SPI Asset Management managing partner Stephen Innes said even if the Fed decides not to raise interest rates, there is no economic evidence suggesting they will lower interest rates soon.

“To truly weaken the US dollar, the Fed would need to signal a willingness to contemplate rate cuts.

“However, the ringgit’s gains might be replaced by concerns that US inflation data may continue to remain high, potentially convincing Fed members a more restrictive monetary policy is still necessary,” he told Bernama.

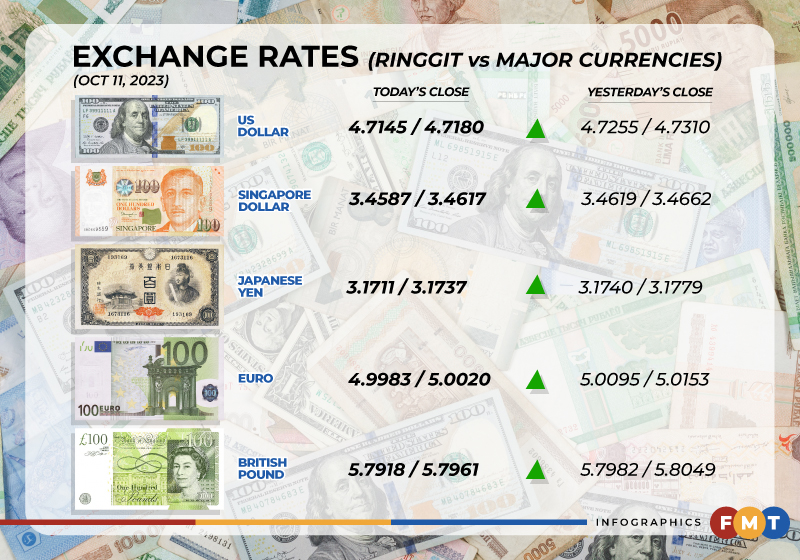

At 6.01pm, the local note rose to 4.7145/4.7180 against the greenback from yesterday’s close of 4.7255/4.7310.

Meanwhile, the ringgit traded higher versus a basket of major currencies.

It appreciated vis-a-vis the yen to 3.1711/3.1737 from 3.1740/3.1779 at yesterday’s close, went up against the euro to 4.9983/5.0020 from 5.0095/5.0153 and rose against the British pound to 5.7918/5.7961 from 5.7982/5.8049.

The local note traded mixed against other Asean currencies.

It appreciated against the Singapore dollar to 3.4587/3.4617 from 3.4619/3.4662 at yesterday’s close and went up against the Philippine peso to 8.30/8.32 versus 8.31/8.32 previously.

It depreciated against the Thai baht to 12.9462/12.9615 from 12.8571/12.8773 and traded lower against the Indonesian rupiah at 300.2/300.6 from 300.1/300.8 at yesterday’s close. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.