KUALA LUMPUR, Oct 14 — The Malaysian government will need to make changes to avoid collecting taxes twice after it introduces Capital Gains Tax (CGT) in March next year, tax advisory firms Deloitte and Ernst & Young have said.

Currently, Malaysia already collects 10 to 30 per cent tax on profits made from selling property or shares in real property companies under the Real Property Gains Tax Act 1976, depending on how long the property has been held before it was sold.

This means the government currently only collects taxes on profits made from selling shares in real property companies, and does not impose taxes on profits from the sale of shares in other types of companies.

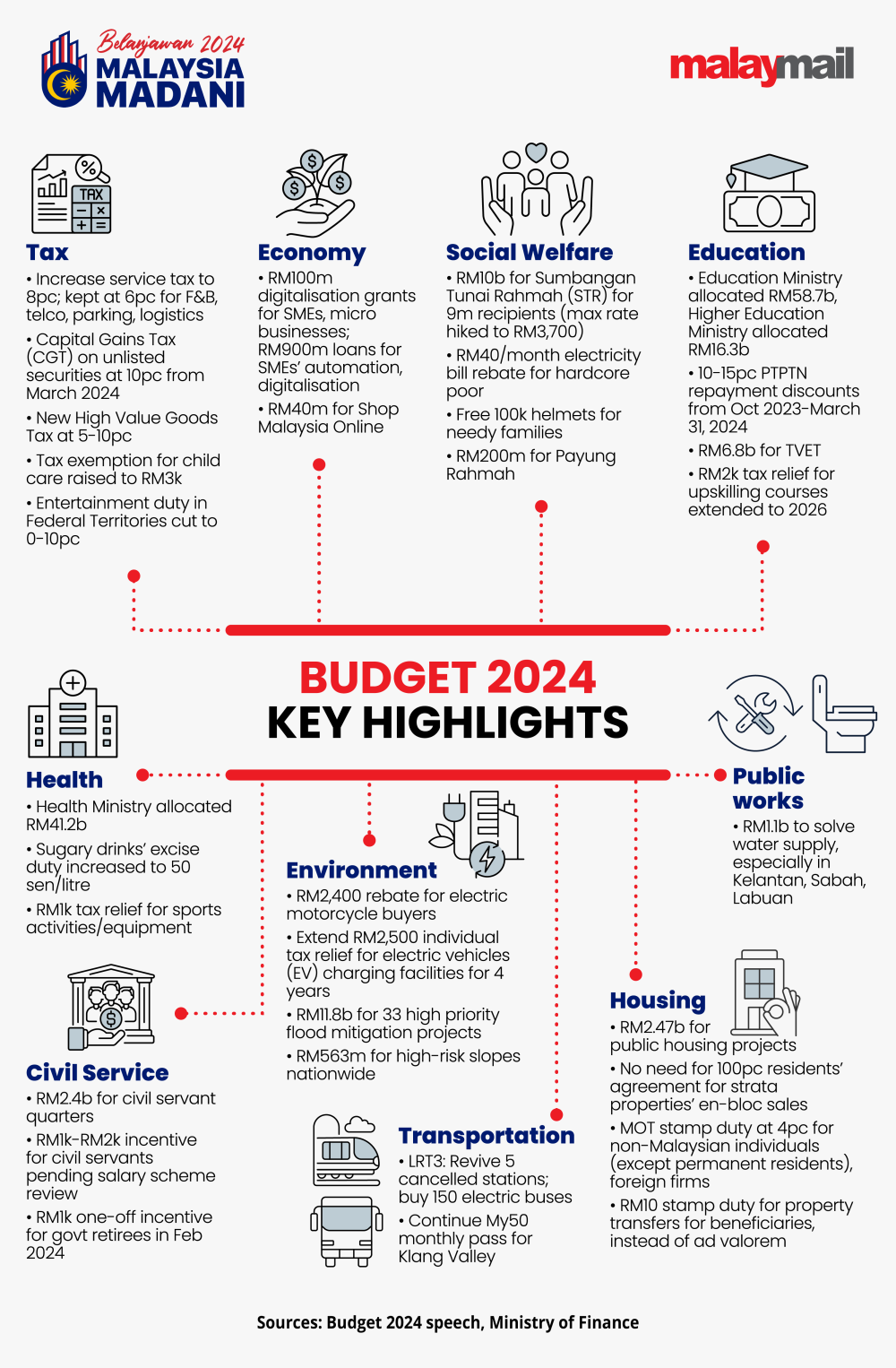

As part of Budget 2024, the government yesterday in its tax measures booklet said it intends to introduce the CGT to collect taxes on profits made by the selling of unlisted shares (shares in companies that are not listed on the stock exchange).

For the new CGT to be collected from next March, the CGT rate will depend on when the shares were purchased.

If a taxpayer had bought the shares in the unlisted company before March 1, 2024, they may choose to either pay CGT at a rate of 10 per cent on the net gain of the shares’ disposal or two per cent on the gross sales value. If the taxpayer bought the unlisted shares after March 1, 2024, they would have to pay 10 per cent CGT on the disposal of shares. To reduce the cost of doing business and for smooth implementation of the new tax, the government plans to provide CGT exemption for the sale of shares related to Bursa Malaysia-approved initial public offering; restructuring of shares within the same group; and for venture capital companies.

The government did not say if profits made from selling shares in real estate companies — which are already subject to the existing real property gains tax (RPGT) in Malaysia — would be exempt from the new CGT.

Deloitte Malaysia country tax leader Sim Kwang Gek expects the government to not collect RPGT for profits made from selling shares in real property companies, after CGT kicks in next year.

“With this, it is expected that the current Real Property Gains Tax Act 1976 will be amended to remove RPGT on disposal of Real Property Company shares to avoid double taxation,” she said in a statement last night.

According to Deloitte Malaysia, CGT is not a new concept and has been implemented by other countries such as Indonesia, Thailand, Vietnam, Philippines, Australia and the United Kingdom with wider scope than just unlisted shares and ranging from as low as 0.6 per cent to 30 per cent depending on the type of assets disposed, while others like Singapore and Cambodia plan to introduce such taxes next year.

Sim said Malaysia’s introduction of CGT on profits from the disposal of unlisted shares “may have a short-term impact on mergers and acquisition (M&A) deals” as it would increase tax costs, but said the market would have taken such tax costs into consideration over time.

She said tax is just one of the factors that investors consider when making decisions, and that there are other factors such as ease of doing business, talent availability and stability of the government.

Sim listed out some challenges to be considered when Malaysia starts collecting CGT, including the question of how unlisted shares’ cost base would be valued, since the proposed 10 per cent CGT will be applied on the net gain or net profit from the selling of these shares.

“In situations where the shares have been acquired many years ago or a company that has been incorporated many years ago with a low capital base, the net gain would be substantial. It does not seem to be equitable to whack 10 per cent on the difference between the sale proceeds and the costs,” she said.

“Similar to Australia, an inflation adjusted cost base should thus be considered in such cases. There are a number of issues that need to be ironed out, to provide clarity to businesses.

“For example, the tax treatment on losses arising from such disposals. Would the losses be allowed to be carried forward and set off against taxable profits from normal course of business or “ring fenced” against transactions relating to disposal of unlisted shares? Is there going to be a limit on the number of years that the losses can be allowed to be carried forward?” she added.

Farah Rosley, Malaysia Tax Leader, Ernst & Young Tax Consultants Sdn Bhd also highlighted the need to avoid double taxation when Malaysia introduces CGT on unlisted shares.

“Since the announcement of the CGT proposal in February 2023, the Ministry of Finance has held consultations with various stakeholders, including professional bodies and various business groups, on the potential impact of the new tax.

“However, no details are available yet on the exact scope of the tax and its interplay with Real Property Gains Tax (RPGT) on disposal of shares in real property companies.

“Currently, capital gains on disposal of shares are not taxable unless the shares are shares in a real property company for RPGT purposes. With the new CGT proposed, mechanisms should be put in place to prevent double taxation,” she said in a statement last night.

Farah said that the government has also yet to provide specific details on a proposed new luxury goods tax, stating: “It is hoped that further details will be shared as soon as possible to allow businesses to understand the impact and make the necessary preparations.”

Yesterday, Finance Minister Datuk Seri Anwar Ibrahim in his Budget 2024 speech said the government plans to enact new laws to introduce a high value goods tax at five to 10 per cent on certain high value items such as jewellery and watches based on the threshold value of the goods’ price, but did not elaborate further.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.