Even as the US government’s criminal case against Goldman Sachs over 1MDB wound down to a close earlier this week, the stark problems that Malaysia faces over this greatest of kleptocracies continue to haunt the country.

While Goldman Sachs has not been sufficiently held accountable for their involvement in the scandal in the US, Malaysia’s problems mount as a pardon and house arrest for the main perpetrator Najib Abdul Razak continues unabated, spearheaded by the most corrupt party in Malaysia, Umno Baru.

On top of that, there is the issue of a lopsided deal in favour of Goldman Sachs which Malaysia signed making any further recovery of money from the US investment giant more bothersome. The MACC is still investigating the deal.

And then there is the slew of trials still taking place involving Najib. Proceedings indicate that there are further issues which are likely to surface and open up a pandora’s box of new revelations.

Let’s take each in turn starting with the issue of whether the convictions and penalties imposed in the US on Goldman Sachs are adequate. No, US$2.9 billion (RM13.75 billion) is too low. And they were not held fully to account for complicity in a major crime.

Complicity in US$6.5 billion losses

They were complicit in the loss of nearly all of the US$6.5 billion raised by the bonds issued by 1MDB and arranged by Goldman Sachs. Without their connivance, it could not have been done.

Even in the transfers of money which led to the theft in the first place, no proper checks were made before money was sent to dud companies with similar names, indicating outright complicity. Without Goldman Sachs’ connivance, the theft could not have happened.

On top of that many top Goldman Sachs bankers knew about the deal. Some US$600 million in fees - over nine percent of bond value - were paid. The normal fee was just one percent or one ninth of fees paid which should have raised alarm bells.

The top brass knew something was not right but did not do anything. Instead, they rewarded the direct perpetrators with massive bonuses. Reportedly, the CEO at the time, Lloyd Blankfein, met Najib in 2009 and Low Taek Jho in 2012.

Yet only two people from Goldman Sachs were charged - Roger Ng was jailed for 10 years but in Malaysia now - it’s not clear where he is held and how he is assisting investigations. Another official, Tim Leissner, pleaded guilty and turned state witness but has not been sentenced yet.

Jail for big guns needed

So long as custodial sentences are inadequate these misbehaviours will continue - witness the numerous money laundering charges against prominent banks including Standard Chartered, HSBC, JP Morgan and the like where huge fines were levied but no one was jailed.

Goldman Sachs is very influential - they have produced at least five treasury secretaries for the US and many top aides in the US government and the White House. The 1MDB may be over for them, but for Malaysia, things are far from it, losing an opportunity to bring Goldman Sachs to account and get full restitution.

Then-attorney-general Tommy Thomas charged 17 senior Goldman Sachs officers with criminal activities under Malaysian law in October 2019 and is on record as saying in August 2020 that the total exposure including interest was US$9.6 billion when commenting on the settlement reached with Goldman Sachs.

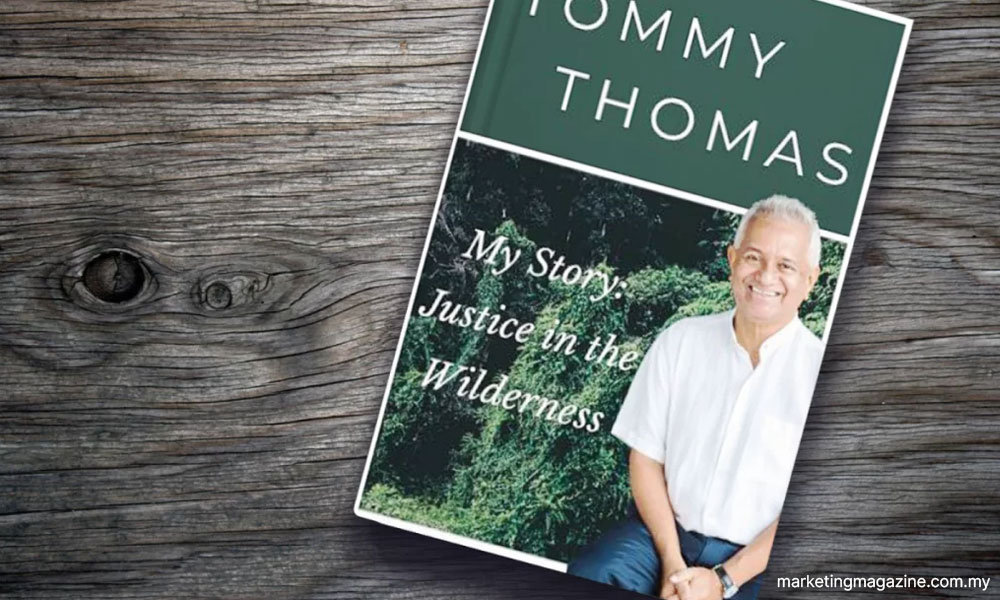

He also said in his book “My Story: Justice in the Wilderness”: “...I was confident of recovering a sum closer to Malaysia’s actual losses of US$9.6 billion.” Further, he revealed that the DOJ was amenable to a sum much closer to what he was seeking.

“Hence, when I resigned at the end of February 2020, Malaysia was wonderfully placed to turn the screws on Goldman Sachs… I would never have advised prime minister (then) Dr Mahathir Mohamad to accept a cash payment of US$2.5 billion (RM11.8 billion). I had sights on a much bigger sum…”.

In July 2020, the charges against Goldman Sachs initiated by Thomas were dropped as part of a settlement. The final sum in the settlement with Malaysia was a paltry US$2.5 billion. The remaining US$1.4 billion was a guarantee if the sums recovered were less than that.

It was very clear the sums recovered would be much more than that. Paradoxically, Goldman Sachs is now suing Malaysia for not appropriately crediting assets recovered against the guarantee amount to reduce payments to Malaysia.

This settlement, made when Muhyiddin Yassin was prime minister and Tengku Zafrul Abdul Aziz was finance minister with advice from two prominent lawyers and the new AG, has been heavily criticised, especially after the Madani government came to power in 2022.

Suing Goldman Sachs

Prime Minister Anwar Ibrahim said in August last year the government was thinking of suing Goldman Sachs but nothing has happened so far. Following that statement, the MACC raided the firm of lawyers representing Muhyiddin over this and other settlements, seeking documents.

They said they were probing the deal and had requested lawyers for documents. But nothing has been heard of since, with the lawyers Rosli Dahlan Saravana Partnership and Chetan Jethwani & Company fighting not to surrender the documents demanded, citing client confidentiality.

Chetan, which represented Goldman Sachs in Malaysia, subsequently represented Muhyiddin in an appeal at the Federal Court regarding a criminal case.

In the meantime, 1MDB Task Force chairperson Johari Abdul Ghani has called for the US government to remit to Putrajaya part of the US$2.9 billion paid by Goldman. They can request but will be entirely at the mercy of the US charity. The US has no legal obligation to pay anything.

My detailed analysis of that deal with Goldman Sachs is that Malaysia made a lousy settlement with Goldman Sachs when they had the firm on the ropes through Thomas’ early action against Goldman Sachs. Johari has criticised the Malaysian govt settlement with Goldman Sachs.

But it’s not clear what Malaysia has done since. It’s pretty difficult to go back on a settlement - unless it can be proven that corruption was involved. That’s not easy to do, although the case against Goldman Sachs should be re-examined and reinvestigated to determine if action against Goldman Sachs can be taken.

Drop pardon, house arrest for Najib

The other thing, given all these circumstances, is to drop all pardon and house arrest processes for Najib at least until all other cases are disposed of and the full extent of losses from the entire scandal is ascertained. Let’s not put the cart before the horse.

If Malaysia makes a full effort to bring all those involved in 1MDB, including Goldman Sachs and numerous other players, and extract from them a proper settlement and justice without fear or favour, we can put this behind us and move forward.

Otherwise, the ghost of 1MDB will continue to haunt us for a long time. - Mkini

P GUNASEGARAM is the author of the first book on this kleptocracy, the biggest ever, “1MDB: The Scandal that Brought Down a Government.”

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.