The Federal Reserve (Fed)’s preferred inflation gauge, the core personal consumption expenditures (PCE) price index will be released later tonight, an analyst said.

The market forecasts the print to rise 0.3% month-on-month.

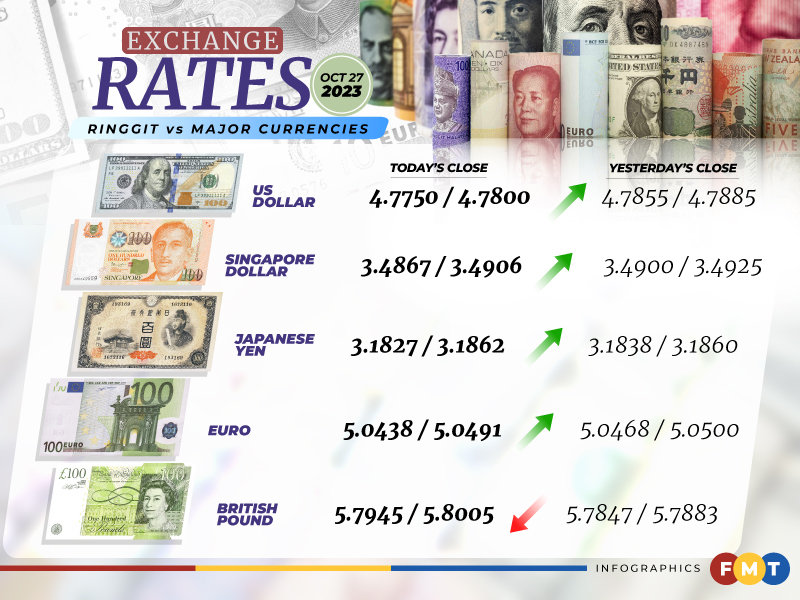

At 6pm, the ringgit rose to 4.7750/4.7800 against the greenback from yesterday’s close of 4.7855/4.7885.

The local currency was mostly higher versus a basket of major currencies.

The ringgit edged up against the Japanese yen to 3.1827/3.1862 from 3.1838/3.1860 at the close yesterday.

It increased against the euro to 5.0438/5.0491 from 5.0468/5.0500 but weakened versus the British pound to 5.7945/5.8005 from 5.7847/5.7883 yesterday.

The local currency was traded mostly higher against other Asean currencies.

It rose against the Singapore dollar to 3.4867/3.4906 from 3.4900/3.4925 yesterday, strengthened against the Thai baht to 13.1808/13.2008 from 13.1952/13.2097, was higher versus the Philippine peso at 8.38/8.39 from 8.40/8.41 and was better vis-a-vis the Indonesian rupiah at 299.5/300.0 from 300.5/300.9. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.