Last week, following the release of the Corporate Governance Watch 2023 (CG Watch 2023) report, the Securities Commission Malaysia (SC) issued a media statement to hail the country’s success in topping one of the surveyed categories.

The report, issued by the Asian Corporate Governance Association (ACGA) and covering 12 Asia-Pacific countries, saw Malaysia come out tops in the “auditors and audit regulators” category with a score of 92 out of 100, edging out Australia. The two countries were joint top with 86 points in the previous rankings, released in 2020.

The SC was also mightily pleased that Malaysia had grabbed second spot, behind Australia, in two other categories – corporate governance rules, and corporate governance practices by listed companies.

It also gave itself a pat on the back for an honourable mention it received. “In terms of the regulator category, the SC was recognised for, among others, effective communication on our enforcement action.

“It is also a strong recognition of the Audit Oversight Board’s role in promoting audit quality. Good corporate governance will remain a priority for the SC and we will continue to act on areas which require reinforcement,” SC chairman Awang Adek Hussin said in the statement.

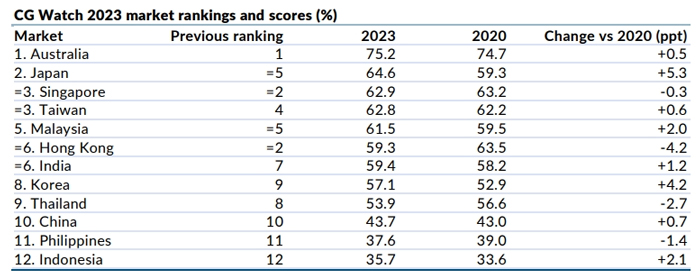

Although Malaysia came out tops in one out of the seven categories, it remained in fifth position overall with 61.5 points, a two-point increase over its 2020 score of 59.5. This put the country behind leader Australia, Japan, Singapore, and Taiwan, but ahead of Hong Kong, India, Korea, Thailand, China, the Philippines, and wooden spoonist, Indonesia.

However, the disappointing aspect of the SC’s statement was that it omitted to mention that Malaysia fared badly in some important categories.

The country’s omission in the realm of capital markets, where public disclosure and transparency by market participants are mandated by regulators and stock market regulations, has raised some eyebrows.

So where did Malaysia flop in CG Watch 2023? In probably the most important category – government and public governance – where it garnered a miserable 37 points, placing eighth out of the 12 nations.

The only positive is that it did slightly better compared to the 32 points garnered in 2020. ACGA’s CG Watch 2023 report said Malaysia saw a marked increase in score, “albeit from a low base”. That is certainly an understatement – whether its 37 or 32 points, it is still an “F”.

“Public governance sets the tone for corporate governance in many ways, hence the absolute level and direction of many of these scores is a concern,” the report said, adding that autonomy of securities regulators, and access to legal redress, are still concerns.

This category is important as it looks at whether securities commissions can operate independently of government, if there is fair access to the legal system for minority shareholders, and the existence of genuinely independent commissions against corruption.

“Sadly, we are not seeing much improvement in anti-corruption work in most markets. Extra-jurisdictional reach still yields few results in most of the region, with blockbuster graft trials few and far between – Malaysia being a notable, though at times disappointing, exception,” the report said.

It also highlighted that political interference in the courts is worsening in several markets.

“Judicial independence is under attack and/or suffers from a perception of bias in several markets, including Malaysia, Thailand and Hong Kong, while it remains questionable at times in others,” it added.

The other area where Malaysia performed poorly was in the investors’ category, which rates the CG-related activities of three groups of investors: domestic institutional, foreign institutional, and domestic retail. It came out marginally worse with 42 points in 2023 compared to 43 in 2020, placing it in fifth spot.

This episode reminds me of the naughty schoolboy who tells his disciplinarian father that he did well in the exams, scoring As and Bs in some subjects, while conveniently omitting the fact that he failed in others.

As a regulator for the country’s capital market, it is imperative that the SC takes the lead in transparency by disclosing the good, the bad, and even the ugly, to stakeholders, the market, and, most importantly, the Malaysian public.

On the local bourse, timely and accurate disclosure of financial statements and material information are fundamental obligations of listed companies, and of paramount importance in maintaining market integrity and investor confidence.

We take the SC chairman at his word. He said: “Good corporate governance will remain a priority for the SC and we will continue to act on areas which require reinforcement.”

However, to “reinforce” weaknesses, one must first acknowledge a problem openly. Only then can you begin to seek a resolution. - FMT

The views expressed are those of the writer and do not necessarily reflect those of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.