PETALING JAYA: A former MP has urged the government to act against those who represented it in a settlement agreement with Goldman Sachs if they are found to have acted against the country’s best interests.

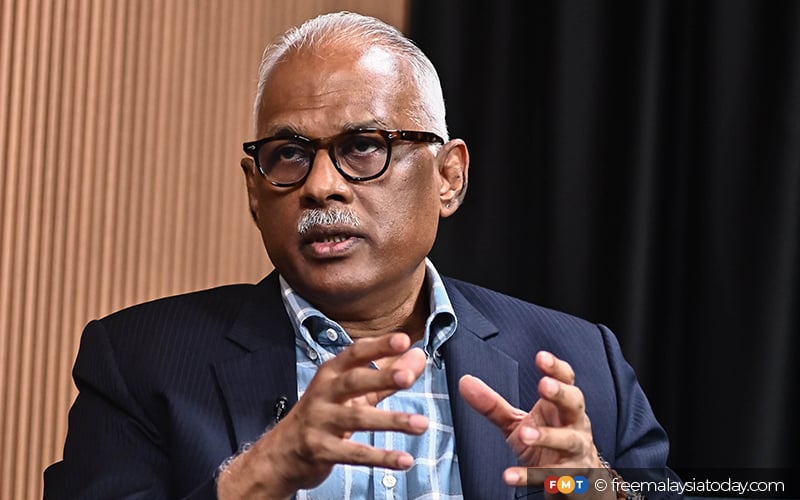

Charles Santiago, who previously described Malaysia’s settlement with Goldman Sachs as a “raw deal”, said those responsible for the agreement must account for their actions.

The former Klang MP was commenting on reports that the 1MDB task force was probing whether negotiators and lawyers who represented Putrajaya in the settlement agreement breached their fiduciary duties or were negligent in the discharge of their responsibilities.

Yesterday, task force chairman Johari Ghani said there were concerns that those who represented the government at the time might have failed to secure a “fair and adequate settlement” from Goldman Sachs.

Johari also highlighted that 1MDB paid “unusually high advisory fees” of US$606 million to Goldman Sachs for advising on the issuance of the three bonds totalling US$6.5 billion.

“Malaysia was shortchanged in the settlement agreement. No one can deny this. I challenge anyone who feels the settlement is fair to come out and say so,” Santiago told FMT.

“We had a solid case (against Goldman Sachs) and we let them get off easily. Who will pay the price for this? The rakyat,” he said, referring to Malaysia’s decision to drop criminal charges against the firm over its involvement in the 1MDB scandal.

As part of the 2020 settlement with Malaysia, Goldman Sachs made an initial US$2.5 billion payment in September of that year.

The bank was also required to make an interim payment of US$250 million if Malaysia did not receive at least US$500 million in assets and proceeds by August 2022.

In October last year, the company took the government to the London International Court of Arbitration following a disagreement over the terms of the US$500 million settlement. The proceedings are ongoing.

Santiago also said he agreed with the task force’s plans to sue the foreign banks that facilitated 1MDB fund transfers without conducting proper know-your-client processes at the material time.

“Everyone who was involved in the 1MDB scandal must face the music,” he said.

“The Malaysian people and economy have paid a heavy price for the 1MDB catastrophe. It is disheartening to read that people entrusted to protect the country’s interests may have been negligent.”

Previously, it was reported that seven or eight international banks were involved in the matter. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.