Former prime minister and finance minister Najib Abdul Razak had questioned why his successors did not pay off 1MDB's bonds ahead of the maturity date to save on interest costs.

Najib said that if the government had used the funds recovered from Goldman Sachs, the US Department of Justice, Ambank, KPMG and Deloitte, it could have paid off the bonds.

"This amounts to almost RM23 billion. It is not public funds. These funds should be used to pay 1MDB's debts," wrote Najib on his Facebook page today.

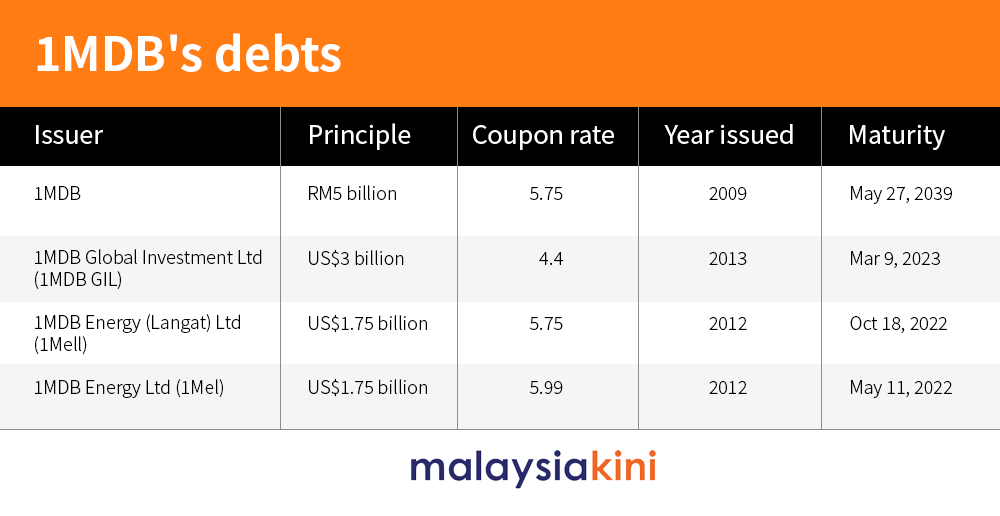

1MDB is a finance ministry-owned company that was established in 2009 when Najib was prime minister and finance minister. It raised billions of ringgit through multiple bond issuance from 2009 to 2013.

As of Dec 31 last year, Malaysia has paid RM13.3 billion of 1MDB's debt with RM38.81 billion still outstanding.

It is unsure if any of these bonds have a call provision to allow the principal to be paid off before maturity as suggested by Najib.

Yesterday, Najib, as the Pekan MP, caused a stir in the Dewan Rakyat when he insisted that tax money was not used to pay off the principal in 1MDB's debts.

Meanwhile, Najib today proposed that Putrajaya should not pay a US$3.5 billion bond that will mature later this year.

"The government has a choice to not pay for the US$3.5 billion bonds this year. International Petroleum Investment Company (Ipic) will make the payment because they are the guarantor," he said.

This, argued Najib, would result in a "savings" of RM15 billion. When "added" to the aforementioned RM23 billion, Najib argued that the government would have RM38 billion to spare.

"RM38 billion will be enough to settle all principal and interest owed by 1MDB," he said.

The US$3.5 billion bond refer to two bonds issued by 1MDB Energy (Langat) Ltd (1Mell) and 1MDB Energy Limited (1Mel).

However, Najib's defence team had in January established that Ipic was not the guarantor of the US$1.75 billion bond issued by 1Mel.

Najib also insisted on his claim that the Bandar Malaysia and TRX projects were worth RM140 billion and RM40 billion respectively "in the long run".

"This will not only allow the repayment of 1MDB debts and interest but also generate a lot of revenue," he said. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.