TNG Digital Sdn Bhd has been approved by Jabatan Tenaga Kerja Semenanjung Malaysia (JTKSM), a government agency under the Human Resources Ministry, to serve as an alternative salary payment instrument for unbanked workers, especially blue-collar migrant workers facing significant barriers to accessing traditional banking services.

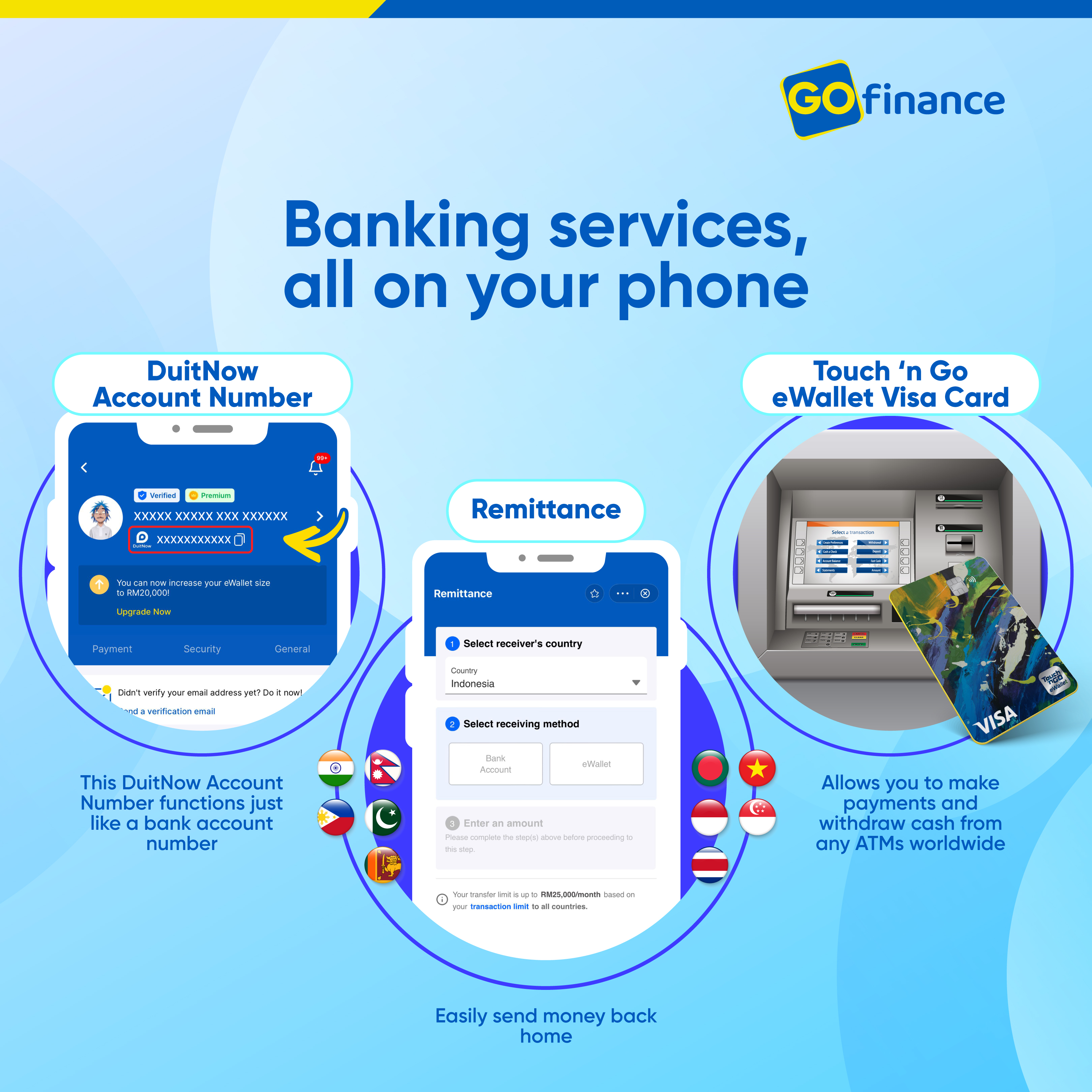

Every TNG e-wallet comes with a DuitNow account number just like any traditional bank account. This means users can seamlessly transfer money to and from any bank in Malaysia through their TNG e-wallet.

Employers can deposit salaries directly into their migrant workers’ TNG e-wallet accounts, ensuring secure and convenient access to their earnings.

“We understand the challenges faced by unbanked communities, especially in accessing financial services and tools,” said TNG Digital CEO Alan Ni.

“By leveraging our technology and comprehensive ecosystem, we aim to bridge the financial gap among migrant workers, who make up 20% of the Malaysian workforce, with nearly 45% unable to open a bank account due to low incomes and lack of required documentation.

“Our goal is to drive financial inclusion for all through affordable and accessible financial products and services on our platform.

“Additionally, integrating these communities into the digital-financial ecosystem will undoubtedly boost economic spending and overall business productivity, directly contributing to Malaysia’s growth and sustained development.”

This initiative aims to boost the nation’s adoption of digital financial services post-pandemic, especially among underserved populations.

Migrant workers often face high costs associated with remittance fees or difficulties in accessing conventional banking services.

TNG e-wallet will not only function as an alternative salary account but also as a one-stop platform empowering unbanked migrant workers to conduct essential financial activities easily and affordably, including:

- A secure place to keep their money: Users without a bank account can use the TNG e-wallet to securely store their money;

- Withdraw cash: With the Touch ‘n Go e-wallet Visa Card, users can withdraw cash from ATMs across Malaysia and make payments at all Visa-enabled merchants, both physical and online;

- Send money home: The Remittance feature in TNG e-wallet allows migrant workers to send money home digitally to over 50 countries, eliminating the need for costly and time-consuming traditional remittance services.

TNG Digital’s innovative solution not only enhances financial accessibility for the unbanked but also supports micro and small businesses by ensuring their workforce has reliable access to their earnings.

This approval by JTKSM marks a significant step towards achieving greater financial inclusion in Malaysia, driving economic growth and improving the livelihoods of the unbanked community. – Focus Malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.