However, the local note traded higher versus other major currencies today.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid said regional currencies were mostly weaker against the greenback as the latest US consumer price index (CPI) print for January was higher than expected.

“This suggests that the Fed is not going to ease their monetary policy very soon as they are not convinced that their 2% inflation target can be achieved in the near term.

“On that note, the ringgit is expected to remain weak, and it will put the US dollar in a sweet spot as the demand for the greenback is anticipated to be strong,” he told Bernama.

The economist said that at the prevailing level, the current resistant level stands at RM4.7958 while the support level is located at RM4.6611.

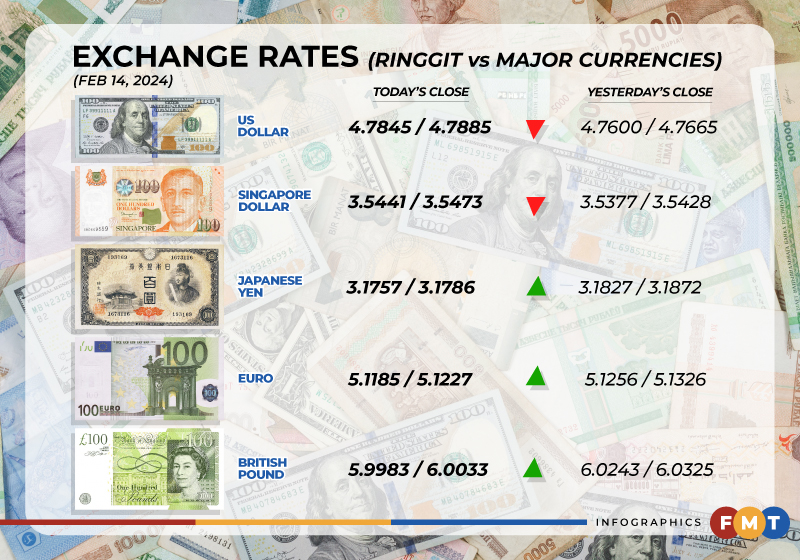

At 6pm, the ringgit stood at 4.7845/4.7885 against the US dollar compared with yesterday’s close of 4.7600/4.7665.

At the close, the local note appreciated vis-a-vis the Japanese yen to 3.1757/3.1786 from 3.1827/3.1872 previously, strengthened against the British pound to 5.9983/6.0033 from 6.0243/6.0325 and rose versus the euro to 5.1185/5.1227 from 5.1256/5.1326.

Meanwhile, the ringgit mostly traded lower versus other Asean currencies but rose against the Thai baht to 13.2366/13.2535 from 13.3240/13.3478 at yesterday’s close.

The local note fell against the Philippine peso to 8.52/8.54 from 8.50/8.52 yesterday, was lower versus the Singapore dollar at 3.5441/3.5473 compared to 3.5377/3.5428 and slipped against the Indonesian rupiah to 306.5/307 from 305/305.6 previously. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.