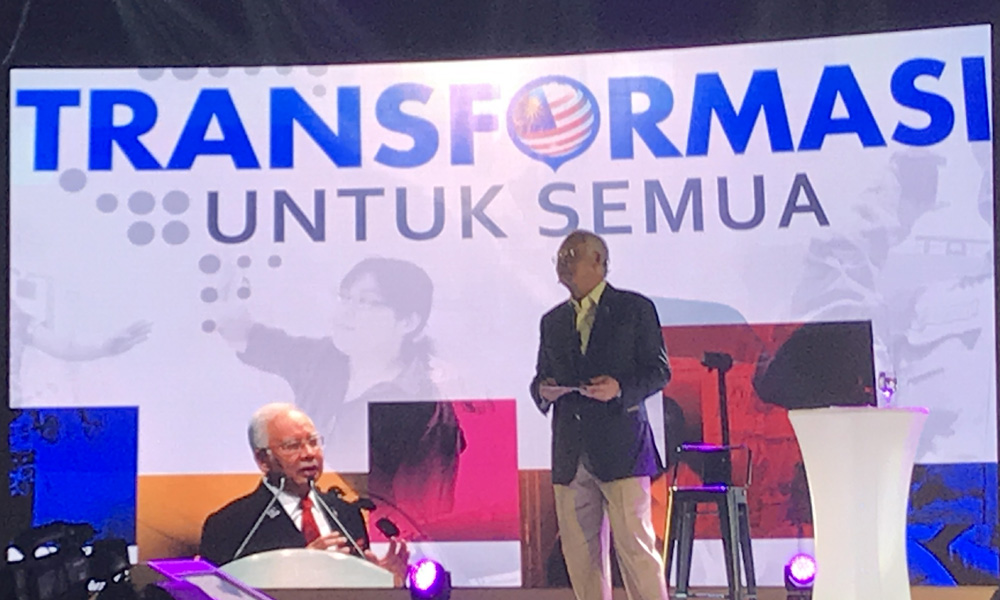

On March 23, the prime minister said the National Transformation Programme (NTP) Annual Report 2017 revealed that we are a success story. He added many milestones were achieved, promises to the rakyat are being met, we decisively moved away from the middle-income trap and are getting ever closer to becoming a high-income nation.

The report is effectively the report card for NTP. Quite an achievement with all the National Key Results Area (NKRAs), National Key Economic Areas (NKEAs) and Strategic Reform Initiatives (SRIs) doing well. Special mention on NKRA - Reducing Crime’ for achieving 161% against the target.

I must congratulate all who worked tirelessly to achieve the good results.

But I pity the Economic Planning Unit (EPU) who prepared the report since all the work done for the year under review was under Pemandu. Knowing the capability and standard of EPU, there are many things not within its control and this is reflected in the report.

The report says we have decisively moved away from the middle-income trap and are getting ever closer to becoming a high-income nation. Our Gross National Income (GNI) per capita and the World Bank’s high-income threshold narrowed from 33% in 2010 to 20% in 2017.

In the World Bank Analytical Classifications - GNI per capita in US$ (Atlas methodology), Malaysia moved from ‘lower middle income’ to ‘upper middle income in 1992 and has not moved since.

Under current classification, upper-middle-income economies are those with a GNI per capita between $3,956 and $12,235. We may have improved but still not moved away from the category we are in since 1992 i.e. still in the upper middle income. To play catch up 20% in two years can be daunting especially when we are targeting lower growths in 2018 and 2019.

Our ratings may have been reaffirmed within the “A” band by Fitch and fiscal deficit reduced to 3.0% as at 2017. However, current geopolitical issues, tighter global monetary conditions and trade war between the larger economies may not deliver what we envisaged.

Our international reserves relative to short-term external debt remain relatively low compared with rating peers. The rating is also constrained by weaker governance standards (deteriorated since 2015), and lower levels of income per capita and human development compared to the median for sovereigns rated in the 'A' category.

Frankly, the Sovereign Rating Model (SRM), a Fitch proprietary, assigns Malaysia a score equivalent to a rating of 'BBB+' but the rating committee decided not to adopt the score with a view this is potentially a temporary deterioration.

Indeed, government debt reduced to 51% of GDP in 2017 because of the forward-thinking and the diversification efforts but the measure of debt must be in relation to the ability to service it and limited by the boundary of revenue growth.

Through excess spending in operating expenditure, debt has grown an average of 10% per year over the past 10 years (RM687 billion as at end-September 2017 from RM266 billion in 2007). But income increase on a compounded annual growth rate (CAGR) of only 3% between 2011 to 2017.

We have to be careful given large foreign holdings (more than 27%) of government debt. We also have a sizeable contingent liabilities increasing close to 17% of GDP at end-September 2017 from 15% in 2016.

According to Fitch, the government's medium-term target of achieving a near-balanced budget by 2020 is unlikely to be met.

The plan for the NTP was that its outcomes must be inclusive and sustainable and to ensure no Malaysian is left behind and that our societal well-being can endure for the long term.

The Gini Coefficient, which measures income disparity may have declined but the Bantuan Rakyat 1Malaysia (BR1M) recipients of over seven million do not seem to be reducing. There may be a stunning reduction in our poverty rate but the Bottom 40% (B40) households are still earning around RM2,800 as at 2016.

It is difficult to improve the purchasing power of the rakyat and ensure better living standards for all Malaysians since the introduction of the Goods and Services Tax (GST). Many items that lead to better living standards still attract GST and it will naturally burden the B40 households.

An interesting development is when the federal territories ministry said that the capital’s poorest residents receive adequate assistance through all its welfare programmes. This is in response to a recent Unicef study that found many urban poor children living in public flats to be malnourished.

I think the Unicef study carries weight and is supported by Bank Negara’s 2017 Annual Report that showed up to 27% of KL households are living below the 'living wage'.

It seems the country’s first Mass Rapid Transit (MRT) is the favourite topic in the report as it is reported by different ministers. I guess because it was successfully delivered and below the allocated budget.

But the New Straits Times (NST) on July 2, 2014, reported that the CEO said “seven more contracts worth slightly below RM1 billion will be given out this year, bringing the total value of jobs awarded to RM23 billion”.

How is it possible that the minister of federal territories reported that MRT Line 1 was delivered two weeks ahead of schedule and saved RM2 billion from the budget? Were there cancellations on contracts awarded and was there compensation paid? And the project is not even under his or the transport ministry but is under the Ministry of Finance Inc.

As for the completion date, how is it completed ahead of schedule because when the project was launched, the project owner expected it to be completed by July 2017 without any specific date?

For Phase 1 of Line 1, there were still some heavy works at the Phileo Damansara station when it started operations.

Announced in 2006, the line was initially planned as an LRT at 43 km in length. A few days ago it was reported that the MRT project needs 250,000 passengers daily to break even. Now, after more than eight months of full operations, it is only recording between 130,000 and 140,000 passengers a day.

Given all the above, I would suggest a full audit of the MRT-SBK Line.

The deputy PM reported that the government continues to address the areas which the rakyat most wants and needs, chiefly, the rising cost of living.

The deputy PM reported that the government continues to address the areas which the rakyat most wants and needs, chiefly, the rising cost of living.

The Economic Intelligence Unit’s Worldwide Cost of Living 2017 report ranked KL just 96th out of the 133 cities surveyed but we were at 100th in 2016.

This is not a relevant indicator since the survey itself is a purpose-built Internet tool designed to help human resources and finance managers calculate cost-of-living allowances and build compensation packages for expatriates and business travellers. A survey based on input by locals will be more appropriate and the ringgit's weakness should be factored in.

The first meeting of the high-level cabinet committee to address the cost of living issues was held in January 2016. Two years on, the issues do not seem to be under control. Only in March 2018, the cabinet committee realised it needs to be upgraded to an action committee.

If we refer to the PricewaterhouseCoopers Report on Cities Of Opportunity, in 2014 KL was ranked 17th out of 30 global cities but dropped to 20th in 2016.

On improving rural development, building and upgrading of roads do not need programmes like Jalan Luar Bandar (JALB) and Jalan Perhubungan Desa (JPD) because that would be in the normal course of duty for the relevant ministries.

So with water and electricity supply. For electricity, there is this Akaun Amanah Industri Bekalan Elektrik (AAIBE) or Malaysian Electricity Supply Industries Trust Account (MESITA). The contributors to the fund are the Independent Power Producers (IPP) which is ‘voluntary’ - contributing one percent (1%) of their annual electricity sales value.

As for crime, there was a remarkable improvement of index crime. But what about other violent crimes or crimes by taxi drivers, credit card fraud, gambling, drugs, prostitution, etc. Index crime includes only 13 types of crimes which occur with regularity.

In a 2016 Crime and Safety Report by OSAC (United States Department of State, Bureau of Diplomatic Security), it’s described that petty crime is fairly common in Malaysia.

On fighting corruption, there were many initiatives including the latest Corporate Liability Provision presented in Parliament on March 26, 2018. In 2017, MACC completed investigations and secured a conviction for 80.7% of corruption cases. But how many of those are really ‘big fish’ cases?

On fighting corruption, there were many initiatives including the latest Corporate Liability Provision presented in Parliament on March 26, 2018. In 2017, MACC completed investigations and secured a conviction for 80.7% of corruption cases. But how many of those are really ‘big fish’ cases?

Despite all the efforts, Malaysia’s ranking in the Transparency International Corruption Perception Index (CPI) nosedived from 55th to 62nd spot. At the current rate, the stated goal to be among the top 30 countries by 2020 could be a pipe dream. One more thing to do is to re-look the Whistleblower Protection Act 2010.

The strong GDP growth and other successes are not entirely due to the NTP. The Bank Negara governor said the domestic economy grew strongly, supported by the global growth upswing and robust domestic demand.

He added that "This is not the fruition of just one year’s effort. It is a reflection of the successful structural changes undertaken over the last two decades. Malaysia’s shift towards a domestic demand-driven economy and continuous economic diversification have placed us in a very good position to adapt to and leverage on the changes in the global economy".

Development and progress go well beyond the individual successes of any one ministry, company or any one individual.

I wish to add that for a report card, it must also show the subjects that were not up to the mark. There is also this thing called compulsory subjects and a fail in one of them means we have not passed the exam. To me, the compulsory subjects are those discussed above.

Consider this quote - "I believe in sustainable help. If you want to lift people off the streets, we need to first treat them like humans. Ask them what they want, give them dignity,” - Yellow House KL founder Shyam Priah.

What say you… -Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.