KUALA LUMPUR: The ringgit closed higher against the US dollar and a basket of other major currencies as well as Asean currencies ahead of Bank Negara Malaysia’s (BNM) decision on the overnight policy rate (OPR) on March 7.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Rashid said most economists are expecting the OPR to stand at 3%.

“This week is quite an important week as the US Federal Reserve chairman will also share its latest economic assessment with Congress on March 7.

“In addition, investors await the US nonfarm payroll (NFP) on Friday,” he told Bernama.

Therefore, Afzanizam said the currency market is expected to remain guarded in the near future as uncertainties over the first US interest rate cut will continue to dominate market sentiments.

“Not to mention, China’s National People’s Congress (NPC) will also be closely monitored as investors will scrutinise the macro targets in the search for clues of economic stimulus,” he said.

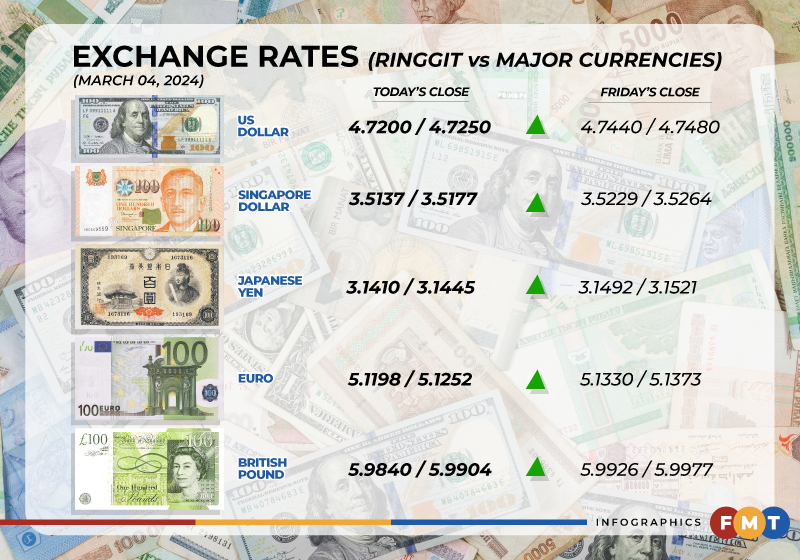

At 6pm, the ringgit improved to 4.7200/4.7250 against the greenback compared with Friday’s close of 4.7440/4.7480.

Back home, the ringgit was traded higher against a basket of major currencies.

The local currency rose against the British pound to 5.9840/5.9904 from 5.9926/5.9977 last Friday, strengthened versus the euro to 5.1198/5.1252 from 5.1330/5.1373 last week, and improved vis-a-vis the Japanese yen to 3.1410/3.1445 from 3.1492/3.1521 previously.

At the same time, the ringgit traded higher against other Asean currencies.

It was higher versus the Thai baht at 13.1766/13.1965 from Friday’s close of 13.1928/13.2120 and gained against the Singapore dollar at 3.5137/3.5177 compared to 3.5229/3.5264 last week.

The ringgit also firmed vis-a-vis the Indonesian rupiah to 299.7/300.2 from 302.1/302.4 and inched up against the Philippine peso at 8.43/8.44 from 8.47/8.48 previously. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.