Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid believes market participants will be wary about the assessment by the US Federal Reserve (US Fed) during its latest Federal Open Market Committee meeting beginning today.

In that sense, he said investors will closely monitor the Job Opening and Labour Turnover Survey (JOLTS) report tonight, with consensus estimates on job openings at 8.75 million in December 2023 against 8.79 million in the prior month.

“Lower opening means lower demand for labour, which supports the view of a rate cut this year,” he told Bernama.

Meanwhile, ActivTrades trader Dyogenes Rodrigues Diniz noted that the awaited interest rate decision is the most important news in the financial market as it can change the flow of money worldwide.

“The expectation of most experts is that the US Fed will keep the interest rate unchanged, and if that happens, the US dollar against the ringgit can fall to the 4.7000 region in the coming days,” he said.

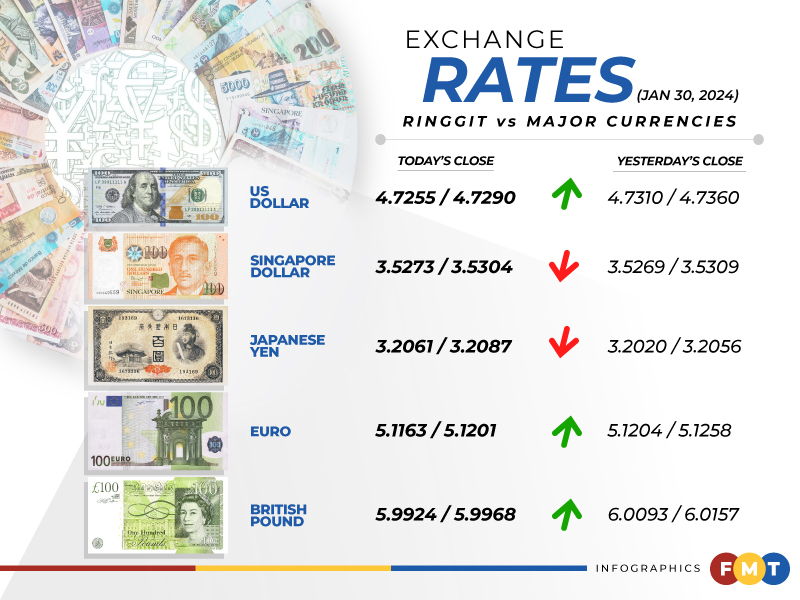

At 6pm, the ringgit rose to 4.7255/4.7290 against the greenback compared to yesterday’s closing rate of 4.7310/4.7360.

The ringgit traded mostly higher today against a basket of major currencies, except for the Japanese yen, where it fell to 3.2061/3.2087 from 3.2020/3.2056 at yesterday’s close.

The ringgit appreciated vis-a-vis the British pound to 5.9924/5.9968 from 6.0093/6.0157 yesterday and was higher against the euro to 5.1163/5.1201 from 5.1204/5.1258 previously.

At the same time, the local note traded mostly lower against Asean currencies.

It was marginally lower against the Indonesian rupiah to 299.4/299.7 from 299.1/299.7 at yesterday’s close but went up against the Philippine peso to 8.37/8.38 from 8.40/8.42 previously.

The local unit eased slightly against the Singapore dollar to 3.5273/3.5304 compared to 3.5269/3.5309 yesterday and was lower versus the Thai baht to 13.3572/13.3727 from 13.2949/13.3153 previously. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.