KUALA LUMPUR: The ringgit slipped further against the US dollar at the close today, in line with the negative performance of most regional currencies following disappointing China trade figures, said an analyst.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Rashid said China’s trade performance continued to deteriorate with total exports and imports falling further by 14.5% and 12.4% respectively in July (June: -12.4%, -6.8% respectively).

“This suggests that the second-largest economy is facing a challenging outlook this year. Consequently, the yuan has weakened against the US dollar by 0.018% to 7.2111 yuan.

“Following this, China’s monetary policy is likely to remain accommodative to provide support to the overall economy. Given the close correlation between the yuan and ringgit at 68%, the ringgit has also weakened further,” he told Bernama.

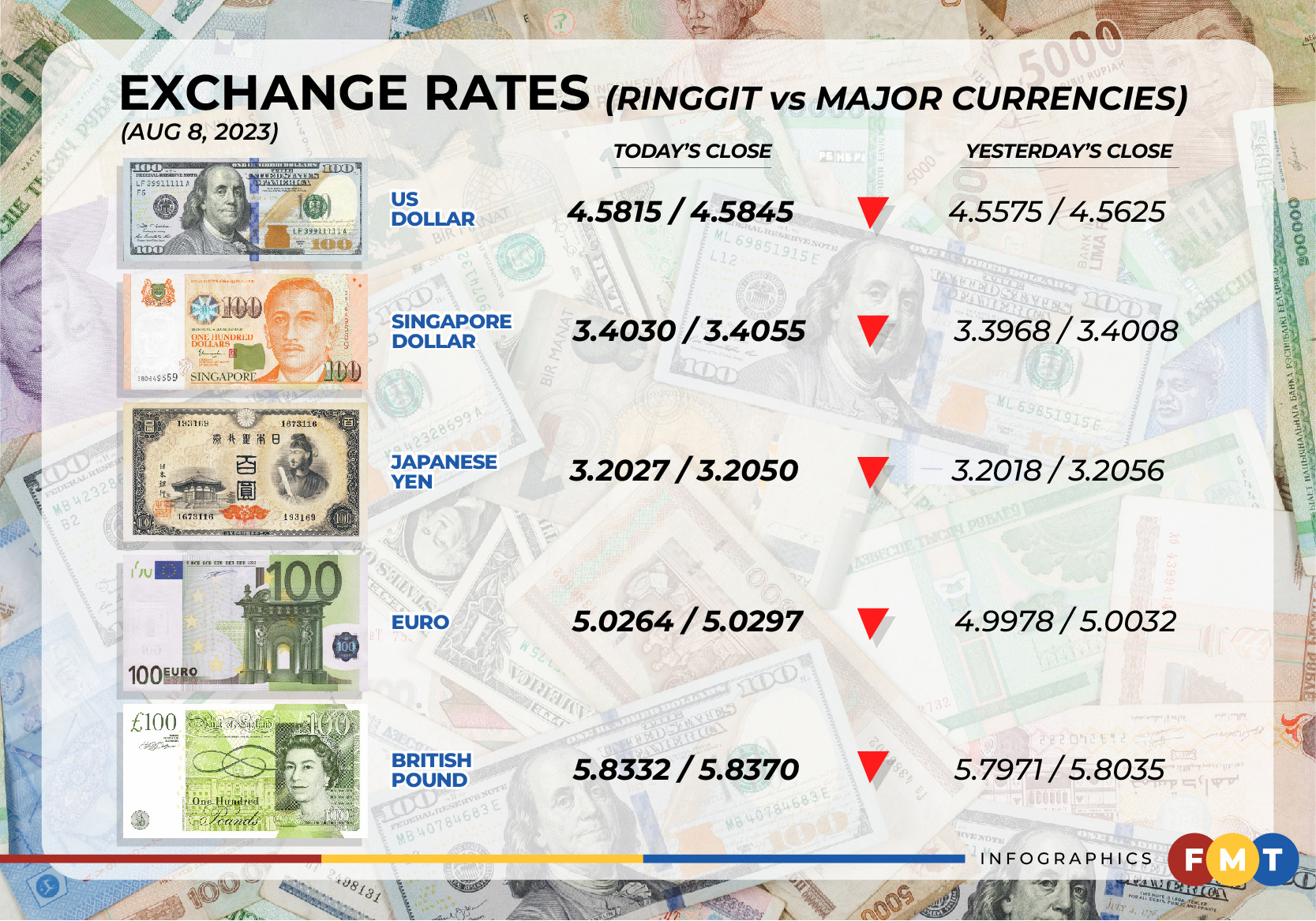

At 6pm, the local currency fell to 4.5815/4.5845 against the US dollar compared with 4.5575/4.5625 at yesterday’s close.

The ringgit was also traded lower against a basket of major currencies.

It dropped against the Japanese yen to 3.2027/3.2050 from 3.2018/3.2056 yesterday, weakened versus the euro to 5.0264/5.0297 from 4.9978/5.0032 and declined vis-a-vis the British pound to 5.8332/5.8370 from 5.7971/5.8035 previously.

At the same time, the local unit traded lower against other Asean currencies.

The ringgit went down versus the Singapore dollar to 3.4030/3.4055 from 3.3968/3.4008 from Monday’s close and depreciated against the Indonesian rupiah to 301.0/301.3 from 300.0/300.6 yesterday.

It eased vis-a-vis the Philippine peso to 8.14/8.15 from 8.13/8.14 on Monday and fell against the Thai baht at 13.1050/1184 from 13.0801/0997 previously. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.