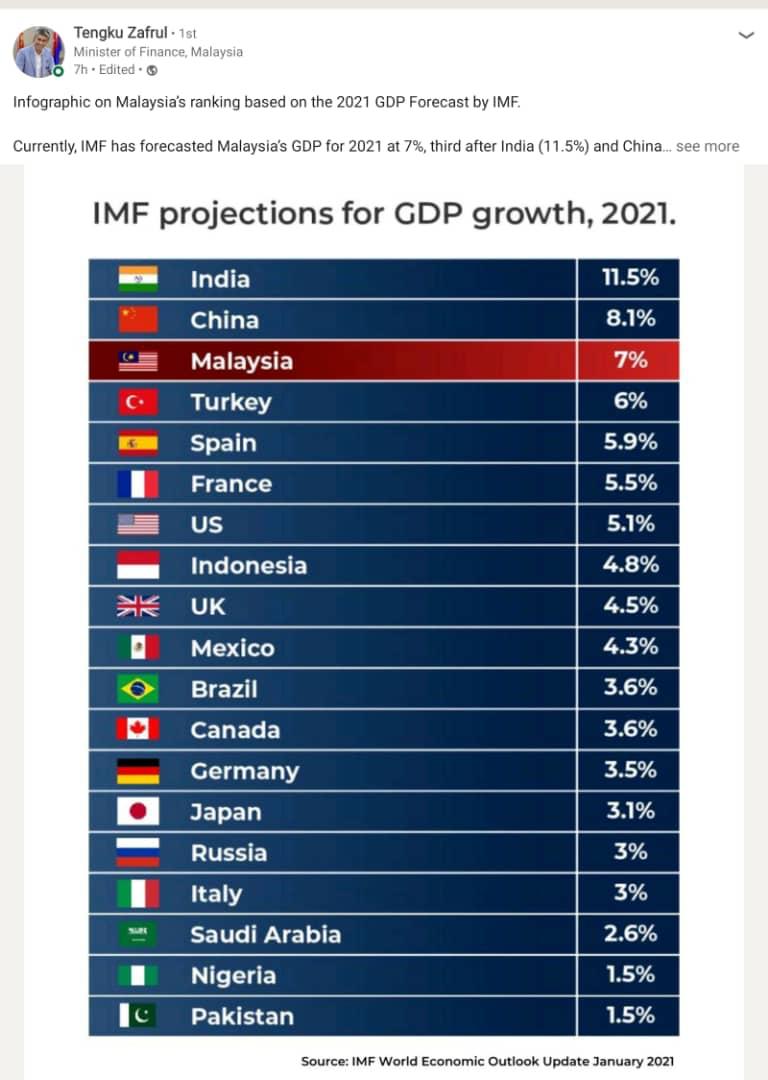

The opposition politicians, plus some from Umno, are accusing Muhyiddin Yassin of all sorts of things. They say Malaysia’s economy is in ruins because of bad policies and management. But that is not what the financial experts say, especially those from the international community. It appears that Malaysia is doing far better than what the critics say.

NO HOLDS BARRED

Raja Petra Kamarudin

The Pakatan Harapan spin is that Malaysia is practically bankrupt mainly due to bad economic planning and management. But that is what opposition politicians say. That is not what financial experts say, especially those from the international community.

For years, Lim Kit Siang has been screaming that Malaysia is a failed state. He says Malaysia began to go downhill when Tun Dr Mahathir Mohamad took over as Prime Minister in 1981 and that Mahathir wasted RM200 billion of the taxpayers’ money.

But then Mahathir was who DAP chose as Pakatan Harapan’s Prime Minister in May 2018. Why did DAP choose the man they accused of ruining the country to be their Prime Minister when they said the first thing they will do if they get to form the government would be to arrest and jail Mahathir? Instead, they made him Prime Minister.

According to the foreign experts, it is not all gloom and doom for Malaysia. That is Pakatan Harapan’s version of things. If at all there is a crisis of confidence, that is because Pakatan Harapan keeps talking about a coup and a power grab. But that is never going to happen because Muhyiddin Yassin has a stronger grip on the government than what people think.

Moody’s affirms Malaysia’s A3 rating, maintains stable outlook

(Bernama) – Moody’s Investors Service has affirmed Malaysia’s local and foreign currency long-term issuer and local currency senior unsecured debt ratings at A3, with a stable outlook.

In a statement today, Moody’s said the rating affirmation is underpinned by its expectation that Malaysia’s medium-term growth prospects would remain strong, and the country’s macroeconomic policymaking institutions would continue to be credible and effective, providing resilience to the sovereign credit profile.

“These strengths are, under Moody’s baseline assumptions, balanced against the government’s relatively high and increased debt burden, which will leave the government with weakened fiscal strength for some time in the aftermath of the pandemic shock to public finances,” it said.

In particular, while Moody’s continued to expect the government to remain committed to its gradual path of fiscal consolidation over the next two to three years, it said the rise in debt burden was unlikely to rapidly reverse.

“The stable outlook reflects Moody’s view that risks to the credit profile remain consistent with the A3 rating level based on current assumptions,” it said.

The credit ratings agency did not expect the Covid-19 pandemic would have a sustained negative impact on Malaysia’s economic model.

“As such, the current and any subsequent waves of infections will delay, but not materially hinder the economy’s eventual return to high growth rates,” it said.

Meanwhile, Moody’s pointed out that the authorities’ track record of effective macroeconomic policies, including prudent fiscal policies, had continued to lengthen, despite ongoing noise in the political landscape.

Concurrently, Moody’s has affirmed the foreign currency ratings on the backed senior unsecured debt issued by the government’s special purpose vehicles, namely Malaysia Sovereign Sukuk Bhd, Malaysia Sukuk Global Bhd and Wakala Global Sukuk Bhd at A3.

“The associated payment obligations are, in Moody’s view, direct obligations of the government,” it said.

Moody’s has also affirmed at A3 the local currency ratings on the backed senior unsecured debt issued by Khazanah Nasional Bhd, which benefits from an explicit guarantee from the government.

Malaysia’s local and foreign currency country ceilings remain unchanged at Aa1 and Aa2, respectively, it added.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.