KUALA LUMPUR: The ringgit extended yesterday’s losses to close lower against the US dollar today as positive US consumer price index (CPI) data prompted some investors to return to the safe havens, dealers said.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid said the ringgit appeared to be fairly stable against the US dollar, lingering at around RM4.642 to RM4.648.

“News over higher-than-expected US CPI (for December 2023) last night did little to nudge the ringgit, with the US Dollar Index (DXY) falling 0.05% to 102.238 points,” he told Bernama.

Another dealer pointed out that oil prices surged today as the US and Britain carried out strikes against Houthi military targets in Yemen in retaliation for attacks by the Iran-backed group on shipping in the Red Sea starting from late last year.

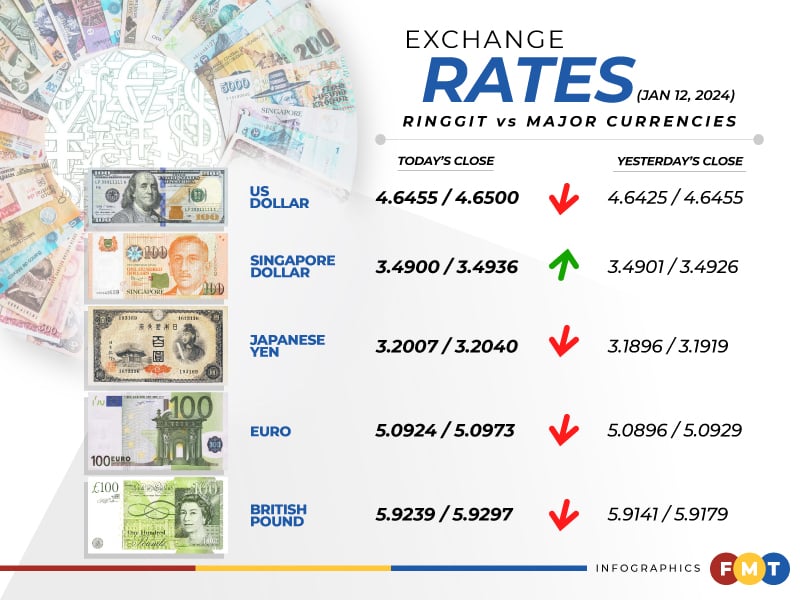

At 6pm, the ringgit eased to 4.6455/4.6500 versus the greenback from yesterday’s close of 4.6425/4.6455.

Meanwhile, at the close, the ringgit was traded lower against a basket of major currencies.

It weakened versus the euro to 5.0924/5.0973 from 5.0896/5.0929 at yesterday’s close, depreciated vis-a-vis the British pound to 5.9239/5.9297 from 5.9141/5.9179, and fell against the Japanese yen to 3.2007/3.2040 from 3.1896/3.1919 previously.

The ringgit traded mostly lower against Asean currencies.

It rose against the Singapore dollar to 3.4900/3.4936 from 3.4901/3.4926 at yesterday’s close.

However, the local note slipped against the Thai baht to 13.2464/13.2664 from 13.2408/13.2551 yesterday, declined vis-à-vis the Philippine peso to 8.30/8.32 from 8.29/8.30 previously, and eased versus the Indonesian rupiah to 298.6/299.1 from 298.5/298.8. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.