SPI Asset Management managing partner Stephen Innes said the currency market is adopting a wait-and-see approach.

He said the foreign exchange market’s expectation is that the forthcoming budget will not entail an excessive fiscal stimulus.

“It will instead focus on policy redistribution, such as reducing subsidies for the affluent and providing financial assistance to the less privileged.

“Nevertheless, this shift in policy direction might be beneficial for the economy and may yield positive results for the ringgit once concerns related to the budget subside,” he told Bernama.

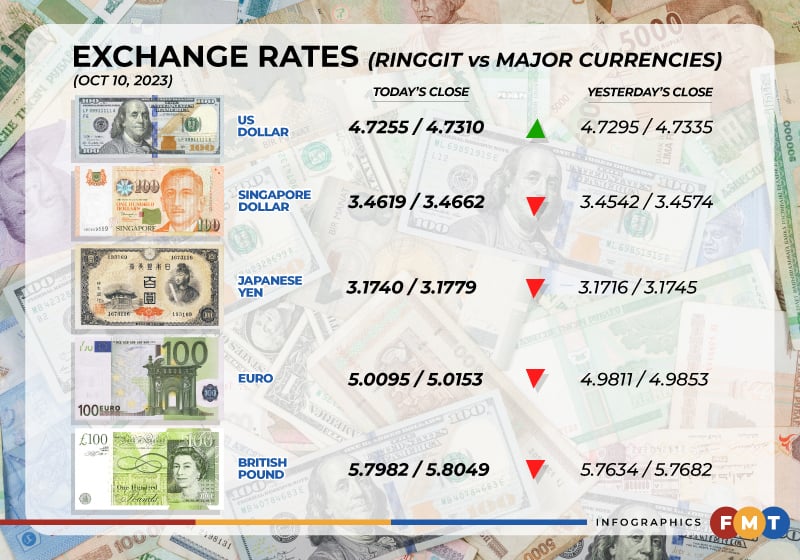

At 6.02pm, the local note rose to 4.7255/4.7310 against the greenback from yesterday’s close of 4.7295/4.7335.

The ringgit traded lower versus a basket of major currencies.

It depreciated against the yen to 3.1740/3.1779 from 3.1716/3.1745 at yesterday’s close, declined against the euro to 5.0095/5.0153 from 4.9811/4.9853 and went down vis-a-vis the British pound to 5.7982/5.8049 from 5.7634/5.7682.

The local note traded mostly lower against other Asean currencies.

It weakened against the Thai baht to 12.8571/12.8773 from 12.7435/12.7588 at yesterday’s close and traded lower against the Singapore dollar to 3.4619/3.4662 from 3.4542/3.4574.

It also depreciated against the Philippine peso to 8.31/8.32 versus 8.30/8.31, previously.

Meanwhile, it appreciated vis-a-vis the Indonesian rupiah at 300.1/300.8 from 301.3/301.7 at yesterday’s close. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.