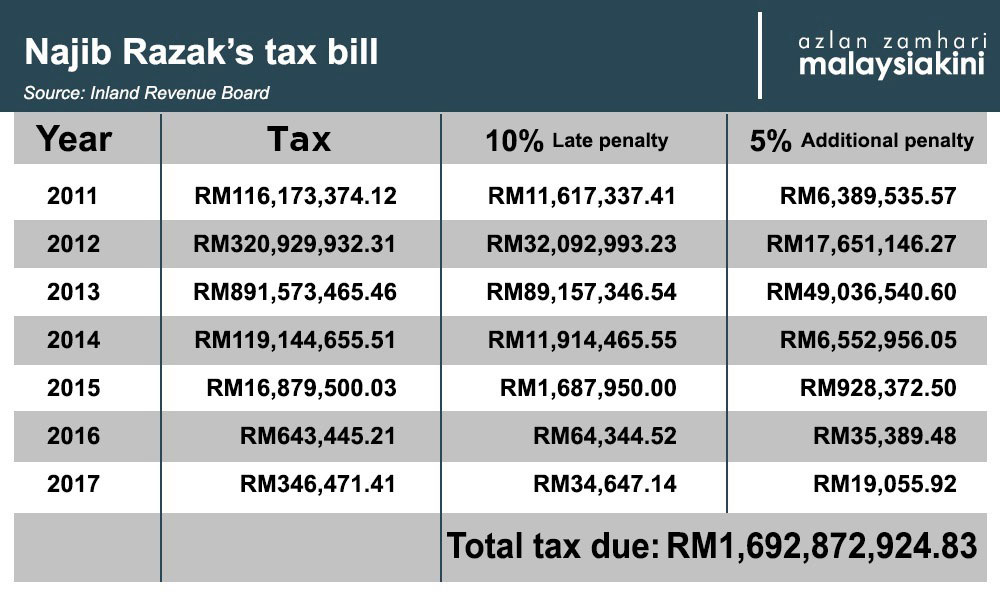

The Inland Revenue Board (IRB) succeeded in its bid for summary judgment in a suit to recover RM1.69 billion in income tax from Najib Abdul Razak.

In effect, this means the former prime minister now has to pay the RM1.69 billion in tax to the IRB.

This followed the Kuala Lumpur High Court’s decision this afternoon to allow the IRB’s application for summary judgment in its RM1.69 billion tax suit against Najib.

Summary judgment is where a court decides on a case without going for a full trial, thereby dispensing with the hearing of the testimony of witnesses, among others.

On June 22, it was reported that judge Ahmad Bache reserved his decision on IRB’s summary judgment application following submissions by legal representatives of the board as well as Najib.

The government filed the suit against Najib on June 25 last year.

It sought over RM1.69 billion from the former premier with an annual five percent interest rate beginning from the date of judgment, as well as costs and other relief deemed fit by the court.

In his ruling that took nearly an hour to read out, Ahmad said the court was not the right forum for Najib to challenge the tax assessment as only the IRB’s Special Commissioner on Income Tax (SCIT) was empowered to hear tax-reassessment appeals.

He noted that the SCIT was empowered by the Income Tax Act to hear a tax-assessed person’s appeal over complaints of incorrect tax assessment among others.

“Under Section 106(3) of the Income Tax Act, it is clearly stated that in proceedings by the government under Section 106(1) (of the Income Tax Act) to recover tax via civil proceedings as a debt due to the government, the court shall not entertain any plea (legal action) that the amount sought is excessive, incorrectly assessed or under appeal (to SCIT).

“Such is the nature of revenue law when due (by a tax-assessed person to IRB), and the court shall not entertain any such plea (legal challenge),” Ahmad said.

The judge said that any dispute of issues of fact in relation to tax reassessment should only be heard by SCIT as the court was not an appropriate forum to decide on tax assessment.

Ahmad was referring to previous submissions by Najib’s defence team during the hearing on the IRB’s summary judgment bid whereby they argued that the IRB's tax assessment was not correct as the billions of ringgit in donations he received from the Middle East were donations and not taxable, among others.

Ahmad noted that any issue of tax reassessment that Najib may have could be dealt with by the SCIT and that this was accentuated by the fact that the defendant currently has a tax reassessment appeal with the SCIT.

He pointed out that the tax payment system in Malaysia was such that the tax assessed person must pay the assessed tax first, then appeal to the SCIT for tax reassessment if they wished to do so.

“This is the tax scheme in Malaysia and the defendant should have been aware that as former finance minister, when a notice (of assessment) has been served, the tax becomes due and payable,” Ahmad said.

The judge noted that the notices of assessment sent by the IRB to Najib for the assessment years 2011 to 2017 had never been disputed as having been received by the defendant.

Ahmad said this reinforced the notion that the notices of assessment had been properly served on Najib in accordance with the Income Tax Act, thus the amount assessed became due and payable.

The judge pointed out that the total amount of assessed tax against Najib, which included penalties, was due and payable to the government in line with the Income Tax Act and that the defendant still had not settled this amount until today.

“The imposition of the penalties are permissible and fair, if a (normal) taxpayer is subjected (to the penalties) for late payment (of tax), it is only fair for the defendant, who is a former prime minister, to be subjected to the same provision like everyone else, to stand equal before the law,” Ahmad said.

The judge pointed out that the existing system in Malaysia of “pay first, talk later” may seem harsh but it was necessary in order to combat instances of tax evasion in the country.

'Harapan oppressed me'

“For the elaborate reasons given at length above, and in the premises, this court holds that summary judgment is entered against the defendant for the amount claimed by the plaintiff as in the plaintiff’s statement of claim, that is RM1,692,872,924.83 with cost.

The judge also ordered Najib, who was not present, to pay costs of RM15,000 to the plaintiff.

Counsel Muhammad Farhan Muhammad Shafee appeared for Najib while deputy revenue solicitor Abu Tariq Jamaludin appeared for the government.

Meanwhile, in a posting on his official Facebook page, Najib claimed that the judge’s ruling in relation to the RM1.69 billion tax case proved abuse of power by the previous Pakatan Harapan administration aimed at oppressing him.

Najib claimed that the year (2019) when he and other family members were hit by the tax suits, was also a time when certain DAP leaders were alleged to have committed abuse of power against him and other BN politicians.

“The judge’s explanation of his ruling today in the RM1.7 billion (RM1.69 billion) tax recovery suit instituted by the previous Harapan government, clearly proved Harapan’s abuse of power when they were in government to oppress me,” Najib claimed.

He explained that today’s ruling was not actually a direct order for him to pay the tax amount but that it was a granting of the IRB’s application for summary judgment so that the board could proceed with its tax claim against him.

“The judge said that the SCIT is the next step for me to quash the baseless (unpaid income tax) claim by the previous Harapan government,” Najib said.

The former Umno president and BN chairperson also reiterated his claim that the previous administration imposed the tax suit on him in relation to the RM2.6 billion donation which he had already been returned to the sender four months after he (Najib) received it.

He also claimed he was slapped with the tax suit in relation to the RM632 million in aid that he allegedly received directly from Saudi Arabia’s Ministry of Finance adding that this amount was not taxable due to it being a donation.

“The truth will be finally revealed when I face the appeal panel before the SCIT later,” Najib said.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.