One of the dealers said the US trade deficit contracted by 9.9% to US$53.8 billion (RM253.75 billion), the lowest since September 2020, according to the commerce department.

He said US job growth likely slowed moderately in September while the employment rate probably eased from a 0.5-1 month high, underscoring the economy’s underlying strength amid rising headwinds as the year winds down.

The ringgit is expected to stay soft next week, with a possible range of RM4.71-RM4.73.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid said the ringgit was generally on the weaker bias this week as data points continue to show a robust US economy.

“This would support the value of the US dollar. Going forward, the ringgit will continue to remain weak as the US dollar will be highly sought-after since the US federal funds rate is expected to stay higher for longer,” he told Bernama.

He said the local market’s focus next week will be on the tabling of Budget 2024.

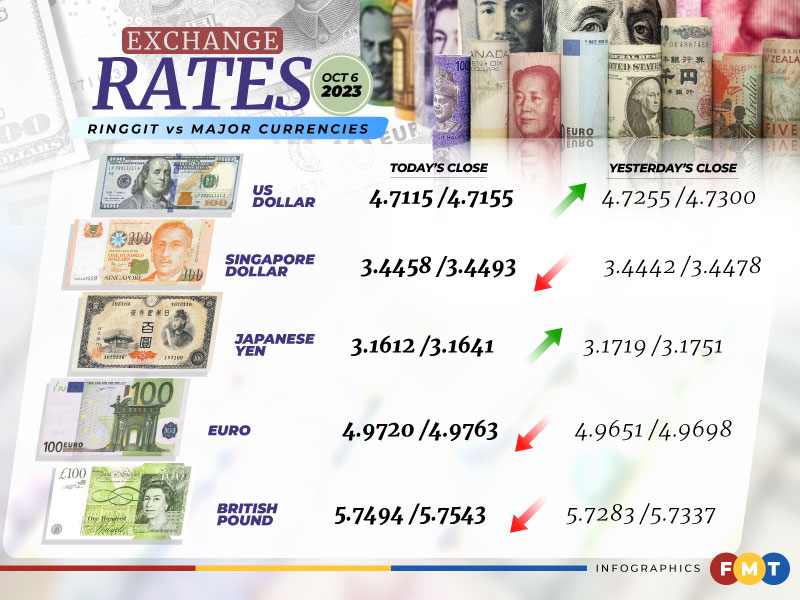

At 6pm, the local note rose to 4.7115/4.7155 against the greenback from yesterday’s close of 4.7255/4.7300.

The ringgit was traded mostly lower versus a basket of major currencies.

It went up against the yen to 3.1612/3.1641 from 3.1719/3.1751 at yesterday’s close, declined against the euro to 4.9720/4.9763 from 4.9651/4.9698 and depreciated vis-a-vis the British pound to 5.7494/5.7543 from 5.7283/5.7337.

The local note was traded mostly higher against other Asean currencies.

It increased versus the Thai baht to 12.7200/12.7367 from 12.7927/12.8115 yesterday and rose against the Indonesian rupiah at 301.7/302.1 from 302.4/303.0 previously.

It was higher against the Philippine peso at 8.32/8.33 compared with yesterday’s close of 8.33/8.35 and weakened against the Singapore dollar to 3.4458/3.4493 from 3.4442/3.4478 previously. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.