KUALA LUMPUR: The ringgit reversed its gains yesterday to end lower against the US dollar today as the US Dollar Index (DXY) inched higher ahead of the US interest rate decision later tonight, said an economist.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid said the market consensus is that the US Federal Reserve (Fed) will keep the Fed Fund Rate stable at 5.5% during its first Federal Open Market Committee meeting for the year.

“More importantly, market players are waiting for the latest assessment by the Fed on the state of the US economy moving forward.

“A hawkish tone would certainly help push the US dollar higher in the near term,” he told Bernama.

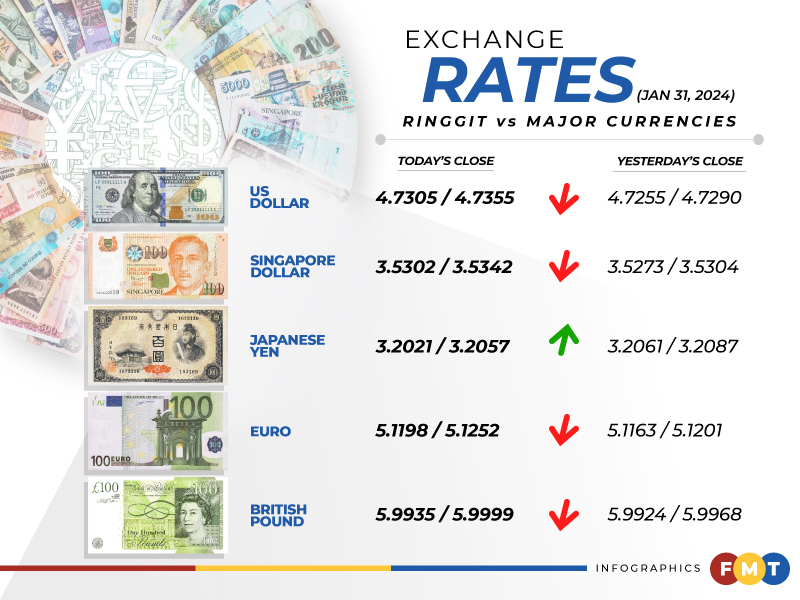

At 6pm, the ringgit eased to 4.7305/4.7355 against the greenback compared to yesterday’s closing rate of 4.7255/4.7290.

The ringgit also traded mostly lower against a basket of major currencies today, except for the Japanese yen where it improved to 3.2021/3.2057 from 3.2061/3.2087 at yesterday’s close.

The ringgit depreciated vis-a-vis the British pound to 5.9935/5.9999 from 5.9924/5.9968 and slid against the euro to 5.1198/5.1252 from 5.1163/5.1201 previously.

Similarly, the local note traded mostly lower against Asean currencies.

The local unit eased against the Singapore dollar to 3.5302/3.5342 versus 3.5273/3.5304 at yesterday’s close, but strengthened against the Thai baht to 13.3321/13.3511 from 13.3572/13.3727 previously.

It was lower against the Indonesian rupiah at 299.6/300.2 compared to 299.4/299.7 yesterday and declined versus the Philippine peso to 8.40/8.41 from 8.37/8.38 previously. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.