When Prime Minister Anwar Ibrahim said the goods and services tax or GST would be introduced only if the minimum income rises to between RM3,000 and RM4,000 per month, he demonstrated a dismal lack of understanding or his hands were tied.

Like value-added taxes everywhere, it’s a system designed to tax consumption, reduce tax evasion through proper record-keeping, and widen the tax net to bring a greater number of people in.

The poor are less affected because they consume less. In Malaysia, they are even more so because of numerous exemptions given to essential goods and services.

This together with a reluctance to cut blanket subsidies in favour of targeted ones, foreshadows grim times for Malaysia’s future economic health, with a twin pincer of revenue shortfalls and too much expenses. If that is not sorted out, it spells disaster.

While Anwar said he understood the importance of GST, he also implied that its implementation would be very far away. Our current minimum wage is RM1,500 a month. If we wait for it to get to even RM3,000 a month, it will take years.

If minimum wages increase by seven percent a year, it would take 10 years to reach RM3,000, and 14 years at five percent. Even if the rate increased by the highly unlikely level of 10 percent a year, it would still take seven years. For a salary of RM4,000, the figures are 13 years at seven percent and nine years at 10 percent.

No GST cut in Anwar’s tenure

GST will not be introduced during Anwar’s time as prime minister and finance minister unless he makes a U-turn. There are other reasons under the current power balance as we shall see shortly.

It, along with targeted subsidies, are the two core areas for increasing government revenue (GST) and cutting costs (subsidies).

Without these two, with no new sources of revenue coming, and as the government ramps up spending and gives out handouts even if it is to the poor, the situation is neither tenable nor sustainable. The government’s financial position will worsen.

Why the reluctance

Which leads us to the question - why is the government so reluctant to introduce the GST?

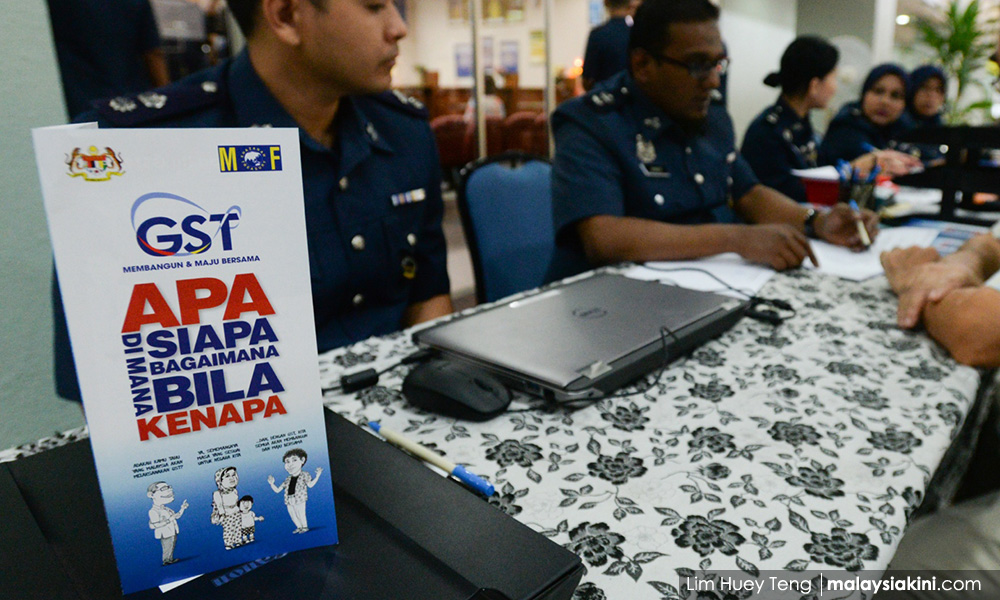

The GST, first introduced on April 1, 2015, with a rate of six percent, the same as the sales and service tax it replaced, had over 200 items which had zero taxes to minimise the impact on the poor, including food items, cheaper clothing, medical expenses, insurance etc.

Also, establishments with less than RM500,000 in sales per year were exempted, leaving out small traders and businesses.

When the DAP made the GST its main campaign platform for the May 2018 elections, the tax was already in place for three years. Thus, it was no longer responsible for inflation in the country as the DAP had claimed.

DAP chief Lim Guan Eng took the undignified step of dancing in front of school kids who sang an anti-GST song to press home his point. It went “A, B, C, D, E, F, G harga naik semakin tinggi…etc.” It earned him police reports and questioning.

It was a blatant lie though, GST was not responsible for higher prices in 2018 because it was implemented in April 2015 and for the full year in 2016.

The other main issue at the time - 1MDB, the thievery it propagated, and the crackdown that followed on people and news reports - likely resonated much more with voters.

Lim, who Dr Mahathir Mohamad elevated to finance minister as a plan to stall Anwar’s PKR and his elevation to the position of prime minister, wasted no time in getting rid of the GST.

The first step was to make GST zero, in June 2018, just weeks after gaining power. Not satisfied with that he ignored an impassioned plea by the most senior Customs official who had implemented it to merely make the GST zero so it could be restored later if needed.

But Lim’s intention was to kill it to satisfy a huge part of his support base - business owners and corporates who were middle class or above. The threshold limit for GST registration was a turnover of RM500,000 or more a year.

‘The GST is finally dead’

In August 2018, Parliament passed the bill to repeal the GST and replace it with the old Sales and Service Tax or SST again, an extremely retrograde step which wasted years of work, time and money spent on systems and infrastructure.

Lim was reported to have said: “The GST is finally dead”. He added that the SST would be easier and would help reduce the cost of living compared to the GST which was charged at various levels. But it had already been charged for three years.

The GST collection of 470,000 traders amounted to RM44 billion in comparison to the RM21 billion revenue earned through SST from 70,000 traders, he said.

RM23 billion windfall for traders

In one swoop, he more than halved the tax collection here and gave 400,000 traders and corporates back RM23 billion a year - a huge tax windfall never before seen in Malaysia to people and businesses who were rather well off.

Surely Anwar must know all this, but politics means he has to do what is politically correct to stay in power. DAP has 40 seats in Parliament, enough to derail Anwar’s power train.

Politics held sway. As long as DAP holds the balance of power in the Madani government, Anwar has to defer to its wishes from time to time. GST will not be introduced again. Period.

Lim has ensured that during his time as finance minister. - Mkini

P GUNASEGARAM says the source of problems sometimes are the most unexpected ones.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.