Just three weeks ago, I woke up to a headline that I found unsurprising, given Malaysia’s track record when it comes to new, disruptive technology, yet deeply disappointing. It read: Bursa Malaysia says no to cryptocurrency on multi-asset exchange.

Let’s look at Bursa Malaysia CEO Muhamad Umar Swift’s reasons for this stance and why I think Bursa is potentially squandering a generational opportunity.

Opportunity and value

Reason 1: Bursa’s goals revolve around creating opportunities and growing value, and cryptocurrency does neither.

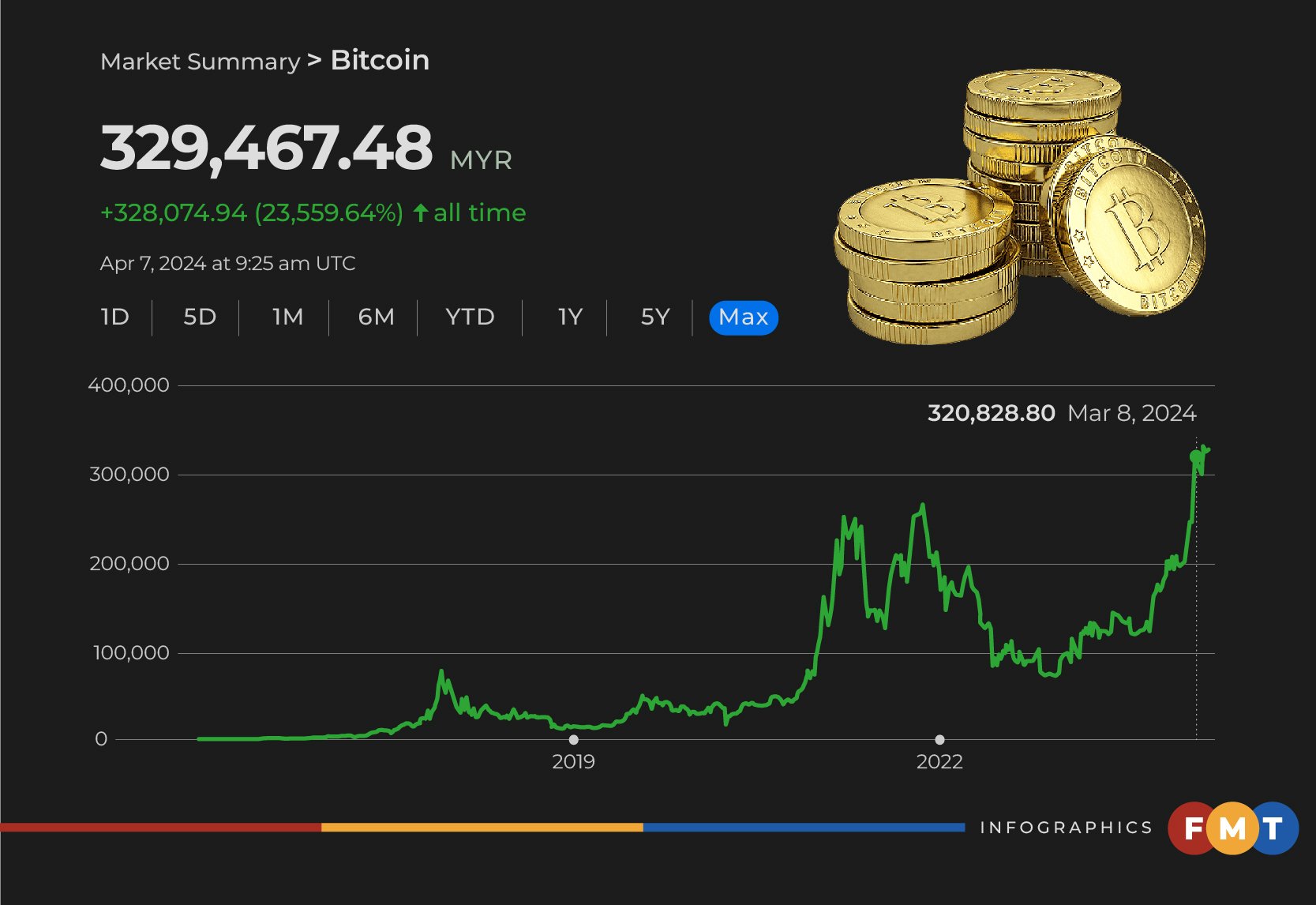

Counter argument: Bitcoin, the first and largest cryptocurrency in the world, has a market capitalisation of a whopping US$1.37 trillion (RM6.5 trillion). A single bitcoin was worth around RM320,000 on April 14 and it has gone up against the ringgit by about 23,000% since its inception in 2008 (yes, you read that right) as shown below:

Bitcoin is now the ninth largest asset in the world by market capitalisation, larger even than Meta (formerly Facebook) and within striking distance of Google, as shown below:

Bitcoin is also 56 times larger than Maybank, the most valuable publicly listed Malaysian company. If this doesn’t count as “growing value”, I don’t know what does.

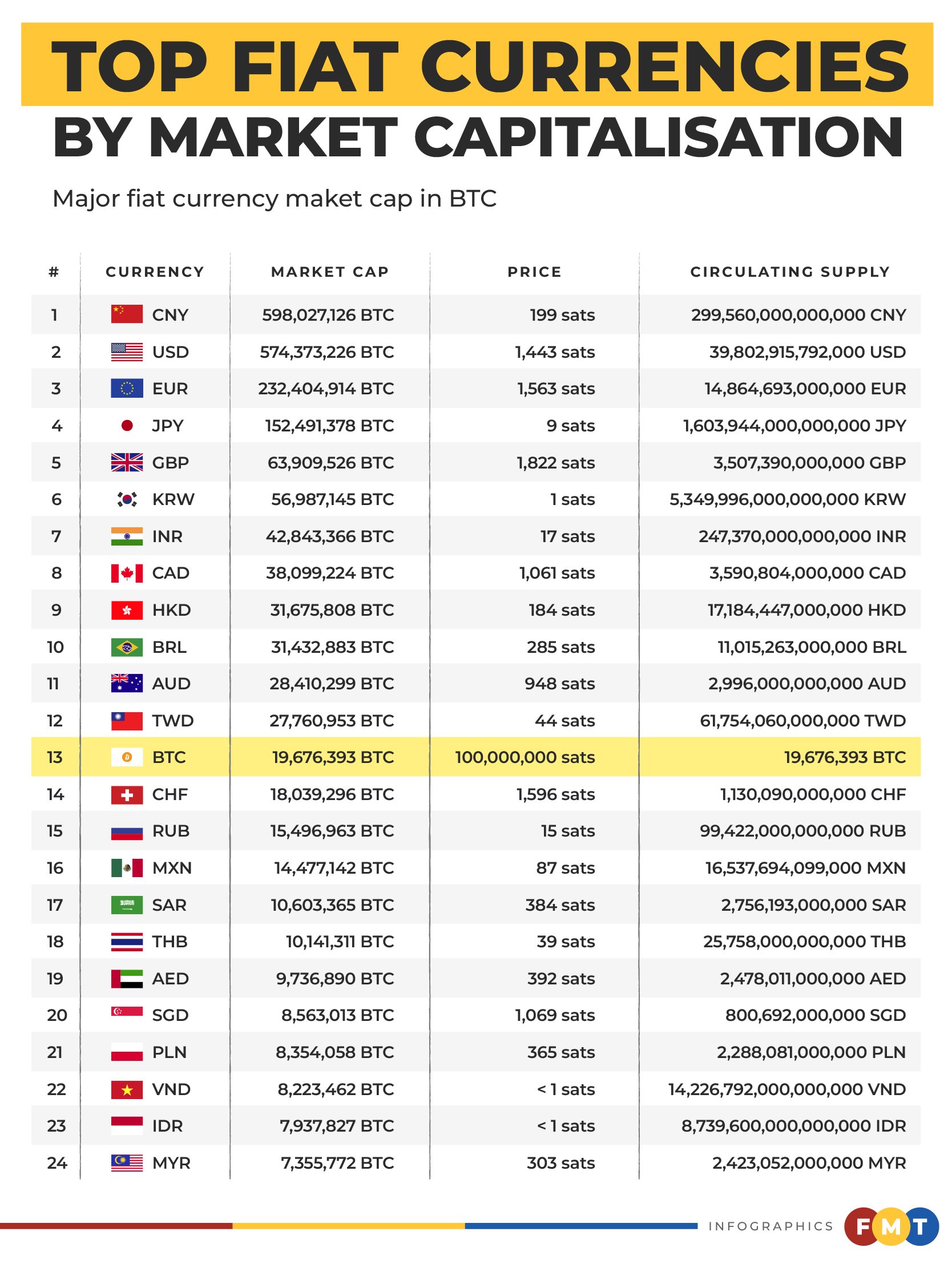

If we compare bitcoin to fiat currencies, it is the 13th largest currency in the world, larger even than our ringgit and the Singapore dollar, as shown below:

In addition, it is estimated that bitcoin has created around 40,000 millionaires (denominated in US dollar). If we include the cryptocurrency industry in general, this number balloons to around 88,000. If this doesn’t count as “creating opportunities”, I don’t know what does.

Plus, asserting that cryptocurrencies don’t create opportunities and grow value is especially jarring when we consider that the first asset Bursa included in its newly introduced multi-asset exchange was gold.

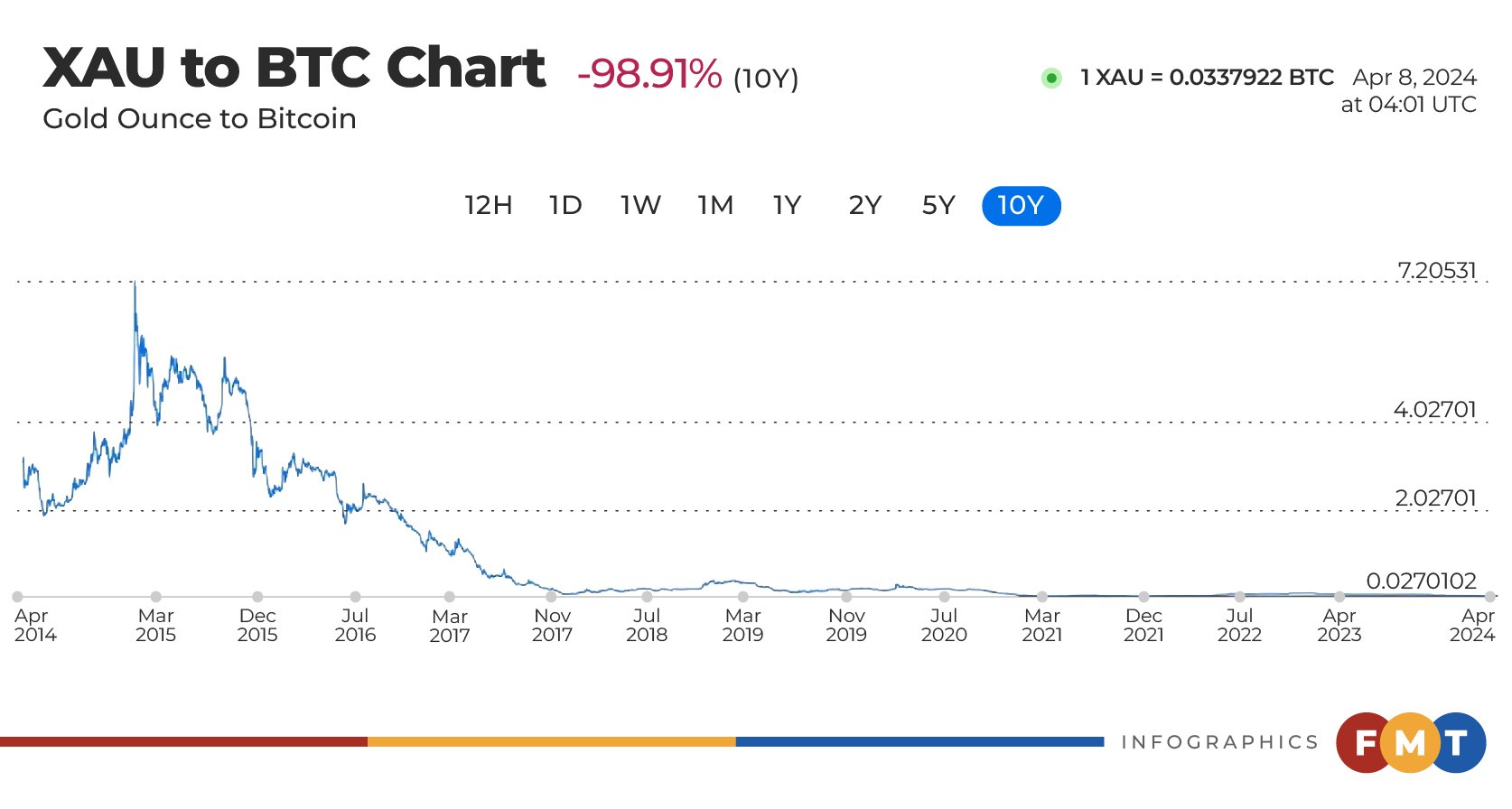

Sure, gold is a decent store of value but it has performed abysmally against bitcoin, depreciating against it by almost 99% just in the past 10 years, as shown below:

Surely if gold is an acceptable investment tool, an asset that has vastly outperformed the precious metal should be as well?

Asset value

Reason 2: Cryptocurrency is not a real asset, it does not have any intrinsic value.

Counter argument: Let’s examine the case for bitcoin first. Like fiat currencies such as the ringgit and dollar, Bitcoin has no intrinsic value.

Fiat currencies have value because governments dictate that they do and this edict is defended by men with guns.

Bitcoin, however, doesn’t depend on such coercion. Rather, it has value because people believe it has value due to it possessing these qualities and more:

1) Hard supply cap of 21 million coins, making it an inflation-resistant store of value;

2) Can be transacted with by anyone from anywhere in the world, making it censorship-resistant;

3) The network has never been hacked, making it a secure bank in cyberspace, and

4) Can’t be controlled or co-opted by anyone or any entity, making it nation-state-resistant.

Further, bitcoin derives value by upending the currently fractured financial system and providing a unified solution.

It is a bearer asset (supplanting gold), it is a currency (supplanting fiat currencies), it is a bank in cyberspace (supplanting commercial banks), it provides a predictable, rules-based monetary order (supplanting central banks), allows cross-border transfers (supplanting the inter-bank Swift system), and allows real-time payments via L2s (supplanting the Visa and Mastercard networks).

And when it comes to smart contract-based cryptocurrencies — Ethereum and Solana being the most popular ones — their value can be ascertained the way the values of conventional companies are.

The major difference between them and a conventional company is that instead of providing a suite of products or services, these crypto networks provide a base substrate or platform that other crypto protocols can use to create value.

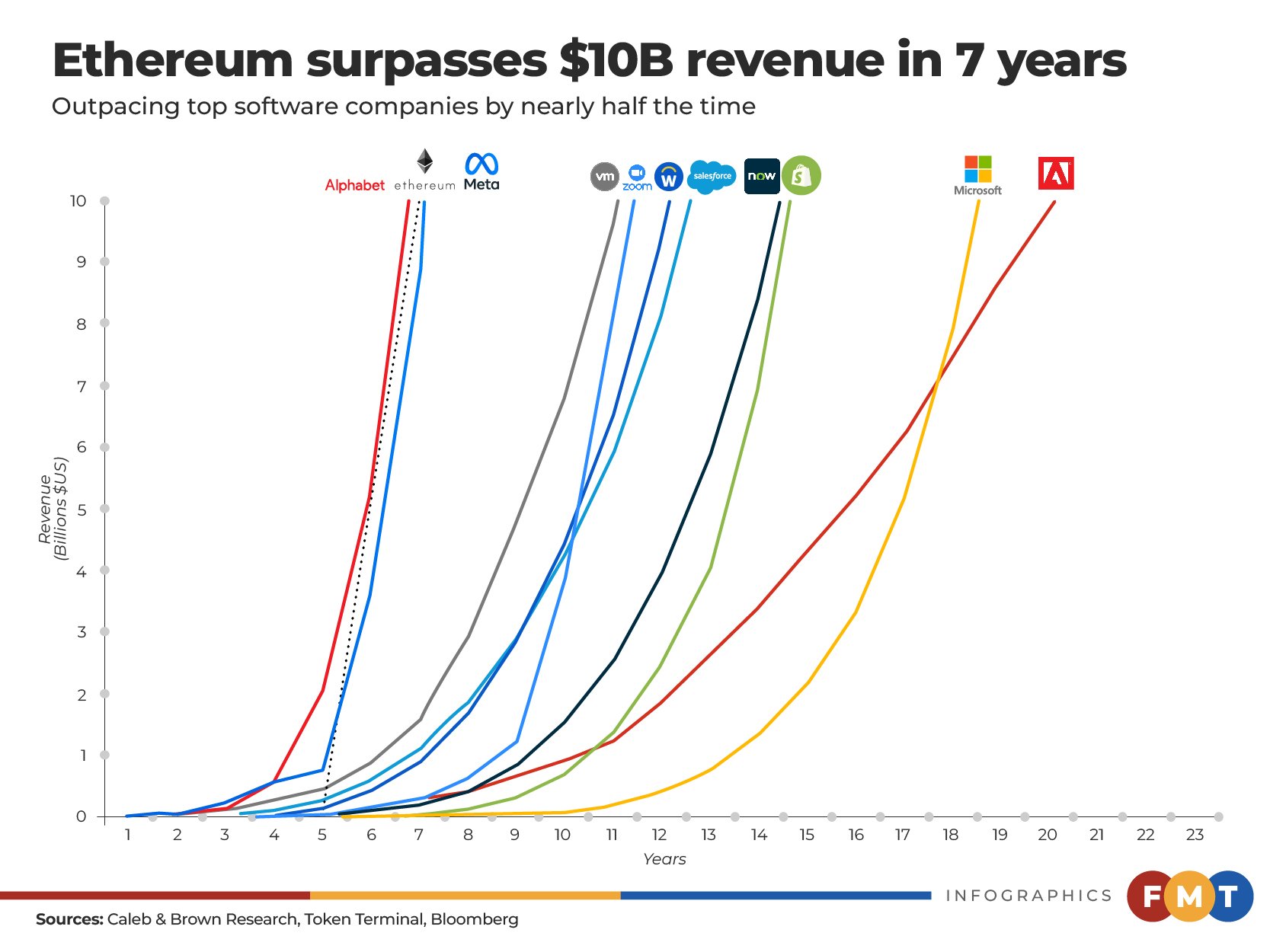

Just last year, Ethereum surpassed US$10 billion in revenue, achieving this feat faster than tech heavyweights Meta, Zoom, Microsoft and Shopify, as shown below:

Solana, a younger, faster and lower-cost crypto protocol, has generated US$134 million in fees just this past year, while regularly hitting more than a million active users daily.

With such metrics pointing to their adoption, how can anyone say that cryptocurrencies have no value?

Economic benefits

Reason 3: All our products come back into the economy. I do not have that call for crypto. Crypto is just crypto.

Counter argument: Many crypto protocols have real-world use-cases and come back into the economy. Let’s look at some of them.

1) Bitcoin is a hedge against the ceaseless debasement of the ringgit. It can protect ordinary, hardworking Malaysians from having their life savings wiped out due to central bank money printing.

This increase in wealth could enable Malaysians to upgrade their standard of living if they choose to by purchasing more real-world items, hence boosting the economy.

2) Helium is a pioneer of a newly budding field in crypto called Decentralised Physical Infrastructure (DePIn).

It launched an Uber affordable phone plan which only costs US$20 a month per user, undercutting plans offered by major US mobile carriers such as Verizon and AT&T.

It bootstrapped the buildout of the network by selling “hotspot miners” which enabled buyers to earn a reward in its token.

3) Render Network is the world’s first decentralised graphic processing unit (GPU) rendering platform. It has created a blockchain-based marketplace where users can utilise idle GPU capacity to serve their AI and rendering needs from anywhere in the world at a fraction of the cost of conventional methods.

4) Farcaster is a new decentralised, censorship-resistant, peer-to-peer social network that feels like a hybrid between X (formerly Twitter) and Reddit. It boasts 80,000 daily active users and just raised a new funding round, valuing it at US$1 billion.

5) Hivemapper sells dashcams that contributors install on their cars to provide it with the freshest maps of the road. In return for providing this map data, contributors get paid in the Hivemapper network’s native token.

Hivemapper then sells this map data to companies that need up-to-date images and maps of the world. Its almost 120,000 contributors have helped it map 10.3 million unique kilometres all over the world.

6) Tether, the world’s largest stablecoin issuer is now worth north of US$100 billion (more than four times larger than Maybank) and made US$6.2 billion last year — more than Goldman Sachs and Blackrock.

Tether is now a top 22 buyer of US treasuries — whose use is to fund US government operations.

Raising capital, making profits

Reason 4: Bursa’s purpose is to help companies raise capital, expand, employ people and make profit. Crypto does not do that, it does not fulfil that basic premise. It is trading for the sake of trading.

Counter argument: As amply demonstrated above, there are plenty of real crypto companies that are raising capital, expanding, employing people and making profit.

And this is just the tip of the iceberg. There are many more crypto companies that are making a lot of money.

Sure, there are plenty of cryptocurrencies that serve no other purpose than to gamble and speculate on — memecoins being the primary ones — but to say cryptocurrencies as an asset class are just “trading for the sake of trading” is straight-up erroneous.

Closing thoughts

Bursa has a golden opportunity here. By allowing people to invest in the most popular cryptocurrencies such as bitcoin, Ethereum and Solana directly in the Bursa multi-asset exchange, they will attract an immense pool of liquidity that will be domiciled in Malaysia, and be part of Malaysia’s capital market.

Its popularity is clearly demonstrated by the fact that the newly launched bitcoin ETFs (exchange-traded funds) in the US — spearheaded by financial behemoths Blackrock (US$10.5 trillion assets under management) and Fidelity (US$4.5 trillion assets under management) — have become the fastest growing ETFs of all time, giving them custody over US$57 billion.

Other major economies are following suit on the back of its incredible popularity. Hong Kong is likely to approve its bitcoin and Ethereum ETFs this month and South Korea’s newly elected government has vowed to allow citizens access to the US bitcoin ETFs.

But since none of the exchanges in Southeast Asia have made such a move, Bursa can become a pioneer in the region by allowing access to bitcoin and other cryptocurrencies.

After all, it’s about time Malaysia stopped being a follower and started becoming a leader. - FMT

The views expressed are those of the writer and do not necessarily reflect those of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.