I refer to the statement and press conference made by Tasek Gelugor MP Wan Saiful Wan Jan on the issue of income-contingent loan repayments (ICLR) for PTPTN loans that were raised by Prime Minister Anwar Ibrahim in October 2023.

For the record, I served as a board member of PTPTN from June 2018 to January 2020. I was appointed as a board member of PTPTN before I took up the position of deputy international trade and industry minister in July 2018.

I was appointed because of my knowledge of the financial and policy positions of PTPTN. When I was the general manager of the Penang Institute, I published a report examining the financial sustainability of PTPTN.

I think Wan Saiful tried his best during this time as PTPTN chairperson to find ways of improving the education fund’s financial position and to bring about some management changes, including the promotion of Ahmad Dasuki Abdul Majid to his current position of CEO.

However, his effectiveness was hampered by communication challenges he had with the education minister during the administration led by Dr Mahathir Mohamad and the higher education minister during the Muhyiddin Yassin and Ismail Sabri Yaakob administrations.

Objection was against method

Wan Saiful was right to say that in December 2018, Anwar and PKR Youth chief Akmal Nasrullah Mohd Nasir raised concerns with regard to the ICLR that was proposed by himself. The challenge was not so much objecting to the concept of ICLR but the way it was going to be implemented.

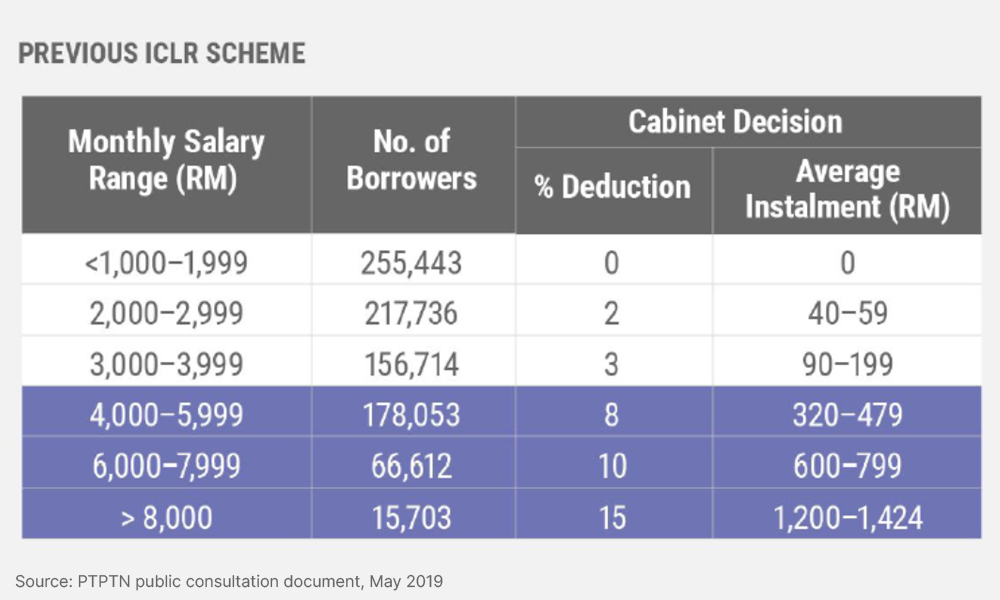

The proposal to significantly reduce the amount of loan repayment for those earning below RM2,000/month also included increasing the monthly repayments of those earning higher salaries.

This would have meant a big jump in monthly repayments of those earning above RM4,000/month, for example (See Figure 1 below).

In hindsight, what should have been proposed was an ICLR that was more gradual according to larger income brackets and to only implement this for new PTPTN recipients rather than existing borrowers, because new borrowers would know about the ICLR right from the start and not be shocked by higher repayment rates if they were to earn a higher salary soon after graduating.

They could then plan their finances accordingly, including servicing their car loans, their mortgages (if any), and their other monthly fixed expenses.

There were also discussions on exempting those earning below RM4,000/month from servicing their PTPTN loans but the financial cost to the government would have reached almost RM15 billion for five years and this was seen as too prohibitive.

Many other ideas

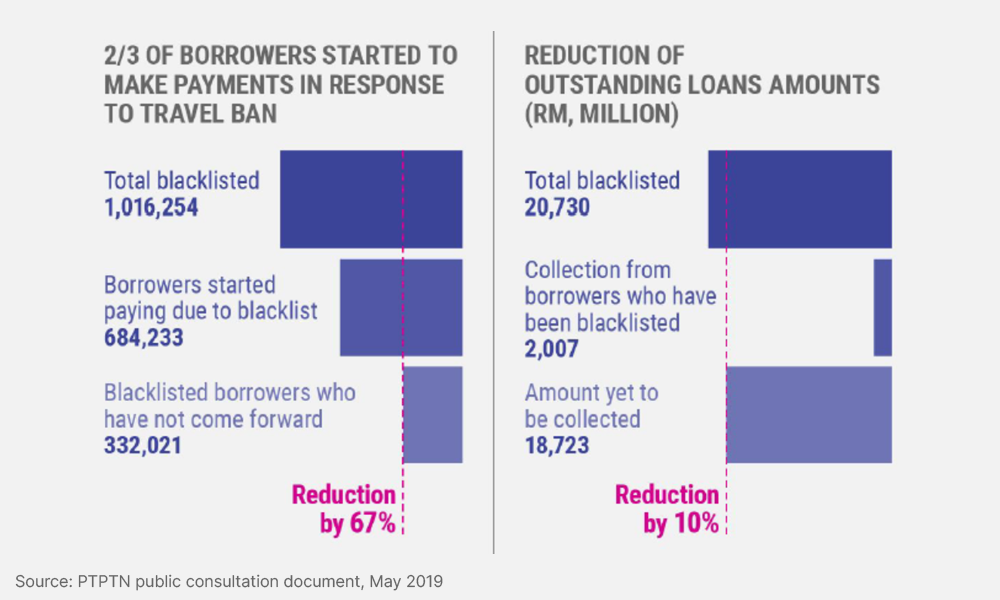

There were other ideas put on the table, including mandatory monthly salary deductions, harsher enforcement measures against hardcore defaulters, passport and driver’s licences restrictions against loan defaulters (as an alternative to the very successful but not very popular travel ban – see Figure 2 below), requiring a family member to be a guarantor for the borrower, removal of the first-class honours waiver or replace it with a partial waiver, reduction of loans (with sufficient notice) and discontinue loans to low-rated and non-rated private institutions and courses, increase the current one percent Ujrah loan (because borrowing costs and costs of funds are higher than the repayment interest rates), just to mention a few.

I would also propose a few additional ideas such as the securitisation of some of the PTPTN loans with higher repayment rates (such as those loans from students who graduated with STEM degrees who are able to secure higher-paying jobs) and working with responsible debt-collecting agencies such as Collectius and others to increase the repayment rate, especially among the defaulters.

The problems at PTPTN are serious. It has been functioning as a cash flow entity for many years rather than as a profit and loss entity. Its contingent liabilities exceed RM40 billion and the government has to cover its interest payments to the tune of RM2 billion a year (and growing).

I do not quite agree with Wan Saiful that PTPTN should be placed under the Finance Ministry and act more like a financial institution with more powers to invest its funds from the National Education Savings Scheme (SSPN) so it could go out to secure more savings.

This would detract PTPTN from its original purpose as a lender to students for higher education, especially for those in the B40 category.

If Wan Saiful is still serious about PTPTN reforms, he should offer his services and experiences as a pro bono consultant to the education fund. - Mkini

ONG KIAN MING is former Bangi MP and former deputy international trade and industry minister.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.