The quarterly employee wage statistics released by the department of statistics Malaysia (DOSM) indicates a 5.5% annual growth in Malaysia’s formal sector median monthly wages during the third quarter of 2023, reflecting a positive trend. However, this optimistic outlook is accompanied by a cautionary note.

While wage growth typically benefits workers, relying solely on year-on-year growth rates can yield misleading interpretations given broader economic trends.

For instance, if inflation surpasses wage growth, workers’ purchasing power may diminish despite nominal wage increases. Additionally, fluctuations in wages, where they decrease and then rebound to previous levels, can inflate year-on-year growth figures, masking any genuine progress in real wage gains for workers.

What is in the official statistics?

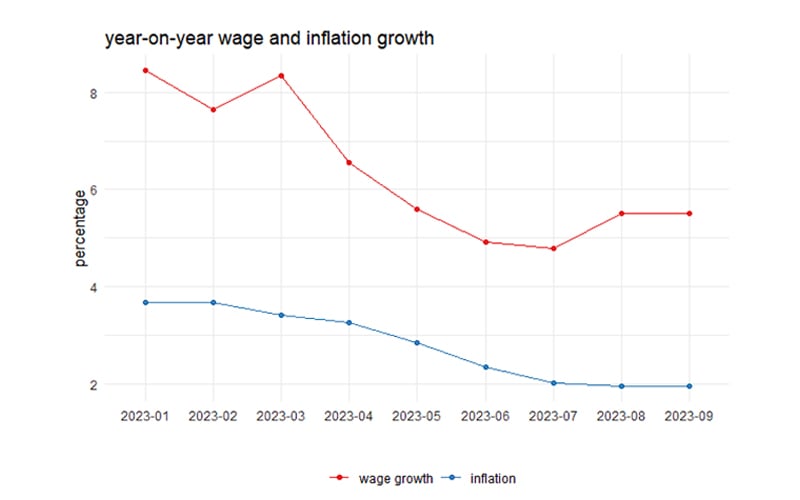

The graph below illustrates the annual wage growth and inflation rate spanning from January to September 2023, revealing a promising trend of a strong wage increase that far outpaces inflation.

However, while this narrative emerges from DOSM’s data, it prompts scrutiny: Is this portrayal accurate? Despite mounting expenses, are we truly witnessing an increase in purchasing power? When everyday experiences like grocery shopping or dining out leave us feeling financially strained, do such sentiments stem from perceived bias or an economic illusion?

Looking behind the curtain

Extending the analysis to January 2022, it is observed that in the early part of the year, the median monthly wage in the formal sector stood at RM2,582. However, by September 2023, the most recent available data indicates a marginal increase of less than 1%, bringing the median wage to RM2,600 per month – a trend contradicting the optimistic projections of DOSM.

What is going on here?

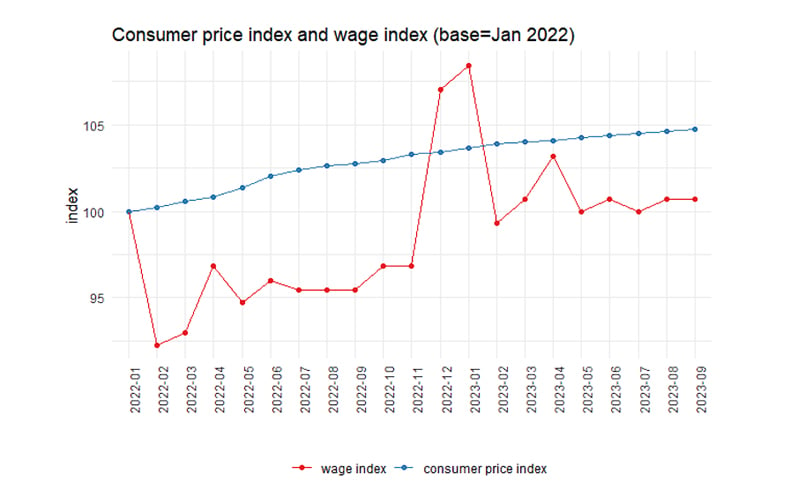

Upon delving into the data, a notable decline of 7.7% in wages is evident from January to February 2022. Subsequently, throughout the remainder of 2022, wages have persisted at lower levels with minimal growth. To provide a comprehensive understanding, a new graph is constructed, utilising January 2022 as the baseline, to depict the fluctuation in both the consumer price index (CPI) and the wage index.

Although CPI has exhibited a gradual upward trend, wages display more variability. Except for December 2022 and January 2023, which experienced a notable surge in wages, the overall trajectory of wage growth lagged behind inflation.

Three noteworthy patterns emerge from this analysis. Firstly, there is a general wage increase during December and January, possibly attributed to salary raises and company bonuses during this period.

Secondly, despite declining wages post-January, the data indicates that the average monthly salaries for 2023 surpass those of 2022, suggesting a degree of wage increases maintaining stability.

Thirdly, even with the observed salary hikes, wage growth since January 2022 has not kept pace with inflation.

Can we afford food?

Amid the examination of data and statistical patterns, it is crucial for us to confront a pressing question: can we adequately afford food? This fundamental concern directly influences the well-being of individuals and families. Upon further exploration of the statistics and wage growth patterns, it becomes apparent that the increasing costs of living, combined with relatively stagnant wage growth, have given rise to a challenging financial landscape for many.

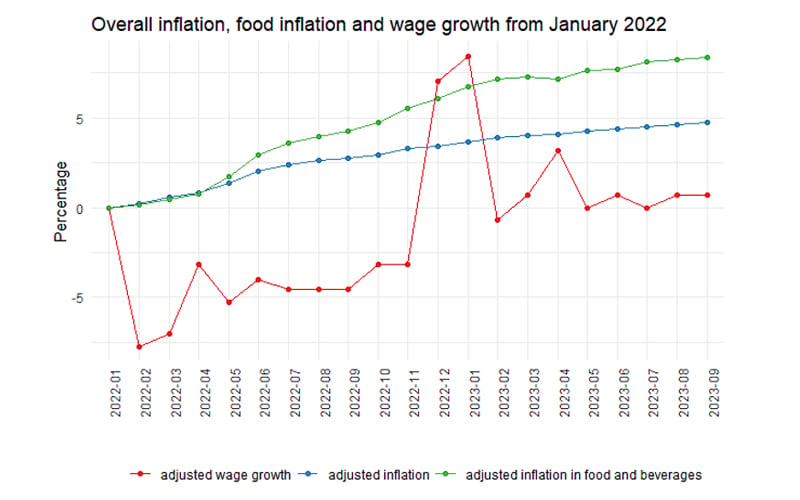

In the next chart, the comparison of wage growth, food inflation, and overall inflation since January 2022 exposes a troubling pattern. Despite a steady increase in overall inflation, food inflation has notably surpassed both overall inflation and wage growth. This indicates that the prices of essential food items have escalated at a much swifter rate than wages and general prices.

The alarming discrepancy between food inflation and wage growth signals a decline in individuals’ purchasing power, particularly in meeting essential needs like food. Despite nominal wage hikes and occasional spikes in average wages, the overarching trend reveals that workers are grappling to match the escalating cost of living, especially concerning purchasing essential food items.

This imbalance is particularly felt during grocery shopping and dining out, thrusting individuals into the harsh reality of higher prices for everyday necessities. For many, this has led to a squeeze on their disposable income and a challenge in maintaining a balanced budget.

Fundamentals behind persistently low wages

It is disconcerting to observe the widening gap between wage growth and living expenses, creating a challenging financial landscape for many Malaysians. According to statistics, approximately 50% of the population is unable to meet the living wage benchmark set by Bank Negara Malaysia (BNM) at RM2,700 in Kuala Lumpur since 2018. This alarming figure underscores the urgent issue of stagnant wages and the escalating cost of living, particularly concerning access to essential needs such as food.

This trend not only impacts individuals and families but also carries broader implications for overall societal well-being. Policymakers and stakeholders must prioritise addressing this disparity and collaborate on implementing measures to alleviate the financial strain on those struggling to make ends meet.

Productivity alleviation and wage support

Ensuring equitable and sustainable wages is crucial for providing individuals access to essential resources and enabling a decent quality of life. The current national minimum wage of RM1,500, falling below the poverty line income of RM2,589, must be revised to reflect the rising living costs, inflation, and economic growth.

Furthermore, fostering productivity-linked wage growth demands investments, subsidies, and encouragement for skills development and career advancement in both the public and private sectors. The Workforce Monitor Report emphasises Malaysia’s shortage of skilled talent, particularly in the emerging digital sector.

The prospective progressive wage model could serve as a valuable policy tool to address the skills gap, connecting the existing workforce to higher value-added employment. Recognising that skills training is cumulative, continuous improvement in education and high-quality worker training programmes promoting upskilling, reskilling, and lifelong learning are essential for continuously reinventing our workforce to changing labour dynamics. Crucially, job promotions and wage increases should accompany such skills upgrading.

While such a wage enhancement model could ameliorate local wages, there exists a risk of brain drain if our industries fail to meet global standards. Employers must invest in higher compensation, employee benefits, improved work environments, greater work flexibility, and enhanced career progression to attract and retain talent.

Considering the global trend towards remote work and flexible arrangements, local companies must compete with international counterparts to secure skilled professionals. Inadequate salaries may limit companies to hiring less productive and low-skilled workers. At the same time, higher-skilled individuals may either compete for a limited number of firms with competitive offers or seek opportunities outside Malaysia.- FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.