(The Sun Daily) – ILLICIT financial flows from Malaysia have been growing rapidly for over a decade. By encouraging Malaysian corporations to invest abroad, “legitimate outflows” have also been growing rapidly with financial liberalisation.

It is generally presumed that illicit financial flows are related to tax evasion and corruption. Many international financial centres are involved in intense competition to attract customers by offering lower tax rates and banking secrecy. This has, in turn, forced many governments to lower direct taxes, not only on income, but especially on wealth.

With the official ambition for Malaysia to become another global financial centre in the face of premature deindustrialisation, the authorities have been promoting financial liberalisation, exposing the country to greater macro-financial risk.

Such financial flows are largely handled by financial service providers, accounting firms, law offices, and companies with transnational activities, often involving investments in real estate and other assets abroad worth billions. Besides governments enabling facilities and regulations, such firms and shell companies have been helping to accelerate these trends.

Illicit financial flows

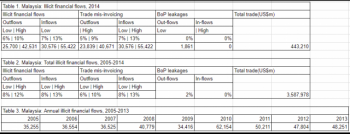

A Global Financial Integrity (GFI) report has estimated that Malaysia lost up to about US$431 billion (RM1.8 trillion) in illicit outflows between 2005 and 2014. The Washington DC based think tank estimated illicit financial outflows from Malaysia at around 6-10% of the value of Malaysia’s trade of US$443.2 billion for the year 2014, i.e. between US$26.6 billion and US$44.3 billion.

Malaysia was fifth among all countries for illicit capital flight, after China, Russia, Mexico and India, but took first spot on a per capita basis. Malaysia accounted for around 6% of total illicit flows out of all developing countries.

In 2014, Malaysia’s illicit financial outflows were between 6-10% of its total trade while such inflows were 7-13% of the country’s total trade of US$443.21 billion. About 87% of illicit financial outflows during 2005-2014 was attributed to fraudulent “trade mis-invoicing”.

Methodological criticisms

GFI estimates have been subject to criticisms, e.g. for making unrealistic assumptions about trade-related transport costs and ignoring other factors that could account for “errors”. The main outflows for Malaysia involve trade mis-invoicing estimated from data inconsistencies.

Also criticised is the presumption that all unreported leakages in inflows and outflows are illicit. However, the GFI report acknowledges that there may be legitimate reporting errors in compiling balance of payments (BoP) accounts. But such leakages only account for a small fraction of total IFFs estimated by GFI, and do not appreciably affect its overall estimates.

Illicit financial flows in developing countries may also be due to transnational criminal activities, which GFI estimates globally for 2014 as follows: Counterfeiting (US$923 billion-US$1.13 trillion ), drug trafficking (US$426-US$652 billion), illegal logging (US$52-US$157 billion), human trafficking (US$150.2 billion), illegal mining (US$12-US$48 billion), illegal fishing (US$15.5-US$36.4 billion), illegal wildlife trade (US$5-US$23 billion), crude oil theft (US$5.2-US$11.9 billion), small arms and light weapons trafficking (US$1.7-US$3.5 billion), organ trafficking (US$840 million-US$1.7 billion), and trafficking in cultural property (US$1.2-US$1.6 billion), totalling between US$1.6-US$2.2 trillion.

Such illicit outflows have to be seen in conjunction with legitimate outflows, which have also been increasing rapidly. Besides the decades-old promotion of tax exemption for “free trade” or export-processing zones, some emerging market economies have also been promoting and enabling outward foreign investments, both direct as well as portfolio.

Not surprisingly, Malaysia is experiencing “premature deindustrialisation” while counting on growth of services, which have been subject to the highest rate of retrenchments.

Such capital outflows are supposed to balance greater portfolio investment inflows, which have greatly increased foreign share ownership in Malaysia in recent years. But this provides no protection in the event of financial panic and a rush to exit, as in 1997-1998.

The push for more financial liberalisation and loopholes, ostensibly to become a major international financial centre, does not bode well for the future. Participating in this “race to the bottom” involves more concessions to the rich and powerful internationally. Meanwhile, rich countries have been selective in enforcing anti-bribery rules, and rarely take effective action, e.g. as shown in last year’s Panama Papers revelations.

International cooperation urgently needed

The nature and scale of illicit flows mean that international cooperation is urgently needed. While the only progress has been at the United Nations, albeit slowly, cooperation of the International Monetary Fund and other multilateral institutions will be vital. If not, rich countries and powerful business interests will continue to “call the shots”.

The Malaysian Anti-Corruption Commission should work closely with national bodies like Bank Negara Malaysia, the Internal Revenue Board, the Royal Malaysian Customs and the Royal Malaysian Police to enhance tax collection, increase government transparency, improve natural resource control by the government, and enable public scrutiny of revenues and other national budgets.

Such efforts will require the cooperation of all relevant parties. Ultimately, political will, especially to take on powerful vested interests, will make the difference. Two decades after the 1997-1998 financial crisis, further international financial integration has not only resulted in growing financial outflows from Malaysia, but also in new vulnerabilities to unpredictable new sources of volatility and instability.

Jomo KS and Raisa Muhtar are Malaysian economic researchers.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.