Prime Minister Anwar Ibrahim is right to focus on fiscal reform as a central aim of economic policy in 2024.

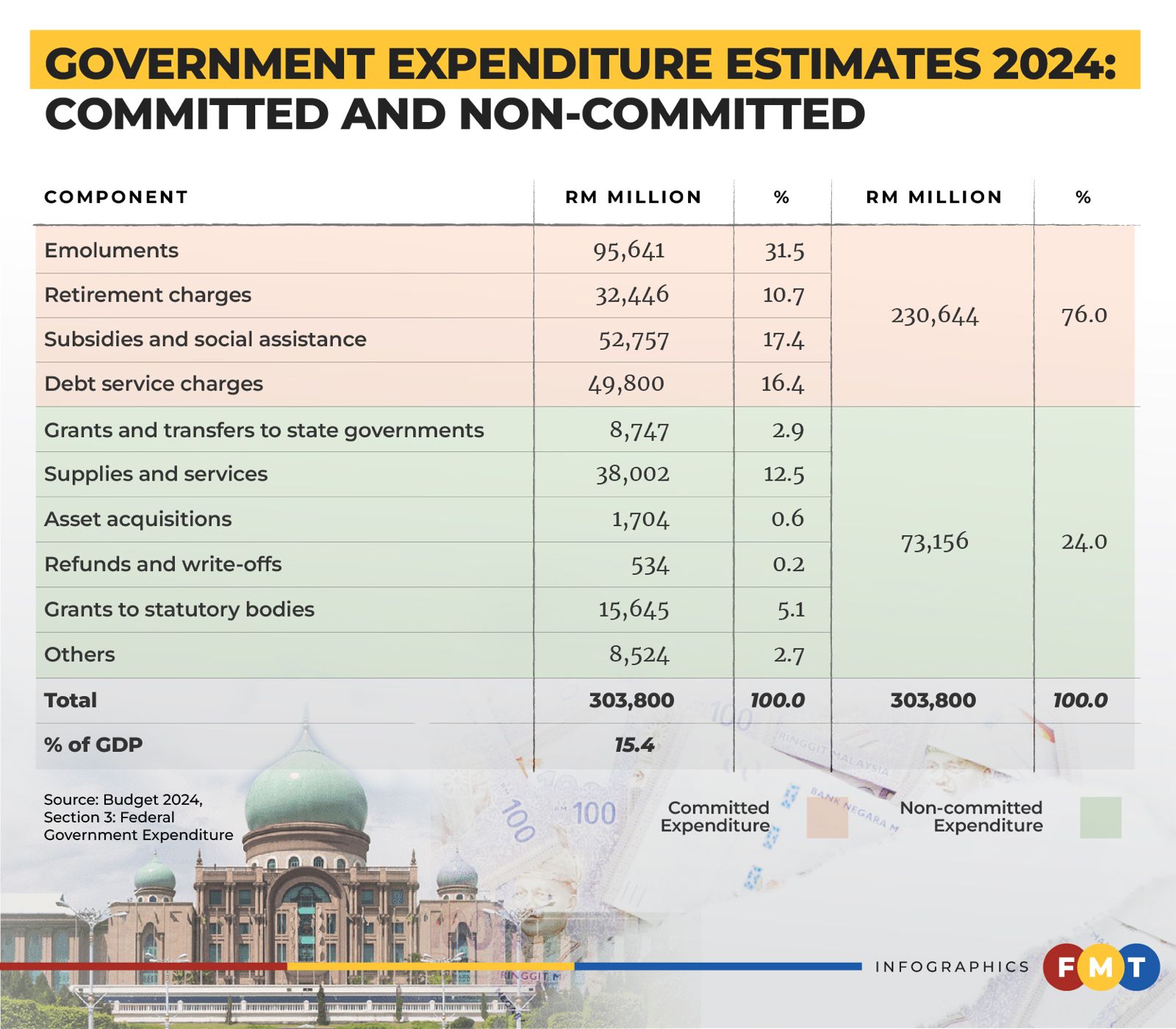

Reform has three sides — spending, revenue and implementation. On the spending side a large share, around 76% of the budget, is committed before the government can even look at other priorities.

For 2024 these commitments include civil service salaries of RM95.6 billion, pension costs of RM32.4 billion and debt service charges of RM49.8 billion. All of these are very difficult to cut and must be paid, so money available for other priorities is limited.

The allocation for subsidies and social assistance of about RM52.7 billion is also difficult to cut, so subsidy rationalisation using the Padu database is essential to reform government spending.

Targeting subsidies can lead to savings of 10% to 17.5%, according to economy minister Rafizi Ramli. This will be more efficient and effective and will free up RM5.3 billion to RM9.2 billion for extra social spending directed to where it is needed.

A reform of civil service pensions is also essential. The government should study the proposal for a Malaysian Superfund to take the RM32.4 billion pension commitments out of general operational expenditure and release that money for other priorities.

On the revenue side government income has fallen from 22.3% of GDP in 2009 to 15.6% in 2024 mainly due to a decline in petroleum income. Taxes and investment income have remained largely the same in percentage terms.

The tax base is narrow and many taxes are ad-hoc. These may not raise enough in the future, so tax reform is crucial. The government must look at new taxes, not just income taxes or consumption taxes such as sales and services tax (SST) versus goods and services tax (GST).

A good choice is e-payments tax which is very broad based, more equitable and efficient and easier to implement than either SST or GST.

A new 1% e-payments tax can raise RM15 billion which could replace all the recent tax hikes including the low-value goods tax (LVG), the digital goods tax (DGT), the capital gains tax (CGT), the high-value goods tax (HVG), the tourist tax and the hike in SST while cancelling personal income tax for everyone below the T20 threshold.

This would still leave RM2 billion which would give the government room to cut taxes for MSMEs or provide free higher education for Malaysians studying for bachelor degrees.

A 2.5% e-payments tax could enable the government to abolish SST altogether and lower prices to consumers across the board. A study of the potential of the e-payments tax is essential.

Without tax reforms, revenue will be limited and spending on essentials such as healthcare, education and social protection will stay below what is needed. It also puts pressure on the deficit and debt levels, so the focus on easing the “addiction to borrowing” is correct and can be addressed by fiscal reform.

In terms of implementation, the new frameworks in the Fiscal Responsibility Act and the Medium Term Fiscal Framework should help to improve government revenue and spending to control debt and deficit levels.

These new regulations impose discipline on fiscal policy and along with better tax collection as well as cutting wastage, leakages and corruption, will add scope for better government policy and improve confidence in economic management in Malaysia.

So reform of fiscal policy is not about cutting spending or raising taxes but about changing the approach, mindset and implementation of fiscal policy to free-up the supply-side and create a low-tax, low-regulation, agile and competitive economy.

This is why it is good to see the prime minister highlighting fiscal reform in his recent comments. Now we need a wide set of views taken into account in the policy discussions. - FMT

The views expressed are those of the writer and do not necessarily reflect those of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.