after another of so-called analysts is being forced to eat humble pies. Now, Credit Suisse believes prices won’t even approach that level until 2020. So forget about the temporary spikes seen in the oil market.

Last month, JP Morgan was so convinced that crude oil was toast and OPEC doesn’t know what they were doing that the American banker slashed its 2018 WTI forecast by a whopping US$11 – from US$53.50 to US$42. On Monday, it was Credit Suisse’s turn – slashing its long-term price forecast for U.S. West Texas Intermediate crude by US$5 a barrel, to US$57.50 in 2020.

Although Saudi has led a powerful group of oil producers in cutting output by 1.8 million barrels a day through March 2018, Credit Suisse believes inventories will still be 120 million barrels above that level by the time the deal is scheduled to wind down. The Swiss bank said oil production from Libya and Nigeria, the two OPEC member countries exempt from the deal, are creating havoc.

In fact, aside from Libya and Nigeria, Credit Suisse was extremely concerned about cheating OPEC members who kept on exporting barrels at a brisk pace. Actually, the World Bank already predicted last year that oil prices up to 2020 would not exceed US$60 per barrel, which will be close to the production cost and U.S. shale cost. Credit Suisse has just confirmed the World Bank’s analysis.

The US$50 to US$60 is presently the price tag for crude oil agreeable by not only non-OPEC but also OPEC members, including Saudi Arabia and Kuwait. Every now and then, you will read and hear some crazy analysts shouting US$80 or even US$120 a barrel by 2018. That would never happen, unless a world war is triggered.

Beyond 2020, it’s not hard to predict the direction of crude oil. The year 2020 has been singled out as the so-called “white petroleum” – a reference to lithium rechargeable batteries. There’s one place on planet Earth to look at for clue if you wish to know whether the demand for crude oil will skyrocket beyond 2020 – China.

Volvo Cars, the Swedish iconic carmaker acquired by Chinese automotive giant Geely in 2010, announced earlier this month that all cars sold by Volvo will be fully electric or hybrids from 2019 onwards. This simply means there won’t be any pure combustion-engine from Volvo by 2020, suggesting that other foreign carmakers in China could be forced to follow the new rules.

To make matter worse, batteries and not crude oil would see a huge demand as Elon Musk’s Tesla is set to install the world’s largest lithium ion battery to power 30,000 South Australian homes. Mr. Musk has promised to deliver the battery – within 100 days – else Australians would get it for free. When battery could deliver electricity to homes and cars at industrial scale, the demand for crude oil will be even lesser.

Therefore, the magic number 2020 could see many oil-exporting countries go bust, or crawling to survive, in 3 more years. Venezuela is essentially bankrupt.Even if crude oil could breach above US$60 a barrel beyond 2020, the upside will be limited. How much foreign reserve could major oil producers, such as Saudi Arabia, burn to balance its annual budget?

– Finance Twitter

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.