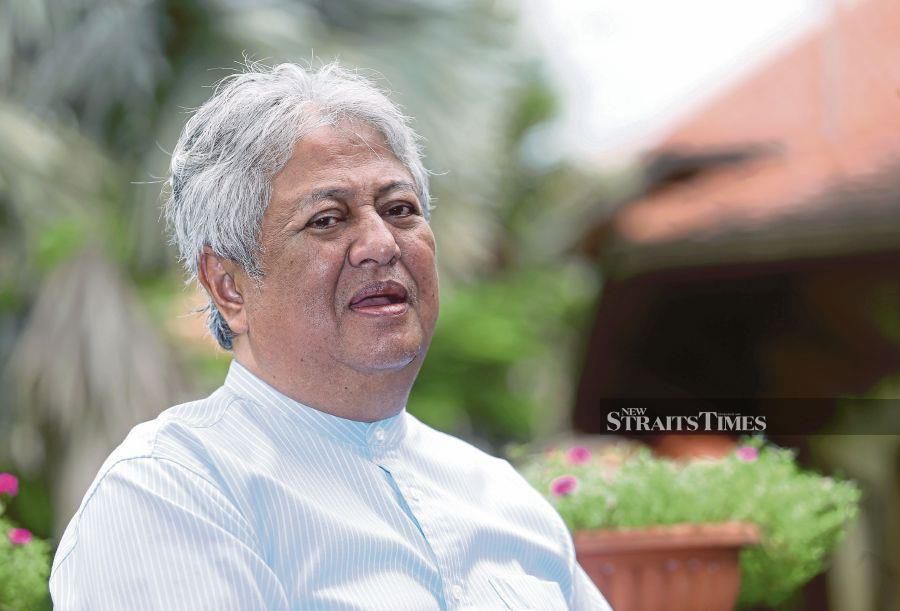

KUALA LUMPUR: Former Law Minister Datuk Zaid Ibrahim said the Ministry of Finance and Bank Negara needs to explain whether it is safe and prudent for a data collection agency like CTOS Data Systems Sdn Bhd (CTOS) to have unlimited access to sensitive financial data of the people and companies.

Zaid said such data was usually given to banks and statutory bodies like the Companies Commission of Malaysia (SSM) but CTOS is given access to it all.

"CTOS is a wealthy private company owned by rich foreigners and local institutions. They have access to all your data.

"I am just wondering if the Ministry of Finance / Bank Negara ever asked if it is safe and prudent to allow a data collection company with the overreach and power to assess the creditworthiness of all our citizens.

"If bank officers and directors are not interested in evaluating and assessing their customers' risk but outsource the job to CTOS, then let the government ensure that only locals can own CTOS....not foreigners," he said in his latest Facebook posting.

Zaid said the underclass with low income and low savings rates will never pass CTOS's test as their score will be in the red zone.

"Their loans will always be more than their income. CTOS will not give them a second chance.

"However, a responsible government must give all of us a second chance. Loans must be given to those who, despite temporary difficulties and inability to pass the CTOS test, have other attributes and potential to make another attempt at success.

"If local lending institutions are too lazy to do their work and depend on foreigners who understand nothing of the socio-economic background of their customers to decide if financial help should be extended, then the poverty cycle will never be broken," he said.

Zaid said it was time members of parliament push for a law mandating the government to set up more lending institutions where the decision to extend credit should be left to the individual bank.

"Let there be real competition. If Singapore can have 200 banks, why do we have only 25?...and why must the banks must be dictated by foreign-owned credit assessors like CTOS," he said, adding it was shocking the recently concluded Bumiputra Congress did not discuss the issue.

The New Straits Times has rached out to the relevant authorities and CTOS for response to Zaid's views.

Zaid started off his posting, titled CTOS vs Suriati Yusof, by congratulating the businesswoman for taking her grievance against the company to the courts and winning the case.

"Others also have grievances against CTOS but did not have the guts to sue. Suriati deserves our praise.

" hope she will win again on appeal," he said.

It was reported the 43-year-old businesswoman sued CTOS for alleged negligence and breach of fiduciary duty in misrepresenting her credit rating leading to a loss of reputation, personal losses as well as business losses.

In May 2019, Suriati's application for a car loan was rejected due to a negative report from the defendant (CTOS).

Upon further inquiry, she discovered that the data collected and retained by CTOS was inaccurate, leading to a false negative rating for her.

The High Court last week ordered CTOS to pay her RM200,000 in general damages.

CTOS has since said it would appeal the ruling.

CTOS Digital Bhd group chief executive Eric Hamburger has also said that the company had all the relevant licenses needed to provide credit rating scores.

He said the agency was licensed under the Credit Reporting Agency Act of 2010 (CRA) to provide credit scoring and CTOS had done so with data from Bank Negara and other sources of information. - NST

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.