KUALA LUMPUR: The ringgit closed marginally higher against the weakening US dollar on the last trading day of the week following the latest Federal Open Market Committee (FOMC) decision this week.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid said investors seem to have fully understood the direction of the US rates given the latest FOMC decision.

The US Federal Reserve (Fed) signalled its intention to cut the Federal Funds Rate (FFR) in 2024.

The FOMC has opted to keep the FFR steady at 5.25%-5.50% following its latest meeting.

“The ringgit versus the US dollar was in a narrow range today.

“It went as high as RM4.6728 in the early session but appreciated to RM4.6667 in the afternoon session,” he told Bernama.

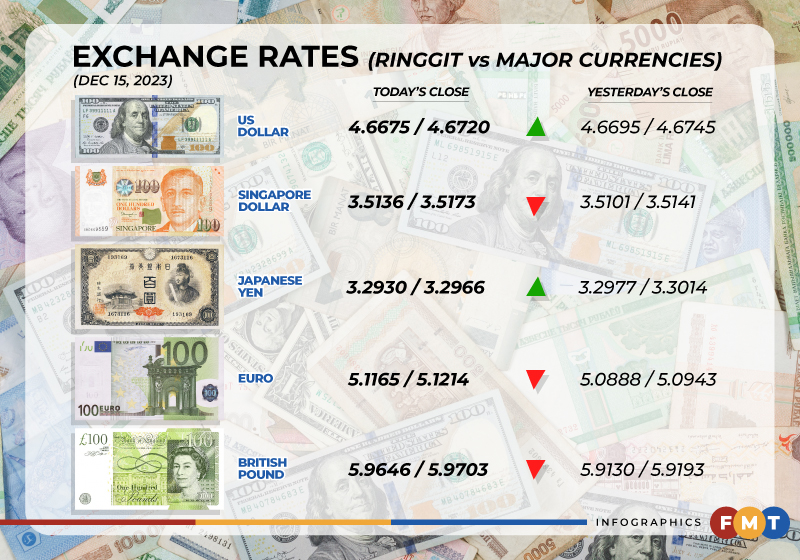

At 6pm, the ringgit rose to 4.6675/4.6720 against the greenback from yesterday’s close of 4.6695/4.6745.

At the close, the ringgit was traded lower versus a basket of major currencies except the Japanese yen, where it firmed to 3.2930/3.2966 from yesterday’s close of 3.2977/3.3014.

The local unit fell against the British pound to 5.9646/5.9703 from 5.9130/5.9193 and depreciated versus the euro to 5.1165/5.1214 from 5.0888/5.0943 yesterday.

The ringgit was traded lower against a few Asean currencies.

It decreased slightly against the Philippine peso to 8.38/8.40 from yesterday’s closing rate of 8.37/8.38 and edged down versus the Singapore dollar to 3.5136/3.5173 from 3.5101/3.5141 yesterday.

The ringgit fell against the Thai baht to 13.3970/13.41769 from 13.3205/13.3424 and was marginally easier against the Indonesian rupiah at 301.2/301.6 from 301.1/301.6 at yesterday’s close. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.