KUALA LUMPUR: The ringgit retreated from recent gains to close slightly lower against the US dollar today as concerns over the US consumer price index (CPI) data to be released later today shifted investor appetite to safe-haven currencies, including the greenback, said dealers.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Rashid said that the US dollar/ringgit hovered around RM4.64 to RM4.65 today as the market awaited the US CPI data that will be released later tonight.

“The US CPI tonight is quite critical in determining the timing of the US interest rate cut. Should the CPI turn out to be higher than expected, it could result in the US dollar appreciating,” he told Bernama.

Another dealer pointed out that Federal Reserve Bank of New York president John Williams said yesterday that it is still too early to call for any rate cuts as the central bank still has some distance to go on getting inflation back to its 2% target.

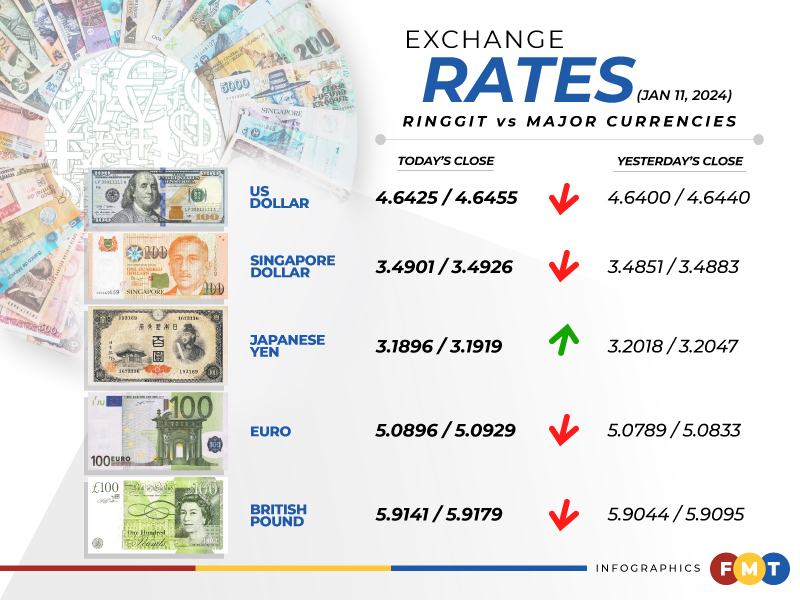

At 6pm, the ringgit depreciated to 4.6425/4.6455 versus the greenback from yesterday’s close of 4.6400/4.6440.

Meanwhile, at the close, the ringgit was traded mostly lower against a basket of major currencies.

It weakened versus the euro to 5.0896/5.0929 from 5.0789/5.0833 yesterday, depreciated vis-a-vis the British pound to 5.9141/5.9179 from 5.9044/5.9095 yesterday but increased against the Japanese yen to 3.1896/3.1919 from 3.2018/3.2047 previously.

The ringgit also traded mostly lower against Asean currencies.

It fell against the Singapore dollar to 3.4901/3.4926 from 3.4851/3.4883 at yesterday’s close and declined vis-à-vis the Philippine peso to 8.29/8.30 from 8.24/8.25.

The local currency was lower versus the Indonesian rupiah at 298.5/298.8 from 297.9/298.4 previously but gained against the Thai baht to 13.2408/13.2551 from 13.2598/13.2777 yesterday. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.