PETALING JAYA: Economists do not foresee the government reintroducing the goods and services tax (GST) anytime soon, with one saying Putrajaya missed an opportunity to announce its revival in 2025.

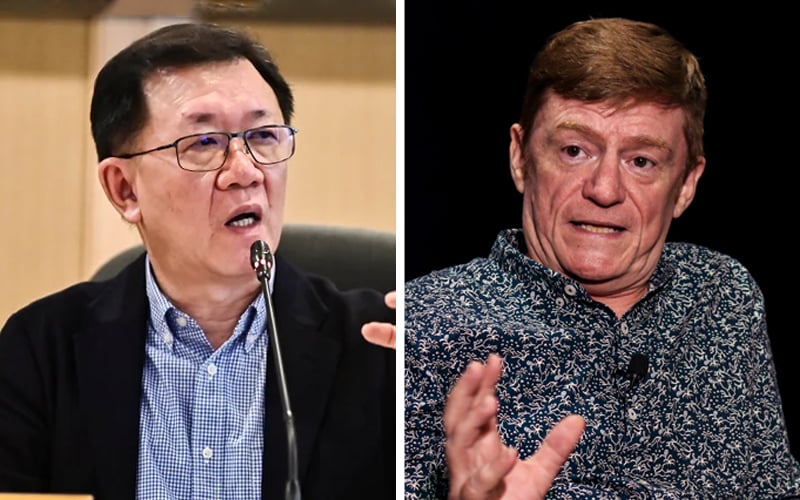

Lee Heng Guie of the Socio-Economic Research Centre said an early announcement at Budget 2024 tabled on Oct 13, would have allowed the government time to address potential public discontent in advance of a revival of the consumption tax.

“If the government had announced the reintroduction of GST from 2025 in the recent budget, it would have given them a 12-month window to prepare for its actual implementation.

“Such a move would assist the government in managing potential price pressures resulting from the reintroduction of the tax,” Lee told FMT.

The government would have also been able to obtain feedback from industry players on how best to implement the tax scheme to minimise cost disruption on households and businesses, he added.

Lee also said it may be too late to bring the GST back in 2026 as any public dissatisfaction may affect the unity government’s chances at the next general election, which would be on the horizon by then.

Nonetheless, he believes Putrajaya may not have ruled out GST altogether, citing the finance ministry’s 2024 fiscal outlook report.

“If you read the report, they did a comparison. They concluded that both the GST and SST are effective fiscal policy tools,” said Lee.

On the other hand, Geoffrey Williams of the Malaysia University of Science and Technology said it is unlikely that the GST will be reintroduced in the near future.

“GST will not be reintroduced anytime soon because it is a regressive tax, disproportionately affecting the poor,” he said.

Williams said minor tweaks to the present tax regime could offer a more responsible approach to fiscal policy.

“Small adjustments to the existing tax system can help manage fiscal policy more responsibly, especially if it is matched with tightening of spending to cut wastage, leakages and corruption.”

On Monday, former health minister Khairy Jamaluddin proposed that GST be reintroduced beginning 2026 as a component of the government’s economic structural reforms.

A 6% GST was introduced in 2015 by the administration of then prime minister Najib Razak, but was ditched by the former Pakatan Harapan government in 2018 in favour of the reintroduction of the SST system. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.