KUALA LUMPUR: The ringgit extended its decline to close lower against the US dollar today as investors assess the timing and pace of the US Federal Reserve (Fed) interest rate cuts.

The Standard Chartered Bank has anticipated the Fed to cut the benchmark interest rate four times in 2024, totalling 100 basis points, with inflation and geopolitics posing a threat to this scenario.

Meanwhile, Bank Muamalat Malaysia Bhd chief economist Afzanizam Rashid said risk-off mode appears to be at the centre stage as the value of the US Dollar Index rose by 0.52% to 102.932 points.

At the same time, the People’s Bank of China surprised the market by not cutting its benchmark interest rate while the US dollar gained strength against major currencies, including the euro and British pound, he added.

“Following this, the ringgit continued to depreciate, around RM4.68, against the US dollar,” he told Bernama.

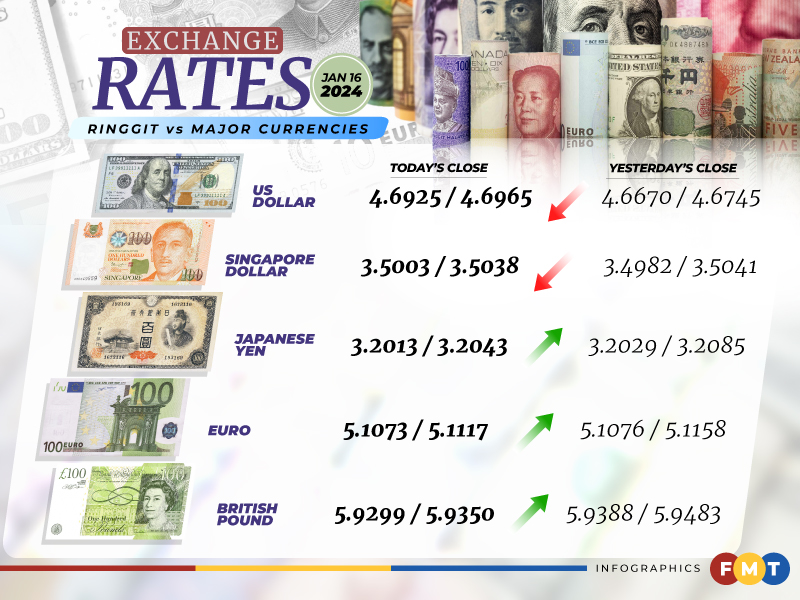

At 6pm, the ringgit eased to 4.6925/4.6965 versus the greenback from yesterday’s close of 4.6670/4.6745.

At today’s close, the ringgit was traded higher against a basket of major currencies.

It was marginally higher versus the euro to 5.1073/5.1117 from 5.1076/5.1158 at yesterday’s close, appreciated vis-a-vis the British pound to 5.9299/5.9350 from 5.9388/5.9483 and was slightly higher against the Japanese yen at 3.2013/3.2043 from 3.2029/3.2085 previously.

The ringgit was traded mostly lower against Asean currencies.

It appreciated against the Thai baht to 13.2579/13.2748 from 13.3518/13.3802 previously but fell against the Singapore dollar to 3.5003/3.5038 from 3.4982/3.5041 at yesterday’s close.

It declined vis-a-vis the Philippine peso to 8.40/8.42 from 8.36/8.38 and the Indonesian rupiah to 300.9/301.3 from 299.9/300.6. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.