The local currency had been languishing at 25-year lows in recent weeks.

The NFP, which is the gauge for the total number of jobs created in the US, rose at a slower pace to 150,000 in October while the unemployment rate crept up to 3.9% after remaining at 3.8% in the past two quarters, dampening sentiment for the greenback.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid said the ringgit has clocked a 2.28% gain on a month-to-date basis, the second best-performing currency after the South Korean won.

“The USD-MYR is currently at RM4.6570, which already breached the immediate support level of RM4.6611,” he told Bernama.

Going forward, Afzanizam said he believes the scope for further appreciation will depend on the next US Federal Open Market Committee meeting which is scheduled for mid-December.

“While the Fed funds rate is expected to remain unchanged, the latest quarterly forecast will be closely scrutinised by the markets.

“The September forecast showed that the US Federal Reserve is expected to cut the rate by 25 to 50 basis points next year,” he added.

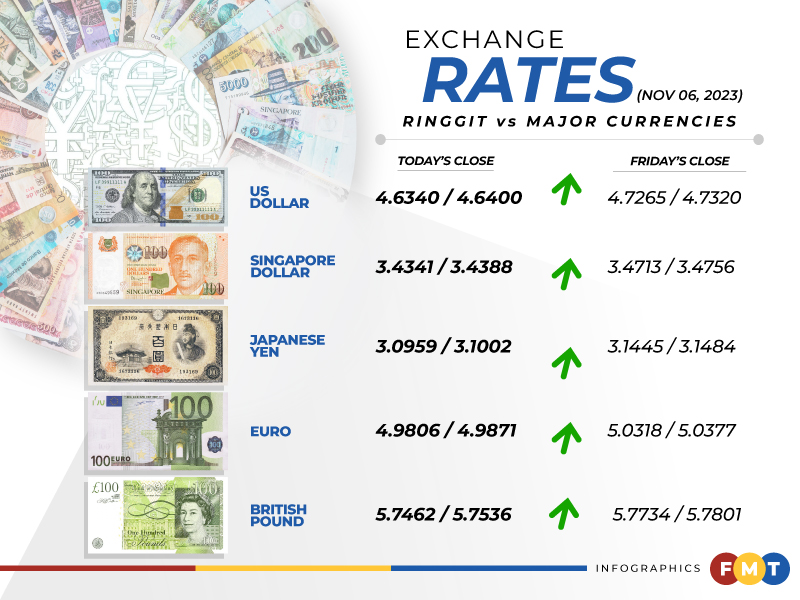

At 6pm, the ringgit surged to 4.6340/4.6400 against the greenback from last Friday’s close of 4.7265/4.7320.

At the close, the ringgit also traded higher versus a basket of major currencies.

It rallied against the Japanese yen to 3.0959/3.1002 from 3.1445/3.1484 at the close last Friday, strengthened versus the euro to 4.9806/4.9871 from 5.0318/5.0377 and gained against the British pound to 5.7462/5.7536 from 5.7734/5.7801.

The ringgit also turned higher against other Asean currencies.

It appreciated against the Singapore dollar to 3.4341/3.4388 from 3.4713/3.4756 and rose vis-a-vis the Indonesian rupiah to 298.1/298.7 from 300.5/300.9 at the close last Friday.

It jumped against the Thai baht to 13.0521/13.0741 from 13.2332/13.2553 previously and gained against the Philippine peso to 8.29/8.30 from 8.42/8.44 last Friday. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.