A QUESTION OF BUSINESS | Bank Negara Malaysia’s (BNM) latest quarterly report has an interesting box article beginning page 26 regarding imbalances in the property market which makes compelling reading.

There’s a lot that the report says about the broad property market which involves a glut of commercial space itself as well as residential space, but let us focus on residential property for this article.

Already indications are that the government does not have a proper handle on what the real problem is and instead has put a ban on further approvals for high-end residential property costing over RM1 million per unit.

At this stage that will do nothing to equalise the demand/supply equation because the problem here is basically this, simply put: most of the public cannot afford to buy what is out there. It is a problem of income.

That means the solution in the longer term is to focus on income improvement and reducing income disparity while in the short term this means nudging the market towards producing more affordable houses and finding the means and mechanism to do that.

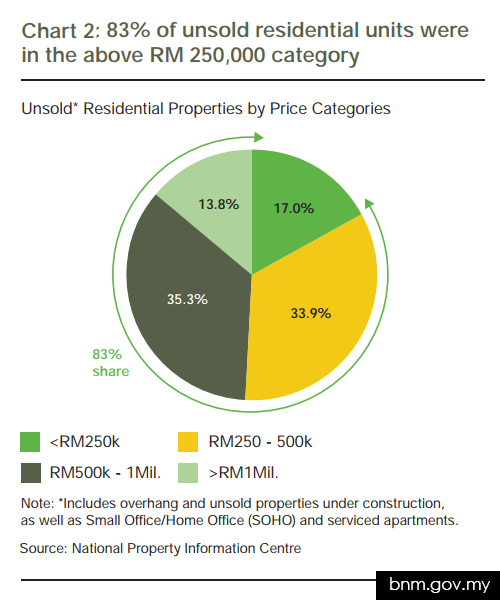

According to the BNM report, supply-demand imbalances in the property market have increased since 2015 with unsold residential properties at a decade-high, the majority of unsold units being in the above RM250,000 price category.

“The large number of unsold properties is due to the mismatch between the prices of new launches and households’ affordability. Over the period 2016 to 1Q 2017, only 21% of new launches were for houses priced below RM250,000. This is insufficient to match the income affordability profile of about 35% of households in Malaysia,” the report said.

It added that the mismatch was exacerbated by the slower increase in median household incomes which rose 9.6% annually between 2012 to 2016 while median house prices rose 15.6% annually over the same period.

“These factors have resulted in median house prices in Malaysia being 5.0 times annual median household income in 2016, rendering house prices ‘seriously unaffordable’ in Malaysia,” the report said.

While the report emphasises that 83% of unsold units were in the over RM250,000 category, that figure is misleading because it compares one category with the rest. As Chart 2 in the report points out, the least number of unsolds are in the top category of over RM1 million where it is just 13.8%, even less than for under RM250,000 which is 17%.

That clearly shows the government move to ban approvals for projects worth over RM1 million is misfounded and will do nothing for the revival of the housing market and reducing imbalances.

The highest unsolds are in the RM500,000-RM1 million category with 35.3% followed by the RM250,000-RM500,000 category with 33.9%. So why is that, especially for those units under RM250,000?

The BNM report itself identifies three reasons. Firstly, it reflects unattractive location of some affordable housing projects due to factors such as distance from workplaces and low transport connectivity. Secondly, the unsold affordable homes may reflect households’ preference towards landed properties over high-rise properties. Thirdly, applicant registries maintained by providers of affordable housing may comprise many non-creditworthy applicants.

It’s a complex problem. And solutions are not easy but we know the first measure that the government is taking - banning approvals for houses costing above RM1 million is wrong.

Ban foreign buyers

But paradoxically the first thing that the government needs to do is to ban purchase of all residential properties by foreigners. Right now, the limit is RM1 million at the federal level, explaining the least number of percentage unsolds in this category as foreign demand takes up supply.

This step, which developers will resist, is important because it ensures that developers will put all their resources to build for local demand, avoiding the spectacle of excess foreign riches buying local houses and leaving them unoccupied for years. According to a Credit Suisse report, 1% of the global population owns over 50% of global wealth.

That, of course is not enough. The BNM report suggests some recommendations for the residential market:

- Establish a single entity for affordable housing to accelerate the rebalancing of supply towards the affordable range.

- Ensure that the development of new projects is in decent locations with good transport connectivity.

- Ensure applicant registries are regularly updated, verified and filtered to prioritise creditworthy households.

- Develop a strong rental market by enacting the Residential Tenancy Act and establish a Tenancy Tribunal to safeguard the rights of both tenants and landlords.

- Direct ineligible applicants to rental housing.

The first measure is perhaps the most important. PR1MA alone won’t do because it merely supplies houses and indications are there are mismatches in what it provides. Right now, there is no sign that any of the other measures are being adopted.

Instead of PR1MA, a central agency such as the Housing Development Board or HDB in Singapore is needed which will provide houses for lower and middle-income households and will ensure that those exiting will sell the houses back to the pool. It’s a complex process, it will take years. But a start needs to be made.

In the long term, the government simply needs to do more to increase incomes and reduce income disparities. That means the right mix of economic and other policies, proper governance, reduction of waste, cutting corruption and patronage, amongst others. At the end of the day, not being able to own a house is an income problem.

P GUNASEGARAM says most material problems are solved by increasing incomes equitably, which should be the top priority of any government. E-mail: t.p.guna@gmail.com.- Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.