1MDB TRIAL | Bank Negara Malaysia's (BNM) investigation in early 2015 found that US$700 million (RM2.28 billion) of 1MDB funds were diverted to an offshore entity linked to fugitive businessperson Low Taek Jho (Jho Low), the central bank's former governor testified.

During today's RM2.28 billion 1MDB corruption trial against former prime minister Najib Abdul Razak, 46th prosecution witness Zeti Akhtar Aziz said the central bank had to undertake a multi-year investigation, following 1MDB officials failing to provide satisfactory answers to the central bank on what happened to the funds sent overseas in 2009.

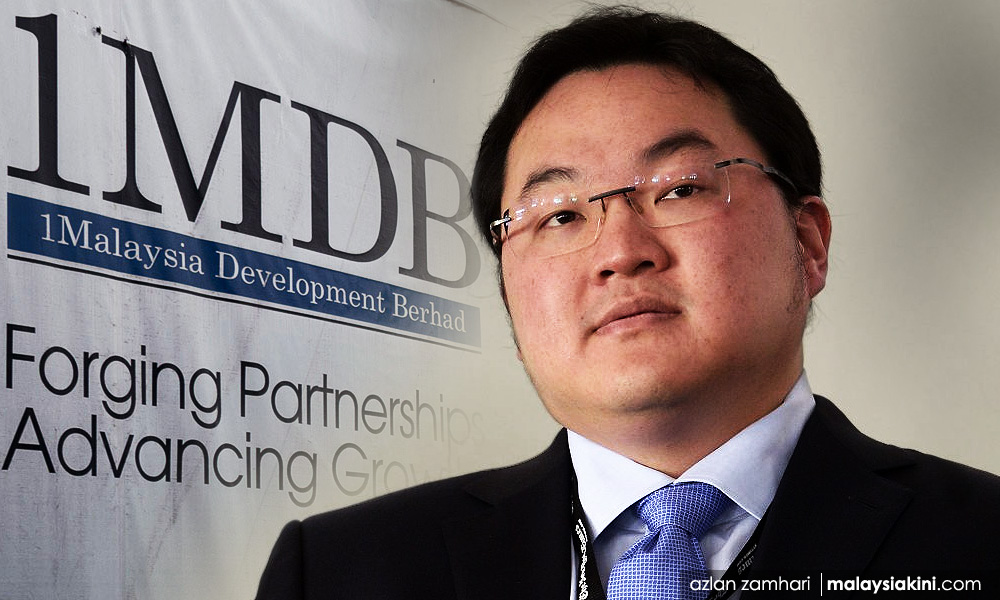

During cross-examination by lead defence counsel Muhammad Shafee Abdullah on why BNM took many years to discover that US$700 million - funds meant for a joint venture between 1MDB and Petrosaudi International Limited (PSI) - had been diverted to Seychelles-incorporated Good Star Limited, Zeti (above) said it was because the central bank had to seek further information from overseas regulators, which took time.

"When (BNM’s) supervisory team went in March 2015 (for onsite examination following intelligence gathered from regulators from foreign jurisdiction), they uncovered it went to Good Star.

“At that point, there was an inquiry on who was the beneficiary owner of Good Star and found out it was Low," Zeti said.

She added that even before 2015, BNM had become very suspicious of what was happening at 1MDB due to the fund officers' uncooperativeness with the central bank over the probe into the 2009 transaction.

She mentioned that BNM had received information that the US$700 million was not sent to an overseas beneficiary of Petrosaudi, but instead to Good Star which was linked to Low.

As such, Zeti said BNM had refused another attempt by the fund's officers for approval to conduct a similar large transfer of 1MDB funds overseas in June 2014.

Years to detect

When Shafee pressed on why it took so long for BNM to find out about the diversion, Zeti testified that central banks worldwide depend on other international regulators to discover information on offshore accounts suspected of involvement in wrongdoing, as such information is kept by overseas authorities.

"It is very common to find out from financial regulators worldwide as it takes years to detect such cases. It is a cumulative effort from all regulators all over the world, as well as internal investigation on the money trail," she said.

The former BNM governor explained that the central bank could not be checking every transaction in and out of Malaysia as there is over US$1 billion worth of such transactions on a daily basis.

Therefore, the country's financial regulations require commercial banks to report suspicious transactions to the central bank via the STR (suspicious transaction report).

In past trial proceedings, Zeti testified that if BNM - through intelligence gathered from overseas regulators and other sources - finds that a Malaysian commercial bank had failed to flag suspicious transactions, then the central bank would take action against the commercial bank such as levying a fine.

Zeti also previously testified that BNM had recommended the Attorney-General's Chambers (AGC) to prosecute 1MDB's former CEO Shahrol Azral Ibrahim Halmi and two others over the embezzlement at the fund, but the then attorney-general Mohamed Apandi Ali did not follow up on the recommendation.

The trial before Judge Collin Lawrence Sequerah at the Kuala Lumpur High Court continues this afternoon.

Abuse of power charges

Former finance minister Najib is facing four counts of abuse of power and 21 counts of money laundering involving RM2.28 billion from 1MDB, a sovereign wealth fund wholly owned by the Minister of Finance Incorporated (MOF Inc).

For the four abuse of power charges, the former Pekan MP is alleged to have committed the offences at AmIslamic Bank Bhd’s Jalan Raja Chulan branch in Bukit Ceylon, Kuala Lumpur, between February 24, 2011, and December 19, 2014.

On the 21 money laundering counts, the accused is purported to have committed the offences at the same bank between March 22, 2013, and Aug 30, 2013.

1MDB is a fully owned entity of MOF Inc. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.