INTERVIEW | A Kuala Lumpur-based economist has offered some suggestions on how the Finance Ministry (MoF) could make the country's debt reporting more transparent and accountable to avoid generating unwarranted concern among investors.

His proposal comes after former premier Najib Abdul Razak blamed Finance Minister Lim Guan Eng for unnecessarily spooking the market with his claim that the country's national debt totals RM1 trillion.

Najib's sarcastic slam came merely four days after the former Penang chief minister was sworn in as finance minister on May 21.

While certain quarters told Lim to be more "tactful", the economist Shankaran Nambiar commended Lim for clarifying Malaysia’s debt situation.

"However, to have merely declared that Malaysia has a debt of RM1 trillion earlier without offering an explanation or breakdown would have only served to roil markets," said the senior fellow at the Malaysian Institute of Economic Research.

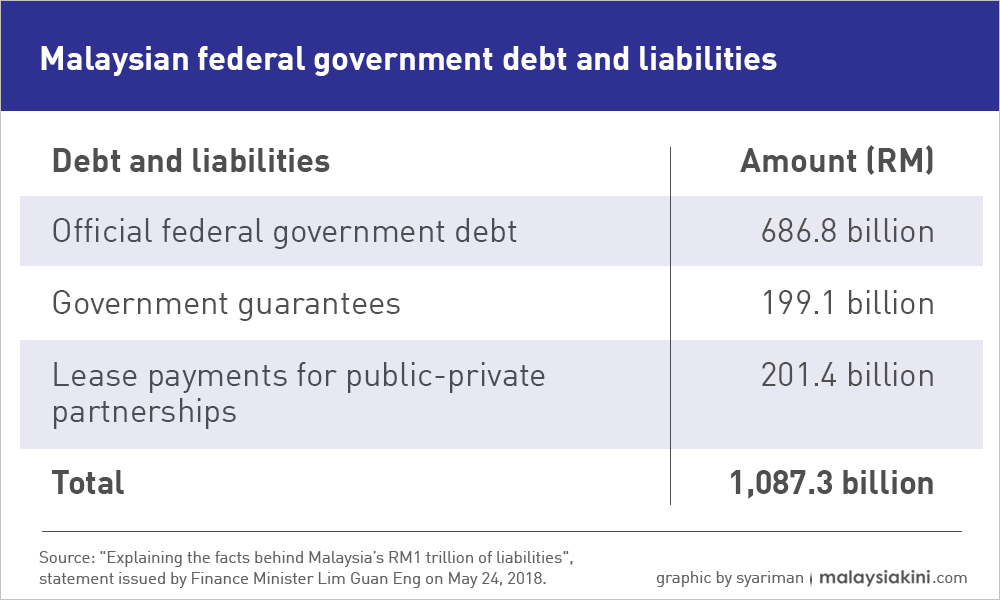

He then cited Lim's written statement where it was mentioned that Malaysia’s official debt stands at RM686 billion, contingent liabilities at RM199 billion and lease payments for various public-private partnerships at RM201 billion.

"This broad itemisation would have helped calm anxieties to some extent, although knowledge of the RM686 billion was commonly known," said Shankaran, who is the author of “Malaysia in Troubled Times”, published by the Strategic Information and Research Development Centre.

Contingent liabilities

The former academic don who hails from Penang then went on to explain that contingent liabilities can be explicit or implicit.

"In the case of the latter (implicit contingent liabilities), they are based on the expectation that the government will take on the obligation although there is no contractual agreement to do so," he said.

Implicit contingent liabilities are based on previous practices or on common practices among governments, said Shankaran, adding that explicit contingent liabilities are contractual obligations.

He noted that explicit contingent liabilities burden the government in the event of default.

"A high level of contingent liabilities implies that the risk the government has to bear is high.

"Further, the extent of risk depends on the nature of the projects that the government undertakes to cover," he said.

Shankaran said the projects that enjoy government guarantees would include projects of varying risk profiles, which could be affected by cost overruns or mismanagement of various sorts.

To him, it is unclear whether appropriate project appraisals and selections were carried out, or if the government was bearing an undue proportion of the risks (rather than the companies undertaking the projects).

Shankaran said to lump all contingent liabilities together, without a more careful examination of the nature and cost of risk, creates alarm and distresses investors.

He proposed that the MoF publish a report on the state and nature of contingent liabilities, listing them according to activity, size and risk profile.

"This could be the basis for annual reporting on contingent liabilities.

"This would create a culture of transparency regarding contingent liabilities; it will also curb the tendency of the government to unnecessarily bear risks," Shankaran said.

Review PPP projects

Meanwhile, Shankaran said the MoF ought to review the various private-public partnership (PPP) projects, where federal involvement can be in the form of providing funds or guarantees.

"A PPP operator can demand a minimum revenue guarantee.

"Historically, government involvement in PPP projects has not been as transparent as it could have been," Shankaran noted.

He asked Lim to make public the true financial state of all public-private partnership entities, including those he had mentioned in his statement: DanaInfra Nasional Bhd, Prasarana Malaysia Bhd, Govco Holdings Bhd, and Malaysia-Rail Link Sdn Bhd.

Shankaran said Lim should explain why these entities depended on the government for their financial sustainability.

He pointed out that at the core of the problem is the basis on which private sector companies are selected and how the terms of engagement are arrived at and designed.

"The private sector should bear a considerable portion of any risk and liabilities to avoid problems relating to moral hazard and adverse selection.

"If this was not done by the previous government, it should be done now and henceforth," Shankaran suggested.

"A two-step process is necessary. First, a clear assessment should be provided as to what went wrong under the previous regime, resulting in high contingent liabilities and PPP debts.

"Second, Lim should clearly outline how MoF proposes to overcome these problems in future.

"To my mind, meritocracy and efficiency should be the only rules guiding the award of contracts and the selection of PPP partnerships," he added. Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.