An analyst said market sentiment is currently cautious as observers are expecting the Federal Reserve to raise the federal funds rate by 25 basis points this week.

Meanwhile, Bank Muamalat Malaysia Bhd chief economist Afzanizam Rashid said the Bank of Japan is expected to maintain its ultra-accommodative monetary stance and keep the yield curve control unchanged.

“That would continue to make the US dollar stand out against the local note,” he told Bernama.

Moreover, he said the latest Malaysian consumer price index print of 2.4% indicates there is no hurry for Bank Negara Malaysia to raise the overnight policy rate target as the real rate of interest has been positive for two consecutive months.

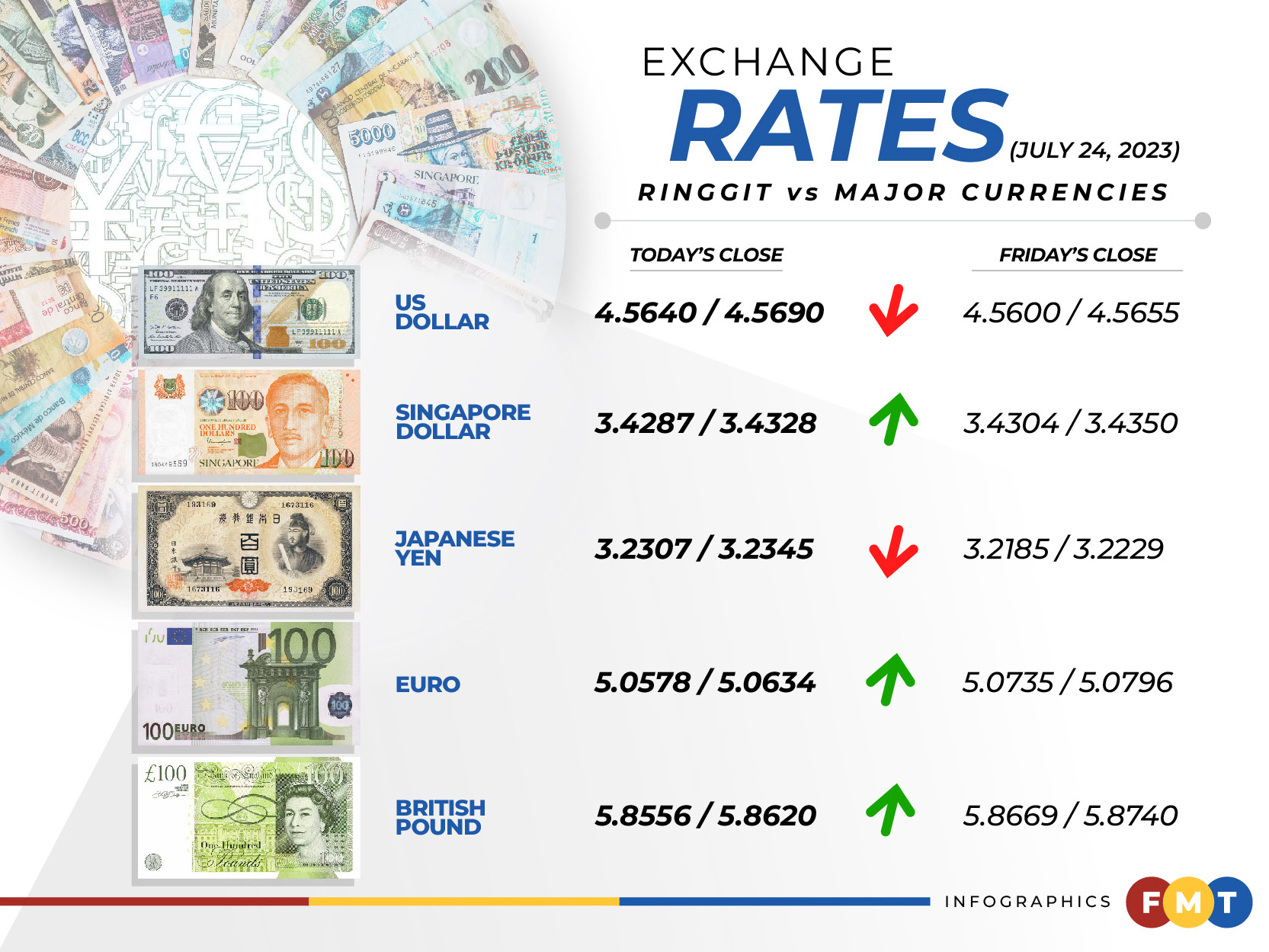

At 6pm, the local currency eased to 4.5640/4.5690 against the greenback compared with 4.5600/4.5655 at Friday’s close.

Meanwhile, the ringgit was traded mostly higher against a basket of major currencies at today’s close.

It strengthened vis-a-vis the euro to 5.0578/5.0634 from 5.0735/5.0796 at Friday’s close, rose against the British pound to 5.8556/5.8620 from 5.8669/5.8740 but slipped versus the Japanese yen to 3.2307/3.2345 from 3.2185/3.2229 previously.

However, the local currency traded mostly lower against other Asean currencies.

The ringgit slid vis-a-vis the Philippine peso to 8.35/8.37 from 8.33/8.34 on Friday, dropped against the Indonesian rupiah to 303.6/304.2 from 303.4/303.9 and decreased against the Thai baht to 13.2417/13.2623 from 13.2327/13.2541, but appreciated versus the Singapore dollar to 3.4287/3.4328 from 3.4304/3.4350 previously. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.