I have been getting non-stop calls from Indians, expressing their fears about the ending of subsidies.

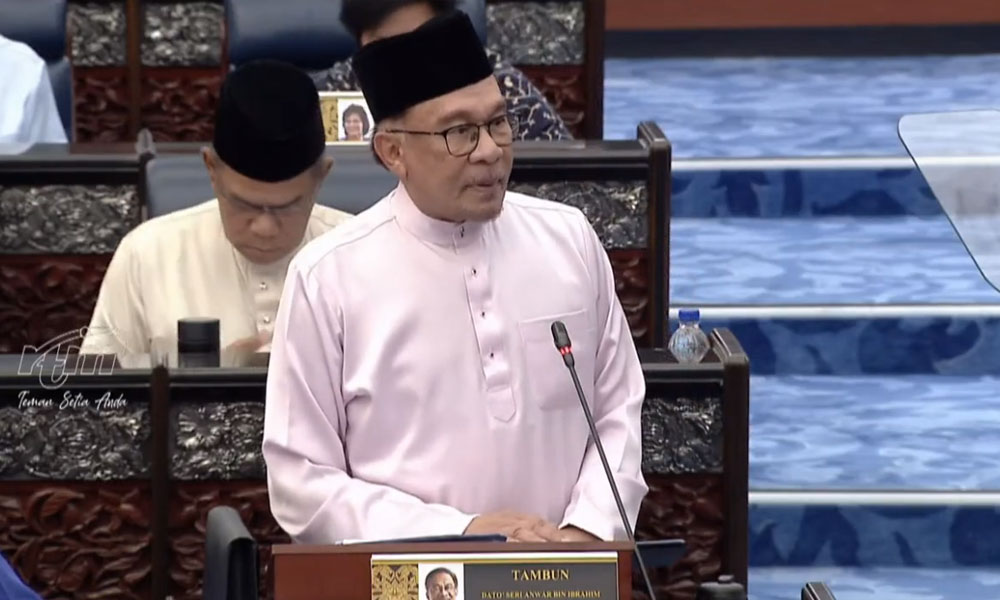

This is largely due to the cynicism and misunderstanding amongst the community about Budget 2024, announced by Prime Minister Anwar Ibrahim last Friday.

The unrelenting worry is that the ending of subsidies would push Indians even deeper into poverty.

This is echoed in the various social media platforms, where they criticise the government for failing to lift the community out of poverty or equip them with business and development skills.

I have been repeating my answer like a mantra, trying to create a deeper understanding of the targeted subsidies and how taking financial aid away from the rich would create a bulk of savings, which would then be channelled back to the poor including Indians.

But there are only so many people I can talk to. The government has to ensure clear information about targeted subsidies is disseminated widely, to iron out the echoing concerns.

As such, the government needs to explain that subsidy rationalisation will not impact the cost of living of the B60, for example.

This is because the government plans to remove subsidies going to the rich in the areas of fuel, electricity and food.

Another line of thinking on social media is that the allocations for Indians are predictable. It’s like how the former Umno and Perikatan Nasional governments offered - a bit of flesh sticking on bones - without much thought given to new ways to uplift the community.

The other busy platforms seem to be kopitiam and restaurants, where the topic of conversation is about the increase of Sales and Services Tax (SST) from six percent to eight percent.

It’s almost like a double whammy where the subsidies are not just cut, but more taxes are imposed to the detriment of the poor and lower middle classes, who are yet to get back on their feet following job losses since the Covid-19 pandemic plus recent price hikes of food and other essential items.

It is the responsibility of the government to explain that a two-percent hike in the SST for the rich will help increase government revenue that can be used for government expenditure in education and health care.

Besides this, it would decrease the prices of goods and services consumed by the B60. Put differently, the two percent increase in SST will be transferred to help the B60 in a targeted fashion.

The Indians have been on the receiving end of the spectrum for decades now. Therefore, it is crucial to work on the sticking points to ensure that frustration and mistrust can be mitigated.

As such, I suggest that the government sets up an Impact Assessment Taskforce that will address the concerns of the Indian community and help them understand the opportunities and challenges in Budget 2024.

This task force must also analyse the impact in terms of deliverables for the community and periodically publish a detailed report.

The task force will allow for direct engagement with the community, an opportunity to handle their grievances without delay and most importantly, ensure they are not misguided by opportunistic politicians and individuals.

Indian support for Pakatan Harapan-BN coalition is waning, as indicated by the last general election and recent six state polls.

The setting up of the taskforce could be one of the many steps to bring back the loss of support and erosion of trust in the government. - Mkini

CHARLES SANTIAGO is former Klang MP.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.