PARLIAMENT | A DAP lawmaker has asked if the Inland Revenue Board Of Malaysia (IRB) tax officers would force Prime Minister Najib Abdul Razak and 1MDB to disclose their foreign bank accounts after the Income Tax (Amendment) Bill 2017 come into effect.

Chong Chieng Jen (DAP-Bandar Kuching) questioned if the bill would retrospectively force the taxpayers to disclose all foreign transactions, even those made ten or twenty years ago.

"If this is the intention of the bill, will the Inland Revenue Board (IRB) issue a letter to (Najib) to disclose his accounts, in relation to 1MDB in Singapore, Switzerland, UK or even US?" he asked during the debate of Income Tax (Amendment) Bill 2017 at Dewan Rakyat.

He raised this after voicing the aggressiveness of IRB officer in pursuing income tax defaulters.

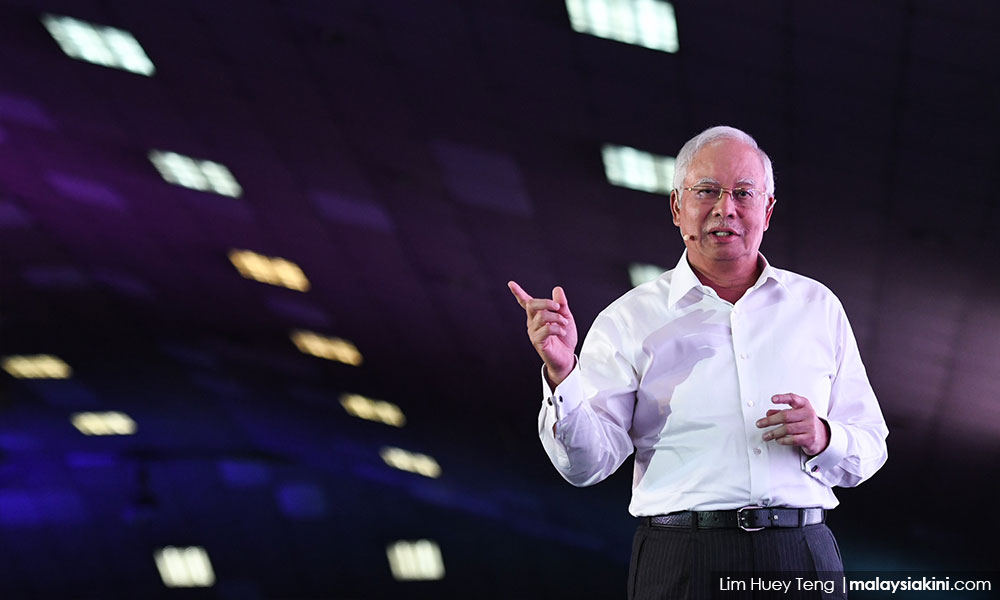

"If we want to enforce the law, law enforcement officers must be fair, and not only press ordinary citizens but do nothing against those in power," he said (photo).

The amendment bill deals with the automatic exchange of information or the

furnishing of a country-by-country report.

furnishing of a country-by-country report.

Failure to furnish a country-by-country report as required by any rules to implement or facilitate the operation of a double taxation arrangement or tax information exchange arrangement will be an offence.

In his winding-up speech, Deputy Finance Minister Othman Aziz admitted the bill will have a retrospective effect.

"Bandar Kuching (MP) asked if the duty or responsibility to disclose to a tax agency oversea that is backdated to seven or eight years ago," said Othman. "I think this will be depending on to the information needed by the relevant country according to the issues the latter is dealing with."

"This bill is about the cooperation of 35 member countries under Organisation for Economic Cooperation and Development (OECD) and the 108 non-members countries which agreed on the double taxation framework," he said. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.