KUALA LUMPUR: The ringgit closed higher against the US dollar today, supported by rising oil prices and weaker US economic data, an analyst said.

KUALA LUMPUR: The ringgit closed higher against the US dollar today, supported by rising oil prices and weaker US economic data, an analyst said.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid said lower-than-expected US Institute for Supply Management manufacturing purchasing managers’ index (PMI), which came in at 46 points in June, helped to lift up the ringgit today.

He said the next hurdle for the ringgit would be Bank Negara Malaysia’s (BNM) monetary policy committee (MPC) meeting on the overnight policy rate (OPR) on Thursday. The central bank is expected to maintain the OPR at 3%.

“From the technical analysis standpoint, the ringgit has been oversold for quite a while. At best, we think the ringgit should exhibit some stability at around RM4.65 with an immediate support level of RM4.62,” he told Bernama.

Meanwhile, at the time of writing, the benchmark Brent crude oil price rose 1.23% to US$75.57 (RM338.33) per barrel.

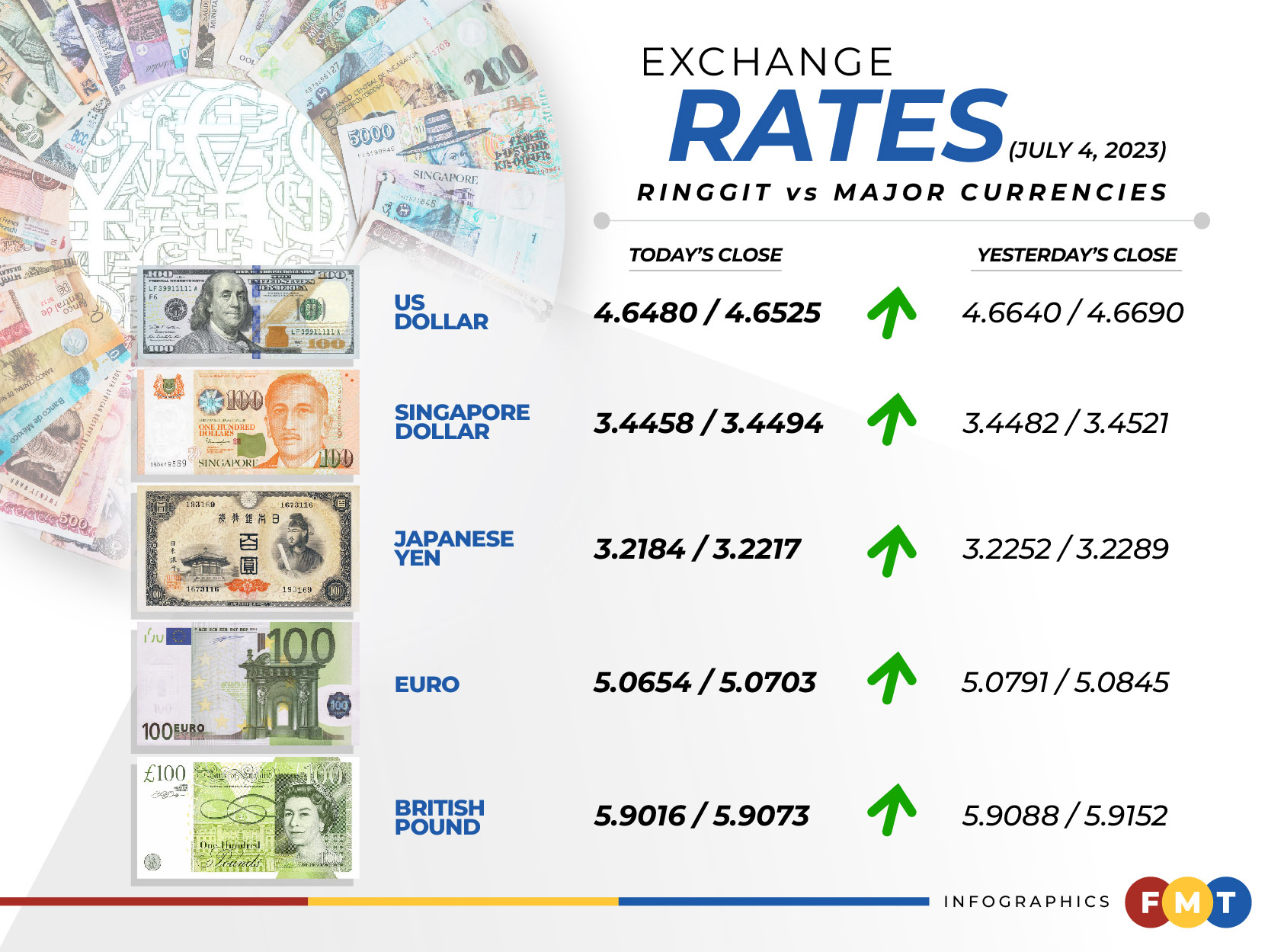

At 6pm, the local note rose to 4.6480/4.6525 against the greenback compared to 4.6640/4.6690 at yesterday’s close.

At the close, the ringgit was traded higher against a basket of major currencies.

It strengthened vis-a-vis the euro to 5.0654/5.0703 from 5.0791/5.0845 at yesterday’s close, rose against the Japanese yen to 3.2184/3.2217 from 3.2252/3.2289 and increased versus the British pound to 5.9016/5.9073 from 5.9088/5.9152 previously.

The local note also traded mostly higher against other Asean currencies.

The ringgit was up against the Singapore dollar to 3.4458/3.4494 versus 3.4482/3.4521 on Monday and rose against the Philippine peso to 8.41/8.42 from 8.43/8.44.

It went up against the Indonesian rupiah at 309.9/310.4 from 310.2/310.7 yesterday, but slipped against the Thai baht to 13.3230/13.3420 from 13.2357/13.2563 previously. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.