None of the RM4 billion in SRC International’s funds was invested in the energy and resources sector, the Kuala Lumpur High Court heard.

Asset recovery specialist Angela Barkhouse testified that SRC funds were transferred through several offshore entities to obfuscate the movement of monies misappropriated from the Minister of Finance Incorporated-owned (MOF Inc) firm.

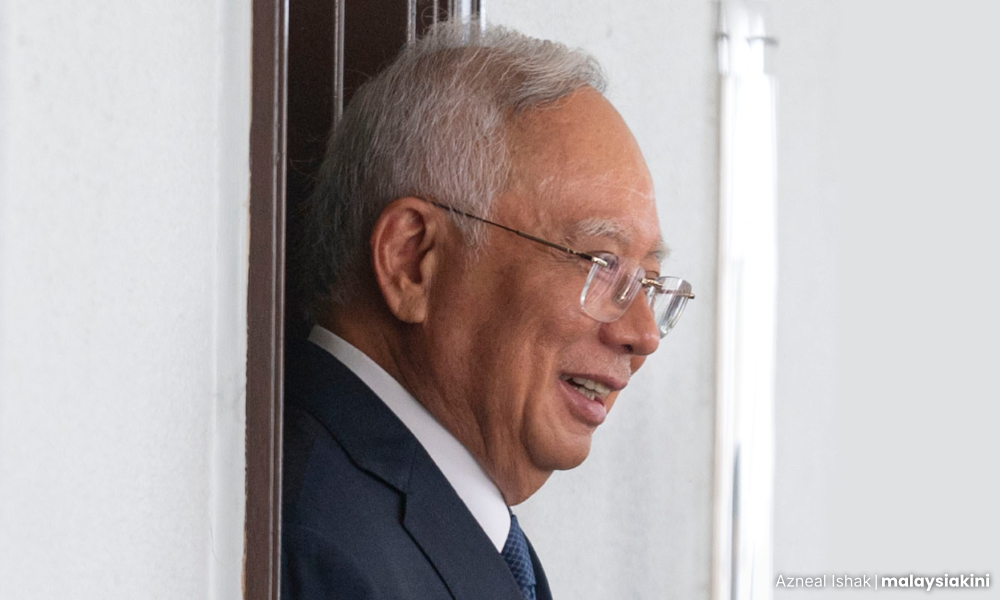

During today’s full hearing of SRC’s US$1.18 billion (RM5.5 billion) lawsuit against former prime minister Najib Abdul Razak, the Cayman Island-based expert was giving oral evidence via Zoom over the transfer of SRC funds to the offshore entities between 2011 and 2014.

The British-born expert said among these entities were Cistenique Investment Fund BV (Cistenique), Enterprise Emerging Market Funds BV (Emerging), and Pacific Rim Global Growth Limited.

“They purported to hold legitimate investment portfolios and to be independent investment funds.

“Their true purpose was to operate as conduits, designed to allow money to be funnelled to third parties while providing a plausible but false representation that misappropriated funds had been ‘invested’.

“They did not use monies received from SRC BVI to invest in legitimate investment portfolios and instead transferred funds to third parties almost immediately following receipt, upon instructions,” Barkhouse told judge Ahmad Fairuz Zainol Abidin.

She said none of the funds transferred out of the SRC BVI BSI account appears to have been used to ensure “the long-term supply of energy and natural resources (other than gas and oil) for Malaysia”.

Barkhouse added that she was the appointed liquidator for 13 offshore entities linked to the matter.

They are SRC International (Malaysia) Limited, SRC Strategic Resources Limited, Bright Oriande Limited, Affinity Equity International Partners Limited, Asia Momentum Fund SPC Limited, Muraset Limited, Blackstone Asia Real Estate Partners Limited (Blackstone), Pacific Rim Global Growth Limited, Aabar Investments PJS Limited, Aabar International Investments PJS Limited, Alsen Chance Holdings Limited, Blackrock Commodities (Global) Limited, and Platinum Global Luxury Services.

‘Shell companies’

She noted that her examination of documentary evidence of certain offshore entities linked to the SRC International money flow - such as Good Star Limited - found that they were “shell companies that conducted no legitimate businesses, other than to launder funds misappropriated from 1MDB and SRC International”.

Before being fully owned by MOF Inc, SRC was a subsidiary of troubled sovereign wealth fund 1MDB. MOF Inc also fully owned 1MDB.

The witness testified that out of the sum of US$506.9 million received by Blackstone from Cistenique and Enterprise, the amount of US$120 million went to Najib’s Malaysian bank account ending in 694.

She said a separate US$82,000 went to Nik Faisal Ariff Kamil, the still-at-large former CEO of SRC.

During cross-examination by Najib’s counsel Harvinderjit Singh, Barkhouse said that her finding was based on documents obtained in the course of acting as liquidator for the numerous SRC-linked offshore entities, helping her track the money laundering trail.

The witness disagreed with the defendant’s lawyer that it was beyond the scope of her duty to ascertain whether there had been misappropriation of funds from Malaysia-based SRC.

However, she agreed with Harvinderjit that she had never met Najib.

Hearing before Fairuz continues this afternoon.

In the civil action, SRC claimed former finance minister Najib had committed a fraudulent breach of duties as the company’s then-adviser emeritus.

SRC’s allegations are linked to the alleged misuse of RM4 billion in loans it received from Retirement Fund Incorporated between 2011 and 2012.

Through the lawsuit, SRC is seeking general and exemplary damages, as well as interest, costs and other relief deemed fit by the civil court.

SRC seeks a declaration that Naijib is liable to account for the MOF Inc firm’s losses due to his alleged breach of duty.

The plaintiff also seeks an order that Najib repay the US$1.18 billion in losses as well as repay the sum of US$120 million that the former premier allegedly received.

Najib is serving a six-year jail sentence and was also fined RM50 million, courtesy of a partial royal pardon that reduced the initial sentence of 12 years jail and RM210 million fine.

SRC was incorporated as a special purpose vehicle on Jan 7, 2011, to invest in conventional and renewable energy, natural resources, and the minerals sector.

Counsel Kwan Will Sen appeared for SRC. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.