QUESTION TIME | Although tolls are not going to be abolished any time soon, if ever, the first steps taken by the Finance Ministry - buying urban toll roads associated with Gamuda - seem pretty good, going by the figures and assurances given by the minister.

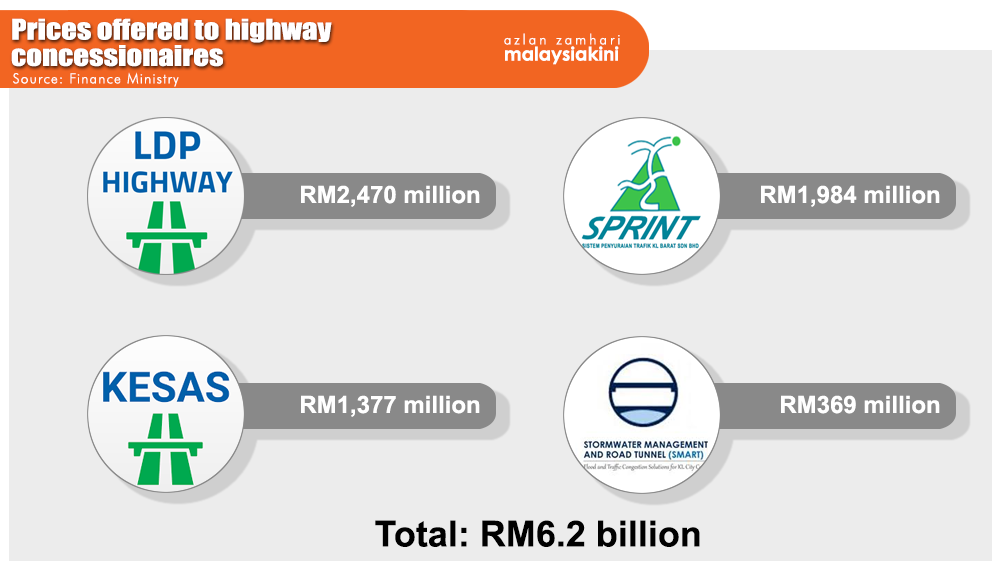

Finance Minister Lim Guan Eng confirmed over the weekend that the purchase price was RM6.2 billion, including debt, for four toll roads. The equity portion alone costs RM4.5 billion.

Three things that Lim revealed would justify the acquisition. They are:

The bond issue to finance the acquisitions and interest charges will be serviced from the collection of tolls, with no additional allocation from the government’s budget. The collection will also be enough for maintenance and operation of the toll roads.

There will be no need of the government to pay up to RM5.3 billion in compensation for tolls to be kept flat, freeing up that amount of money for other expenditure.

Under a new system of “congestion charges”, where the rates are the same as now during peak periods and discounted or no tolls during other periods, commuters will save RM180 million a year.

The most important of these three are the first two. A special purpose vehicle (SPV), to be wholly owned by the Minister of Finance, will hold the four toll roads, which are Lebuhraya Damansara Puchong (LDP), Sistem Penyuraian Trafik KL Barat (Sprint), Lebuhraya Shah Alam (Kesas) and Smart Tunnel (Smart).

These account for some 48 percent of tolls in urban Kuala Lumpur. Total prices, including debt, are indicated in the table below:

According to Lim, “The SPV will finance the offer of RM6.2 billion by way of bond issuance. The collection of congestion charge will be sufficient to service the debt, as well as to finance the operation and maintenance costs of the highways without requiring additional budget allocation by the Finance Ministry.

"In other words, the acquisition cost will be self-financing through the collection of congestion charge and will not require any government expenditure.”

If that can be achieved over the life of the concessions, it is very commendable, because the government then saves the RM5.3 billion in compensation payments if it were to allow the concessions to be in private hands, while at the same time ensuring that there are no toll increases in the future.

If it is so good for the government, why is Gamuda agreeing to this? One reason could be an expropriation clause, which has been reported to be in the concession contract. This clause will enable the government to take over the concession with little compensation.

However, if that clause is used, it can throw financial markets into kilter because valuations of companies and loans would have been based on returns guaranteed by the contracts.

Also, Gamuda, which is embarking on other projects, including the massive RM46 billion Penang Transport Master Plan (PTMP) being pushed by the Penang government, may need cash for these.

According to advisory firm UOBKayHian, “Gamuda, being the main driver of the project via a 60 percent stake in the SRS Consortium, has received conditional approval from the Department of Environment in relation to the Environmental Impact Assessment (EIA) for Penang Island Link 1 and expects to receive subsequent EIA approvals for the LRT and Penang South Reclamation (PSR) projects.

"The entire cost of PIL1 is estimated at RM9.6 billion, and the tender is expected to be called in 2020, subject to securing funding.”

Will this be a forerunner for future toll-road takeovers? Perhaps for those with shorter tenures in the urban areas, but more difficult for others such as the Plus highways which are inter-city and of longer terms. The key deciding factor, however, must be that it must bring net benefits to the government and the people.

This time, Lim appears justified in saying: “These figures directly prove that the highway toll concession model under the BN government had only profited private concessionaires and did not prioritise the people’s best interest.

"The (current) government had negotiated earnestly with the concessionaires to make a fair acquisition offer, such that it maximises the returns for the people, and not result in any financial burden for the government at the same time.”

Ironically, the head of the BN government during the time all the concessions were agreed and signed was Dr Mahathir Mohamad, who was prime minister from 1981-2003, and who became PM, albeit interim, again after a 15-year break under a Pakatan Harapan agreement following GE14.

But transparency is still not there to enable a proper and full analysis. While the latest deal announced looks very good for the government at first glance, it would be helpful if more information was disclosed.

This would include some details on the toll roads, such as time to expiry, revenue and profit per year. Others would include discount rates, internal rates of return, and the net present value of each of the concessions for their remaining lives, including assumptions.

Still, it sets up a commendable springboard for further such acquisitions in future.

One other thing. The finance minister should give a commitment to disclose the progress of the SPV which will be running the toll operations, including full yearly accounts. This will go some way to allay fears that the SPV might have problems servicing its debt obligations and has enough money to maintain and operate the toll roads.

P GINASEGARAM is a former equity analyst and head of research. E-mail: t.p.guna@gmail.com - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.