The new Pakatan Harapan government is committed to deliver our key manifesto goals and promises to ease the burden of the rakyat, who were suffering under decade-high inflation rates, as well as to improve the standard of living for Malaysians.

To do so, we have already announced:

- Zero-rating GST on June 1, 2018 and re-introducing the Sales and Services Tax (SST) on September 1, 2018. This will “return” approximately RM17 billion back to ordinary Malaysians for the rest of the year.

- The stabilisation of the price of RON95 at RM2.20 per litre and diesel at RM2.18 per litre. This will save Malaysians RM3 billion.

- An RM700 million Hari Raya special assistance to civil servants (Grade 41 and below) and pensioners.

These three measures amounting to RM20.7 billion will provide a significant boost to consumer spending in Malaysia and lead to improved consumer optimism and business profits.

At the same time, we are mindful that the federal government debt, which has exceeded RM1 trillion, requires fiscal discipline to be maintained to ensure sustainable expenditure.

Here, I would like to commend the Treasury officials for working tirelessly round the clock, despite fasting in the month of Ramadan, to come up with real solutions for the rakyat.

1. Rationalised expenditure

As part of the re-allocation of expenditure priorities, the new federal government will review, defer and renegotiate at least RM10 billion worth of identified high-priced projects. These include:

- Projects awarded via direct negotiation or a limited tender exercise, some of which can be revoked. For example, a RM350 million contract that was awarded to carry out the renovation and rehabilitation of the Sultan Abdul Samad Building in Kuala Lumpur.

- Non-essential operating expenditure, including professional and consulting services, refurbishments, events and promotional activities, and selected Information and Communications Technology (ICT) systems upgrading.

- Certain big-ticket budget allocations for megaprojects such as the Malaysia-Singapore High-Speed Rail (HSR) and MRT3.

- Other expenditure items such as special projects under the Internal Coordination Unit (ICU), capital injections to various funds, transfers to the authorities of the various development corridors (such as the East Coast Economic Corridor (ECER) and the Northern Corridor Economic Region (NCER)) and projects paid for under the facilitation fund.

In the longer term, the government would save billions of ringgit when these projects are retendered or scrapped altogether.

2. Optimised revenue

In addition to rationalising federal government expenditure, the ministry will achieve additional revenue from:

- An estimated RM5.4 billion, as a result of the rise in the price of oil from the US$52 per barrel used in the 2018 budget to the current price of US$70 per barrel. This additional revenue will come from the additional corporate and petroleum income taxes from the oil companies operating in Malaysia.

- An estimated RM5 billion as a result of higher dividends from government-linked companies (GLCs) such as Khazanah, Bank Negara Malaysia (BNM) and Petronas.

- An estimated RM4 billion from the implementation of the SST in September. This conservative estimate is due to the fact that the SST revenues will only be fully realised from November onwards, taking into account the bi-monthly tax collection mechanism for local manufacturers.

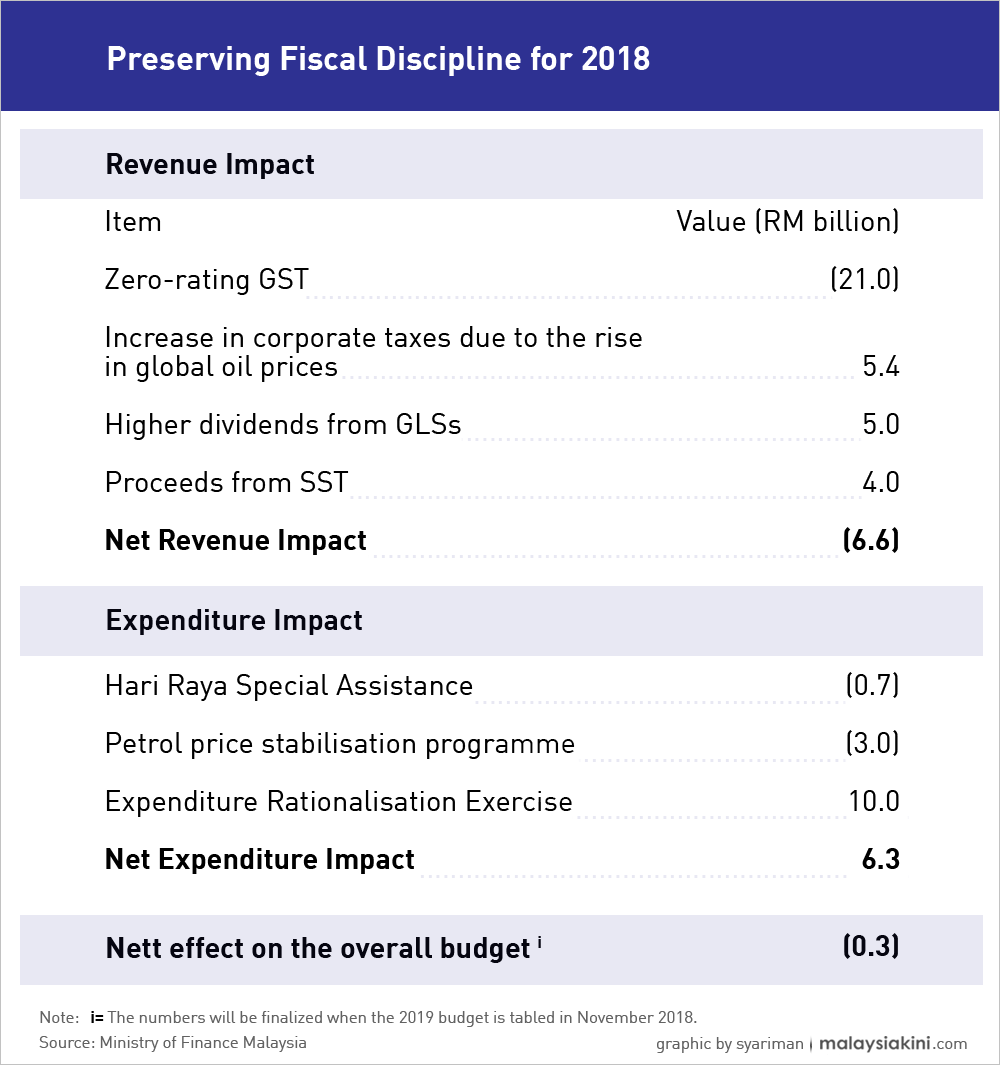

Overall, the estimated impact and mitigation measures to maintain the deficit level are summarised in the table below:

In other words, the projected fiscal deficit will increase from RM39.8 billion to RM40.1 billion, which would maintain the federal government budget deficit at 2.8 percent of the GDP.

In addition, the government’s current balance (government revenue minus operating expenditure) will also remain positive.

LIM GUAN ENG is finance minister, DAP secretary-general and Bagan MP. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.