KUALA LUMPUR: The ringgit closed higher against the US dollar today, eking out a marginal gain after recent losses as funds flowed back into emerging markets.

MIDF Research said the ringgit and other regional currencies would benefit from the weakening US dollar moving forward, with more funds flowing back into emerging markets.

It said that a recovery in regional trade, underpinned by sustained growth in China’s economy and recovering global manufacturing activities would further lift sentiment.

“Following the recent rally in US Treasuries, we foresee that the dollar weakening will continue as safe-haven demand subsides, along with growing investor appetite for riskier assets.

“Nevertheless, the upside bias for the dollar remains as the risk of a possible recession in the US and rising geopolitical tensions could result in increased risk aversion, which is supportive of the US dollar,” it said in a note today.

The research firm said interest rate cuts may be delayed by the continued resilience of the US economy if demand conditions stay robust and the American labour market remains tight, with the dollar gaining from a higher-for-longer policy bias.

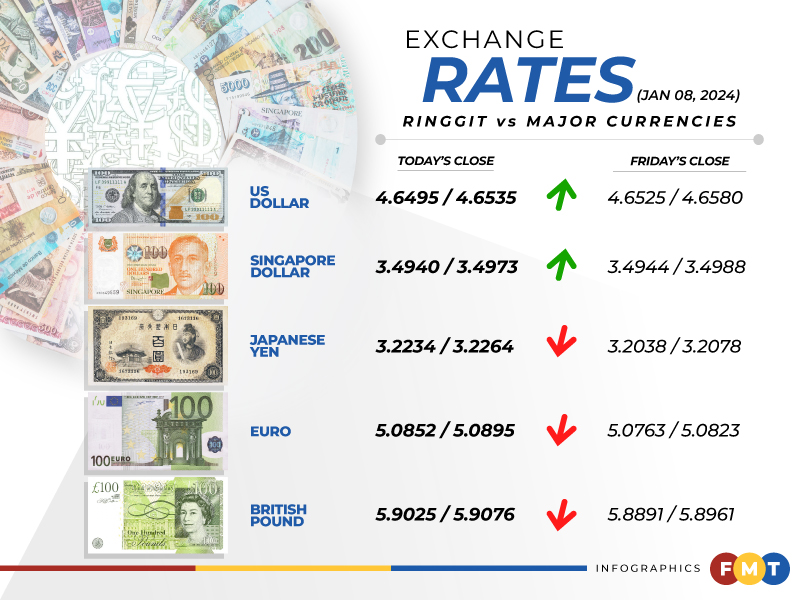

At 6pm, the ringgit climbed to 4.6495/4.6535 versus the greenback from Friday’s close of 4.6525/4.6580.

At the close, the ringgit was traded lower against a basket of major currencies.

It declined vis-a-vis the British pound to 5.9025/5.9076 from 5.8891/5.8961 on Friday, weakened versus the euro to 5.0852/5.0895 from 5.0763/5.0823 last week, and depreciated against the Japanese yen to 3.2234/3.2264 from 3.2038/3.2078 previously.

The ringgit was traded higher against Asean currencies.

It was slightly higher against the Singapore dollar at 3.4940/3.4973 from 3.4944/3.4988 at Friday’s close and rose vis-à-vis the Philippine peso to 8.35/8.36 from 8.37/8.38.

The local currency appreciated versus the Indonesian rupiah to 299.4/299.8 from 299.8/300.3 and rose against the Thai baht to 13.2661/13.2870 from 13.4001/13.4236. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.